CVA EOS Srl has completed a mandatory public tender offer on Renergetica SpA

CVA EOS Srl has acquired Renergetica SpA.

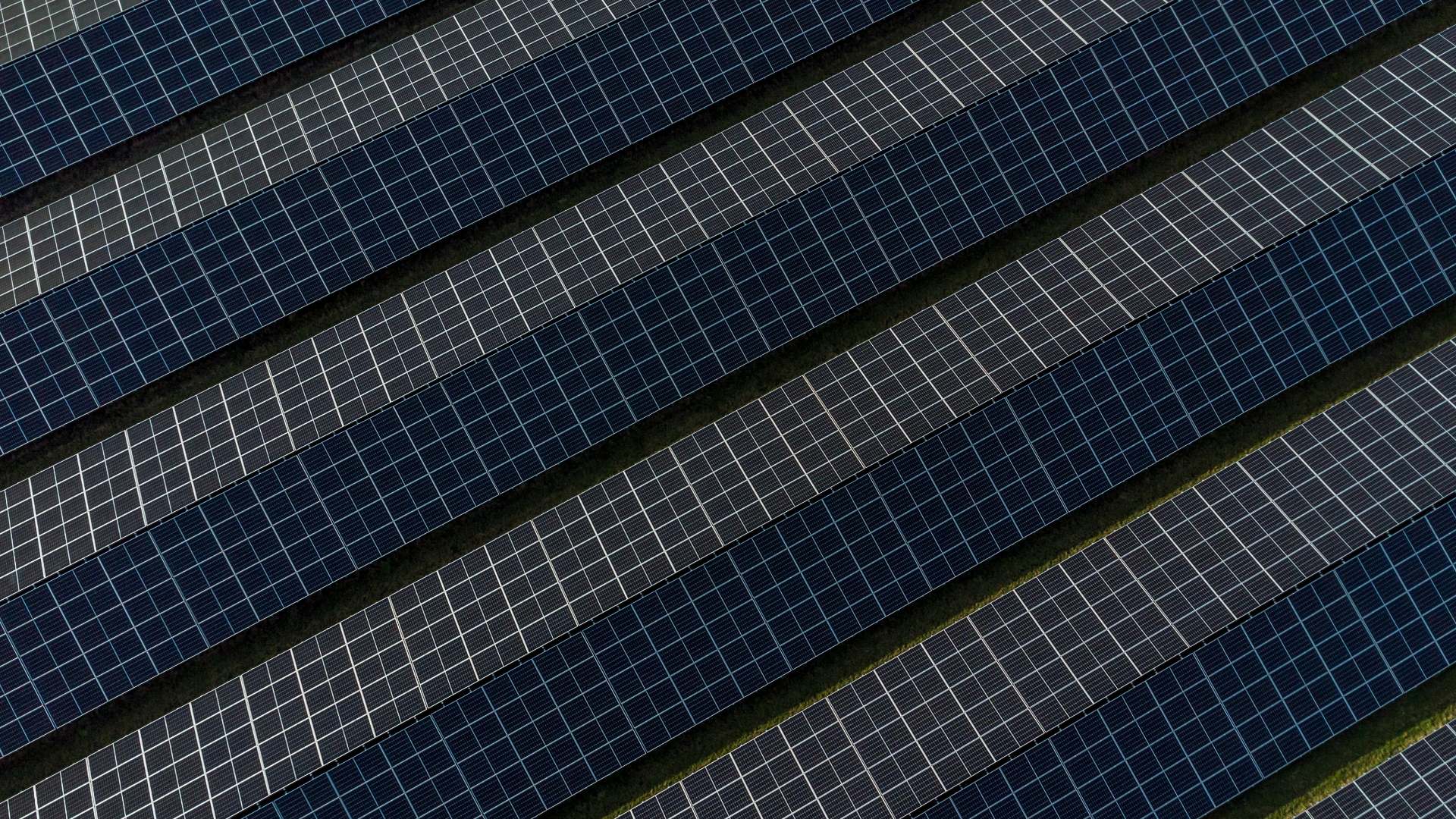

CVA EOS is a company operating in the wind and photovoltaic sector, wholly owned by CVA SpA (Compagnia Valdostana delle Acque).

Headquartered in Italy, Renergetica is a listed entitynt hat engages in the design of engineering solutions for the renewable energy sector. The company specializes in the development of renewable energy plants, hybrid power generations systems and hybrid grids.

Oaklins Italy’s parent company Banca Akros acted as financial advisor to CVA EOS and appointed broker for the collection of the shares in the total mandatory public tender offer of 17.8% of the shares of Renergetica SpA by CVA EOS Srl.

Talk to the deal team

Related deals

Energy Solutions UK Ltd. has acquired Oceanic Systems (UK) Ltd.

Energy Solutions UK Ltd., a marine electrical systems supplier, has completed the acquisition of marine monitoring and control systems manufacturer, Oceanic Systems (UK) Ltd. The acquisition is designed to expand Energy Solutions’ marine technology offerings, particularly supporting their growth in marine hybrid propulsion systems.

Learn moreACTEAM ENR has been acquired by Butagaz Group

Butagaz Group has acquired ACTEAM ENR as part of a wider strategy to expand their solar energy portfolio.

Learn moreBloom Equity Partners Management, LLC has acquired GRC International Group plc

GRC International Group plc, a leading provider of IT governance, risk management and compliance solutions, has delisted from the LSE’s AIM market and partnered with Bloom Equity Partners Management, LLC to further develop its product offering to meet its customers’ most critical cyber security and regulatory challenges.

Learn more