Advanced Health Limited has completed a partially underwritten non-renounceable rights offer

Advanced Health Limited has raised funds.

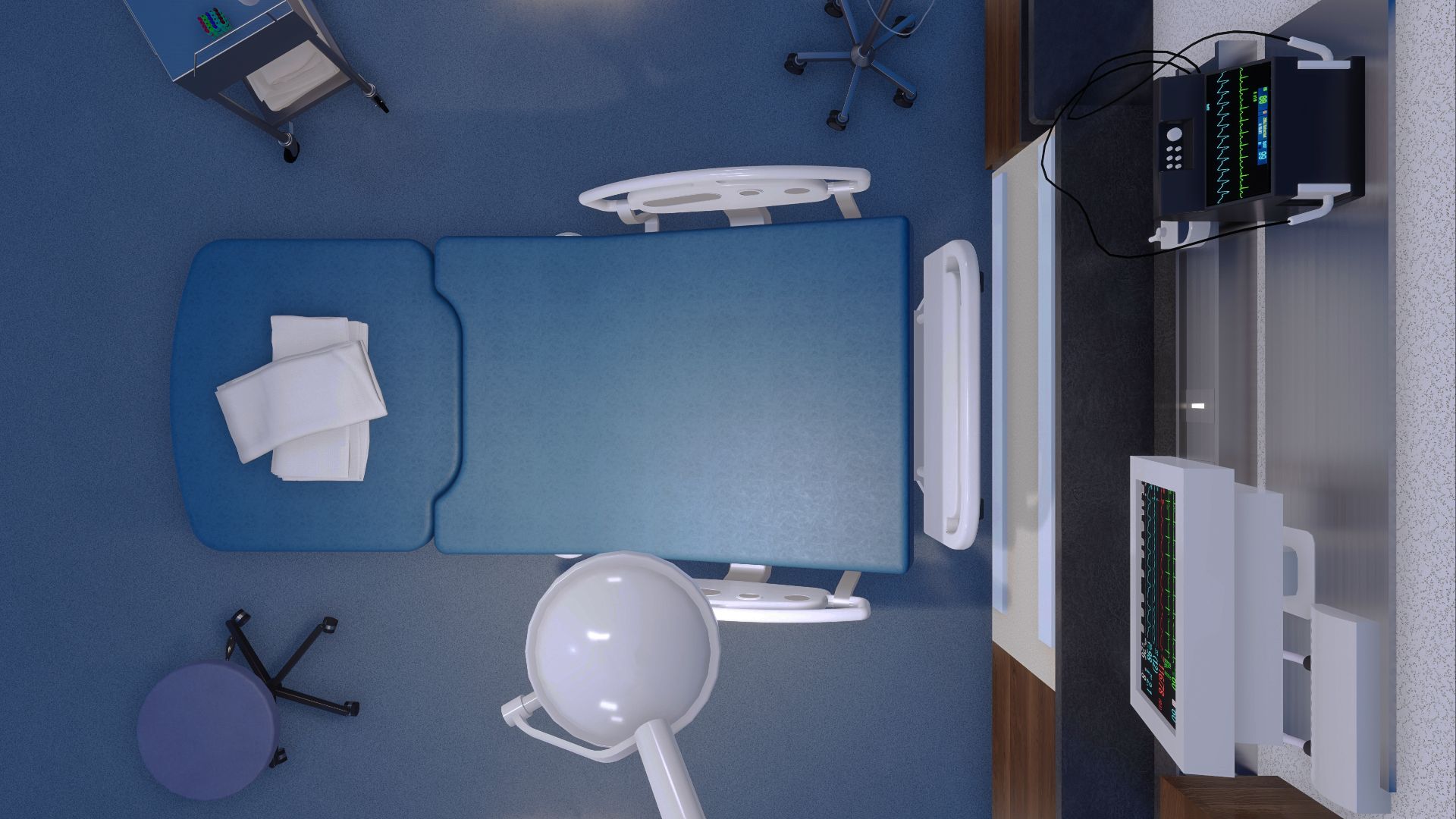

Advanced Health owns and operates a network of day hospitals across South Africa. Listed on the Johannesburg Stock Exchange in 2014, it has established itself as a leader in day surgery across the country. Through its subsidiary Presmed Australia, Advanced Health invests in various day hospitals in Australia.

Oaklins’ team in South Africa acted as corporate and designated advisor in this transaction.

Talk to the deal team

Annerie Britz

Oaklins South Africa

Related deals

Backspin has completed a mandatory public tender offer for the shares of Spindox

Backspin S.p.A. has completed a mandatory public tender offer for Spindox S.p.A.

Learn moreRare Patient Voice has been acquired by Konovo

Rare Patient Voice has been acquired by Konovo, a technology-first healthcare intelligence company backed by Fraser Healthcare Partners.

Learn moreLindenhofgruppe has sold its majority stake in LabPoint to Affidea Switzerland

LabPoint Medical Laboratories AG has been acquired by Affidea Switzerland AG. Through the transaction, Lindenhofgruppe AG gains a strong strategic partner to support the further development of LabPoint and will remain a shareholder with a reduced stake, continuing as a key customer of the company. It lays the foundation for LabPoint’s sustainable development under a new anchor shareholder, with the aim of further strengthening and selectively expanding its position in laboratory diagnostics.

Learn more