Jasco Electronic Holdings has raised funds

Jasco Electronic Holdings has completed an equity capital raise in the form of a rights issue in order to recapitalize the company.

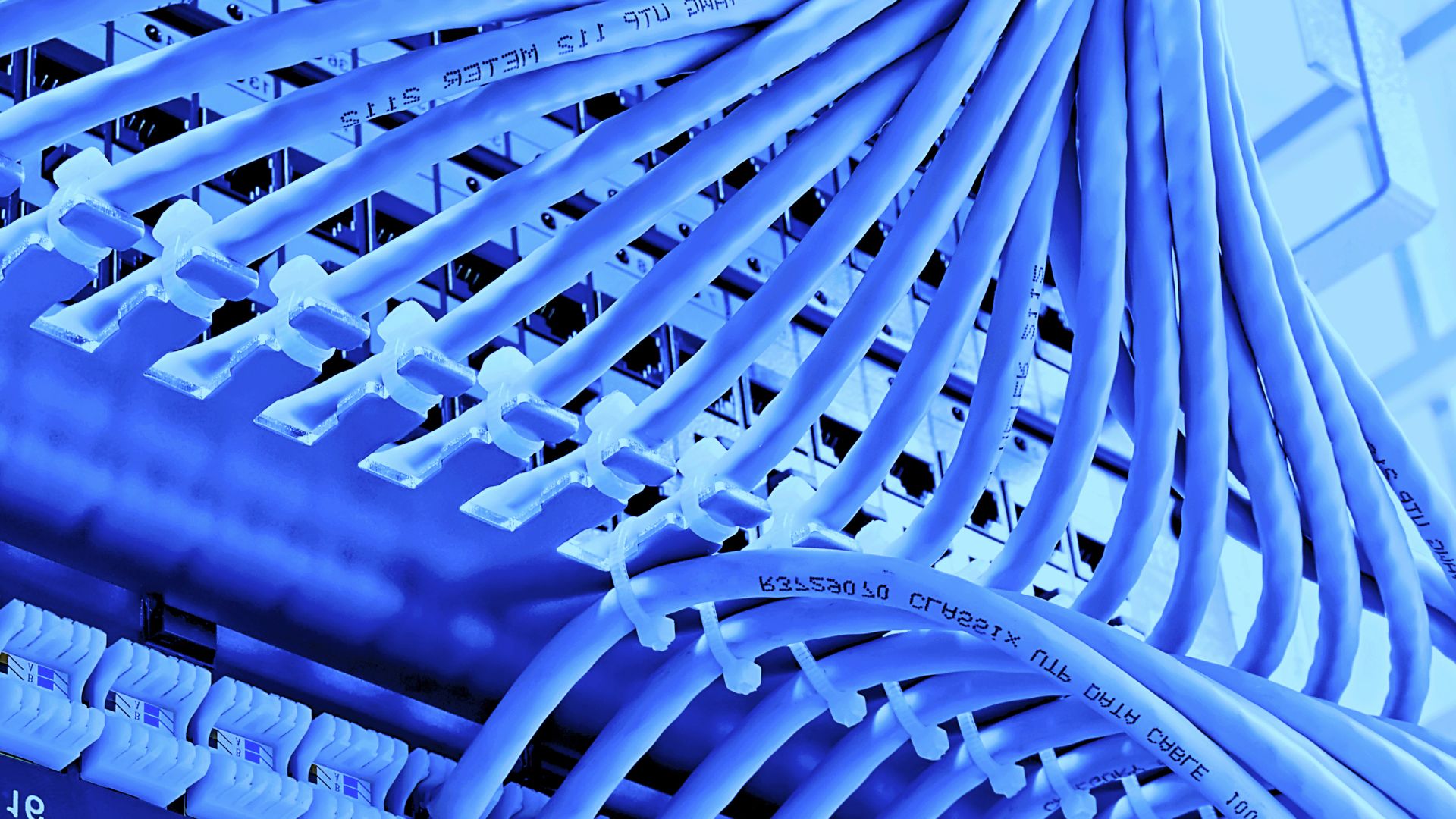

Jasco is a South African company that delivers technologies across information and communication technology (ICT), manufacturing, security and fire, and power and renewables. The firm has been listed on the securities exchange operated by the JSE Limited, since 1987. Jasco is a distributor, reseller, systems integrator and service provider that delivers innovative solutions. The company has a wide range of products, services and solutions that focus predominantly on the key sectors of ICT, manufacturing, security and fire, and power and renewables.

Oaklins’ team in South Africa acted as corporate advisor and JSE sponsor in this transaction.

Talk to the deal team

Annerie Britz

Oaklins South Africa

Related deals

Middlecon has been acquired by Nion

Middlecon has been acquired by Nion, a digital consultancy backed by Stella Capital. The acquisition strengthens Nion’s capabilities in data management and advanced analytics, enabling it to undertake larger and more complex data-driven initiatives for its customers. The partnership with Nion provides Middlecon with a strong foundation for continued growth and expansion.

Learn morePresight Solutions has been acquired by Banyan Software

Banyan Software, a leading acquiror and operator of mission-critical software businesses, has entered Norway with the acquisition of Presight Solutions AS, a SaaS company delivering advanced software for safety, operational integrity and regulatory compliance in high-risk industries. The transaction marks a new chapter for Presight, strengthening its ability to scale while preserving the product focus, sector expertise and customer trust built since its founding in 2003.

Learn moreBackspin has completed a mandatory public tender offer for the shares of Spindox

Backspin S.p.A. has completed a mandatory public tender offer for Spindox S.p.A.

Learn more