Automotive

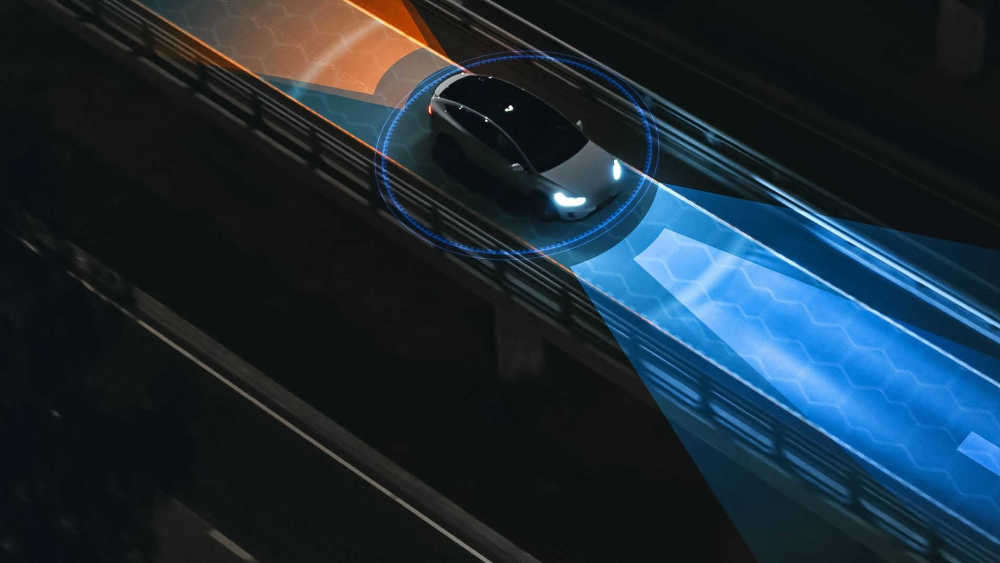

In the midst of the transition from legacy fossil fuels to alternative powertrains and autonomous driving capabilities, the automotive industry has also endured the disruption from COVID-19 and ongoing global supply chain constraints. Our dedicated professionals, located in each of the world’s key automotive markets, are committed to your success in this shifting climate. Oaklins’ capabilities in M&A, growth equity and ECM, debt advisory and corporate finance services span from traditional OEMs suppliers to emerging technology companies. We will help you navigate the current market and close the deals crucial to your future success.

Contact advisor

FAI Automotive has been acquired by Motus Holdings

FAI Automotive plc (FAI), one of the UK’s leading distributors of replacement automotive parts, has been sold to Motus Holdings, a South Africa-headquartered automotive group.

Learn moreSAPA has acquired 100% of Promens Zevenaar and Promens Rongu

SAPA S.p.A., the One-Shot® company, engaged in the sustainable mobility solutions sector, announces a considerable expansion into the truck sector and in northern Europe with the acquisition of 100% of Promens Zevenaar (Netherlands) and Promens Rongu (Estonia). With this acquisition, SAPA bolsters its presence with major customers, including Volvo, Scania and Daimler Truck.

Learn moreSAPA Group has acquired a majority stake in Grupo Hispamoldes

SAPA Group, one of Europe’s leading makers of specialist next-generation parts for the sustainable mobility industry, has acquired a majority stake in Grupo Hispamoldes, a portfolio company of Quarza Inversiones, the investment vehicle created by Cristian Abelló in 2019, who will stay on as one of Hispamoldes’ shareholders.

Learn more

Jonathan Alexander

CEO, FAI Automotive plc

Read more

A look back: Success stories and smart moves in Q1

QUARTERLY M&A ACTIVITY: Q1 saw a dynamic market with significant M&A activity in various industries, with TMT leading with 15 deals. Energy, Real Estate, and Construction & Engineering Services also saw high activity.

Learn more

Talk to our local advisors