Great Range Capital has sold Fairbank Equipment to Pfingsten Partners

Fairbank Equipment Holdings, Inc. (Fairbank), a portfolio company of Great Range Capital, has been sold to Pfingsten Partners.

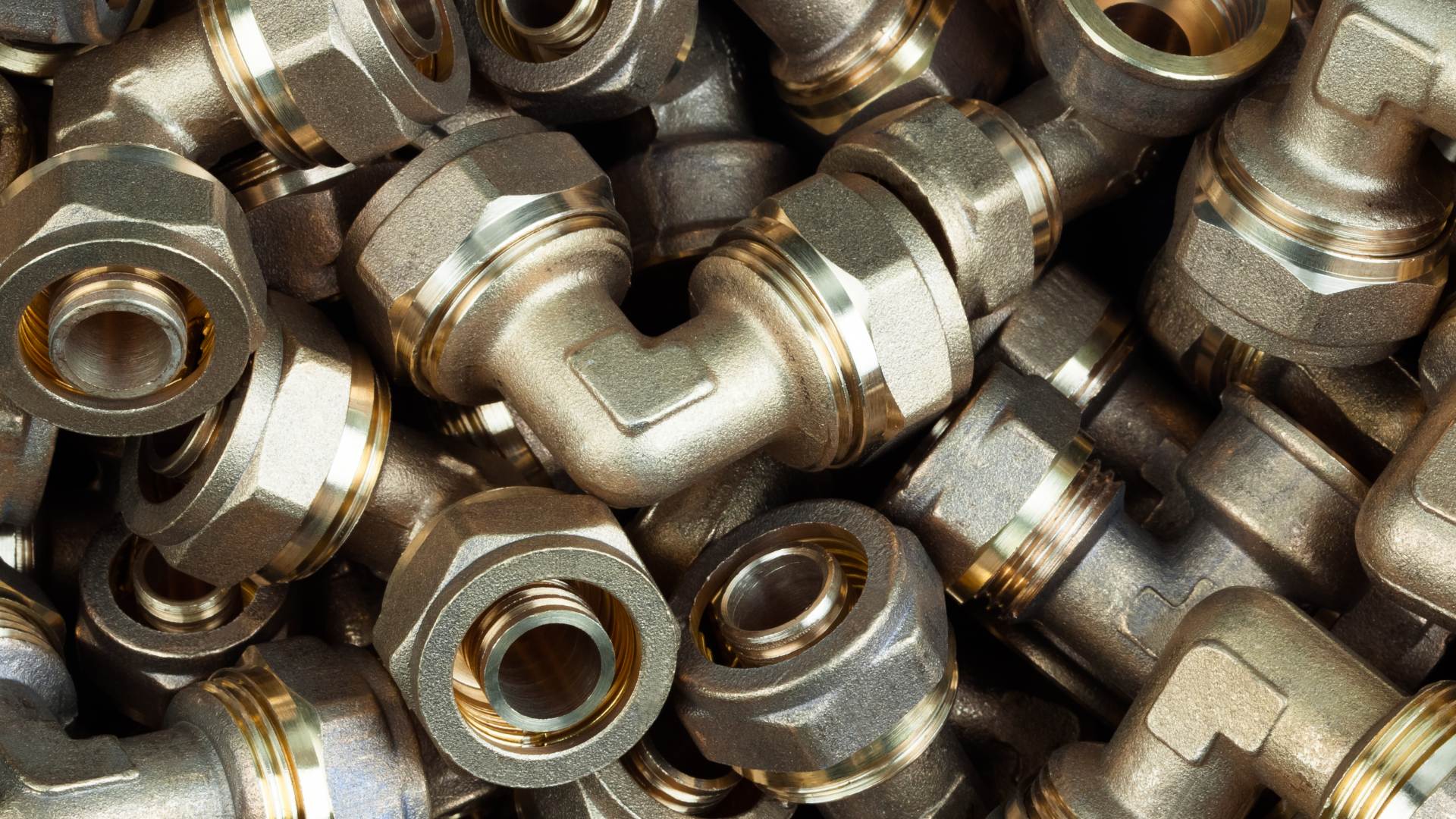

Based in Wichita, Kansas, Fairbank is a leading specialty distributor and dealer of agricultural and propane parts, specialty components and equipment add-ons.

Founded in 1989 and headquartered in Chicago, Illinois, Pfingsten Partners is a highly regarded private equity firm that invests in manufacturing, distribution and business services companies.

Great Range Capital is a leading middle-market private equity firm based in the greater Kansas City area, primarily investing in the niche manufacturing, business and industrial, consumer and retail, and healthcare services sectors.

One of Oaklins’ teams in the USA served as the exclusive financial advisor to Fairbank Equipment Holdings, Inc. in this transaction.

Ryan Sprott

Managing Partner, Great Range Capital

Talk to the deal team

Allan C. Cruickshanks

Oaklins TM Capital

David M. Felts

Oaklins TM Capital

Related deals

Royal Reesink has sold Motrac Industries to Anders Invest

Royal Reesink and Anders Invest have completed the sale of Motrac Industries, a specialist in hydraulic and electrical engineering.

Learn moreSTAC has been acquired by n2 Group

Strategic Technology Analysis Center (STAC), a world leader in financial-technology benchmarking and events, has been acquired by n2 Group, the UK specialists in advanced computation and IT infrastructure.

STAC joins NAG and VSNi in the growing community of n2 Group companies dedicated to advancing computation through collective innovation, technical excellence and long-term strategic growth. STAC will operate as an independent business within n2, maintaining its brand, identity and ethos.

Tri Fire Limited has been acquired by Phenna Group

The shareholders of fire protection safety consultancy Tri Fire Limited have sold the company to testing, inspection, certification and compliance firm Phenna Group.

Learn more