Acquisition of Stantraek by Novedo

Novedo has acquired Stantraek.

Headquartered in Stockholm, Sweden, and founded in 2020, Novedo acquires and develops profitable companies across three segments: industrials, infrastructure and installation and services. Novedo seeks to acquire high-quality companies and allow these to thrive under a decentralized structure, benefitting from the support of the Novedo group. Following the acquisition, Novedo’s proforma revenue is approximately US$257 million and US$28.5 million EBITDA.

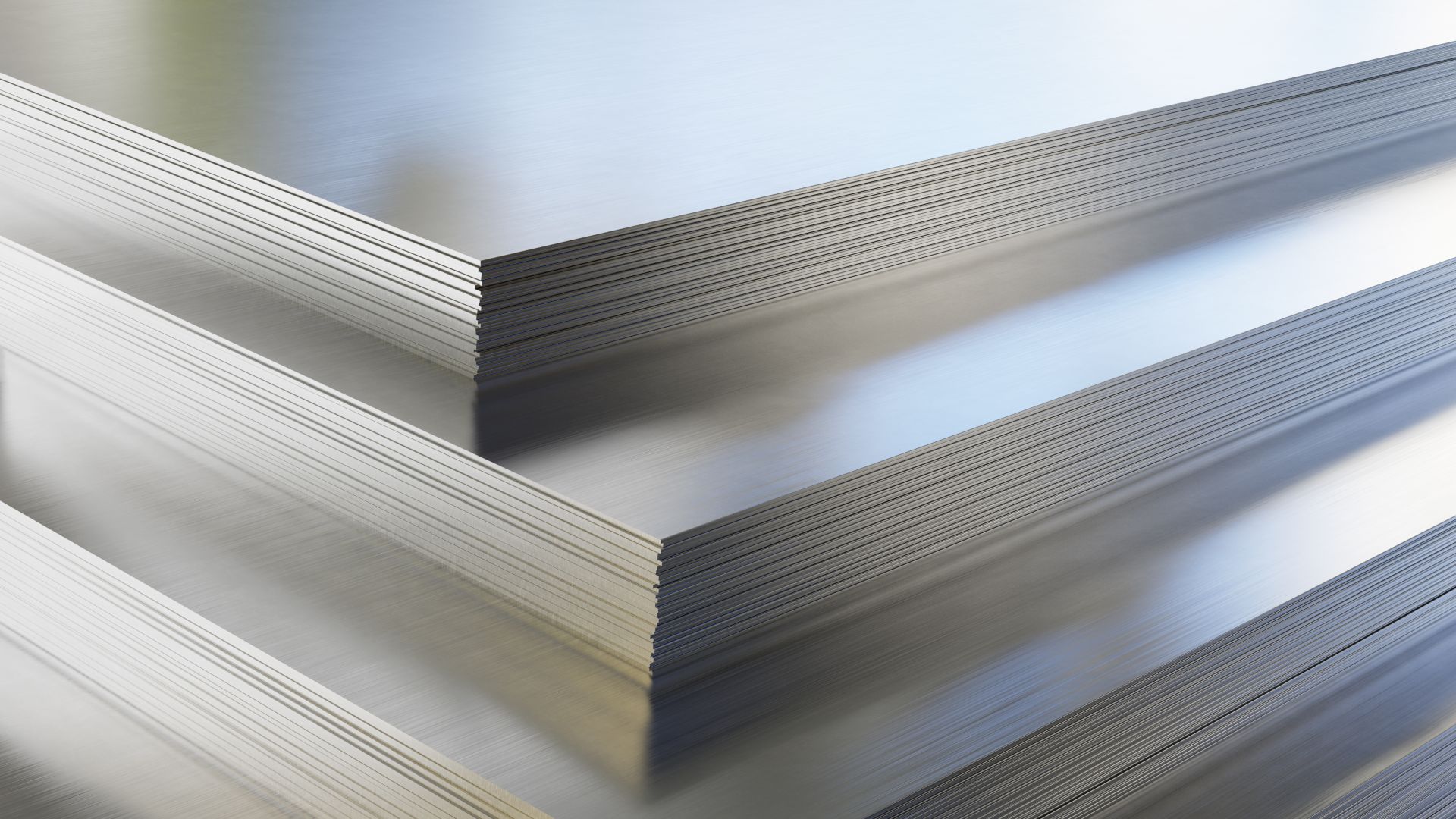

Founded in 1967 in Lystrup, outside Aarhus, Denmark, Stantraek specializes in customized components and sheet metal details for industrial applications, and offers a wide variety of competences, from the production of semi-manufactured parts to box-build solutions, creating the most optimal solution for its customers regarding choice of material, process, quality and supply chain management. Stantraek has a stable and diversified B2B customer base in various industries, including wind/energy, electronics and the process industry. Its turnover for 2022 amounted to approximately US$21 million.

Oaklins’ team in Denmark was engaged by Novedo as strategic and financial advisor in this transaction. The acquisition also marks Oaklins’ second transaction as advisor to Novedo.

Per-Johan Dahlgren

CEO, Novedo

Talk to the deal team

Related deals

Xeros Technology Group has completed a placing, subscription and retail offer

Xeros Technology Group plc has raised funds to drive forward its commercialization strategy.

Learn moreSuccesful integrated solution for strategic deadlock and tender offer by CMB on Euronav

Compagnie Maritime Belge (CMB) has successfully resolved the strategic and structural deadlock within Euronav through an agreement with Frontline, a world leader in the international seaborne transportation of crude oil and refined products, resulting in a mandatory takeover offer on Euronav.

Learn moreIndustrie Polieco - M.P.B. has sold a minority stake to RedFish Longterm Capital

T.P. Holding Srl, the company controlled by the Tonelli family, has sold Industrie Polieco - M.P.B. SpA to RedFish Longterm Capital SpA.

Learn more