Betronic has raised growth financing

Betronic has raised debt provided by Rabobank to support its future growth plans.

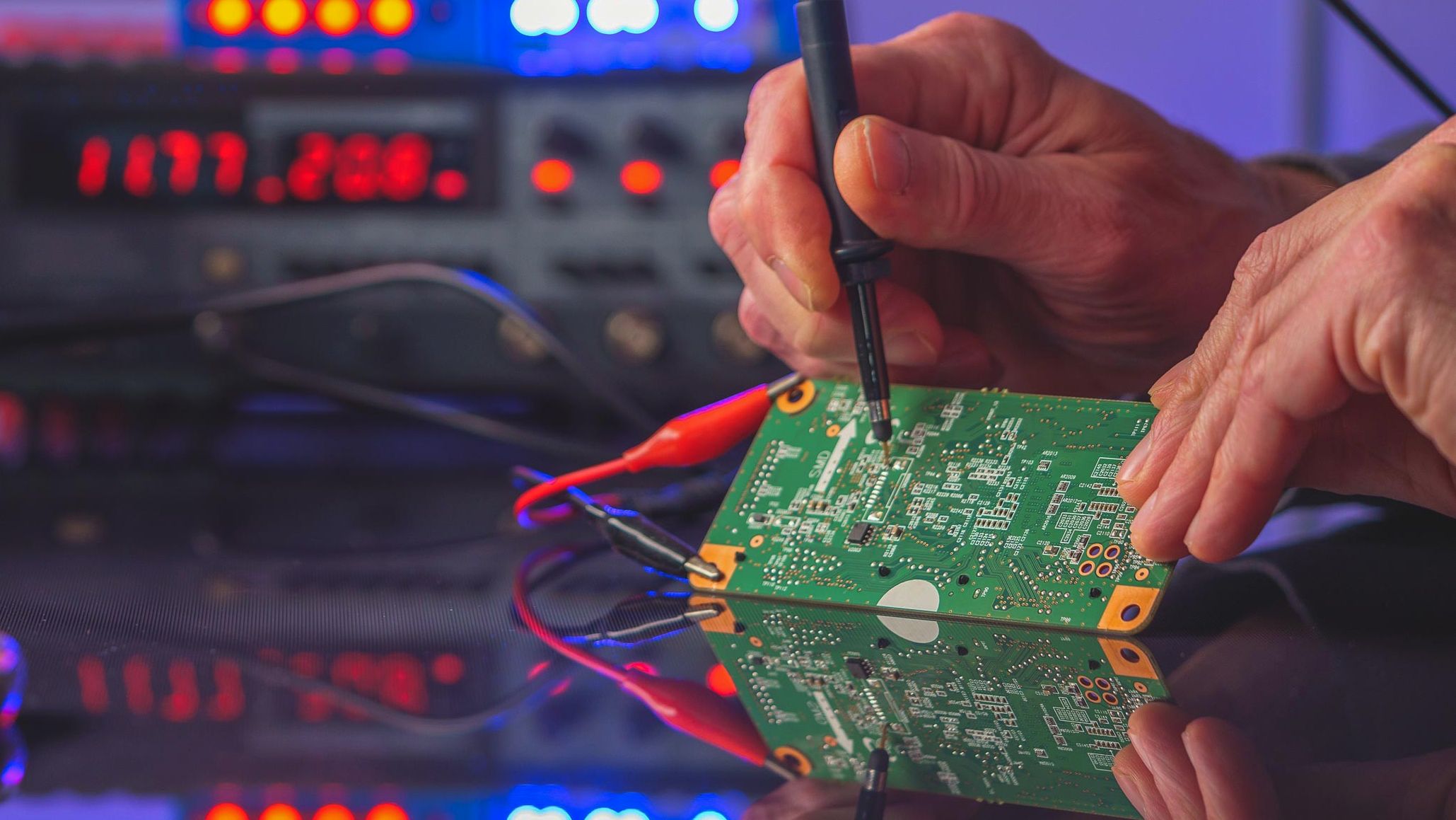

Founded in 1977, Betronic is a Dutch electronic development manufacturing solutions provider of innovative electronics across Europe. The company’s offering focuses on developing and producing technology-driven electronics, both software and hardware. Its main services include the development and production of printed circuit boards and semi-finished products. Furthermore, Betronic develops and produces its own test equipment and provides these services also to third parties.

Oaklins’ debt advisory team in the Netherlands advised Betronic in this transaction by establishing a financing package aligned with the current business profile and future growth ambitions. This transaction emphasizes Oaklins’ strong track record in the industrial sector.

Talk to the deal team

Related deals

Royal Reesink has sold Motrac Industries to Anders Invest

Royal Reesink and Anders Invest have completed the sale of Motrac Industries, a specialist in hydraulic and electrical engineering.

Learn moreSondrel secures a major investment

Sondrel has secured funding from Rox Equity Partners Ltd. through a subscription for new shares. The funds will enable the company to grow and expand its presence as one of the world’s leading providers of custom chip design and supply. In particular, it will help them rapidly develop their presence in the US.

Learn moreForeman Capital has raised financing for the acquisition of Rijcken Groep

Foreman Capital, a Netherlands-based private equity firm, has secured debt financing for the acquisition of international food wholesaler Rijcken Groep. The financing package, provided through a club deal by Rabobank and ING, is designed to support Rijcken Groep’s organic growth as well as its planned buy-and-build strategy.

Learn more