BHKW Pfaffenhofen GmbH has been acquired by Danpower GmbH

CERASUS Handels- und Beteiligungs GmbH (CERASUS) has sold Biomasse Heizkraftwerk Paffenhofen GmbH (BHKW Pfaffenhofen) to Danpower GmbH for US$10 million.

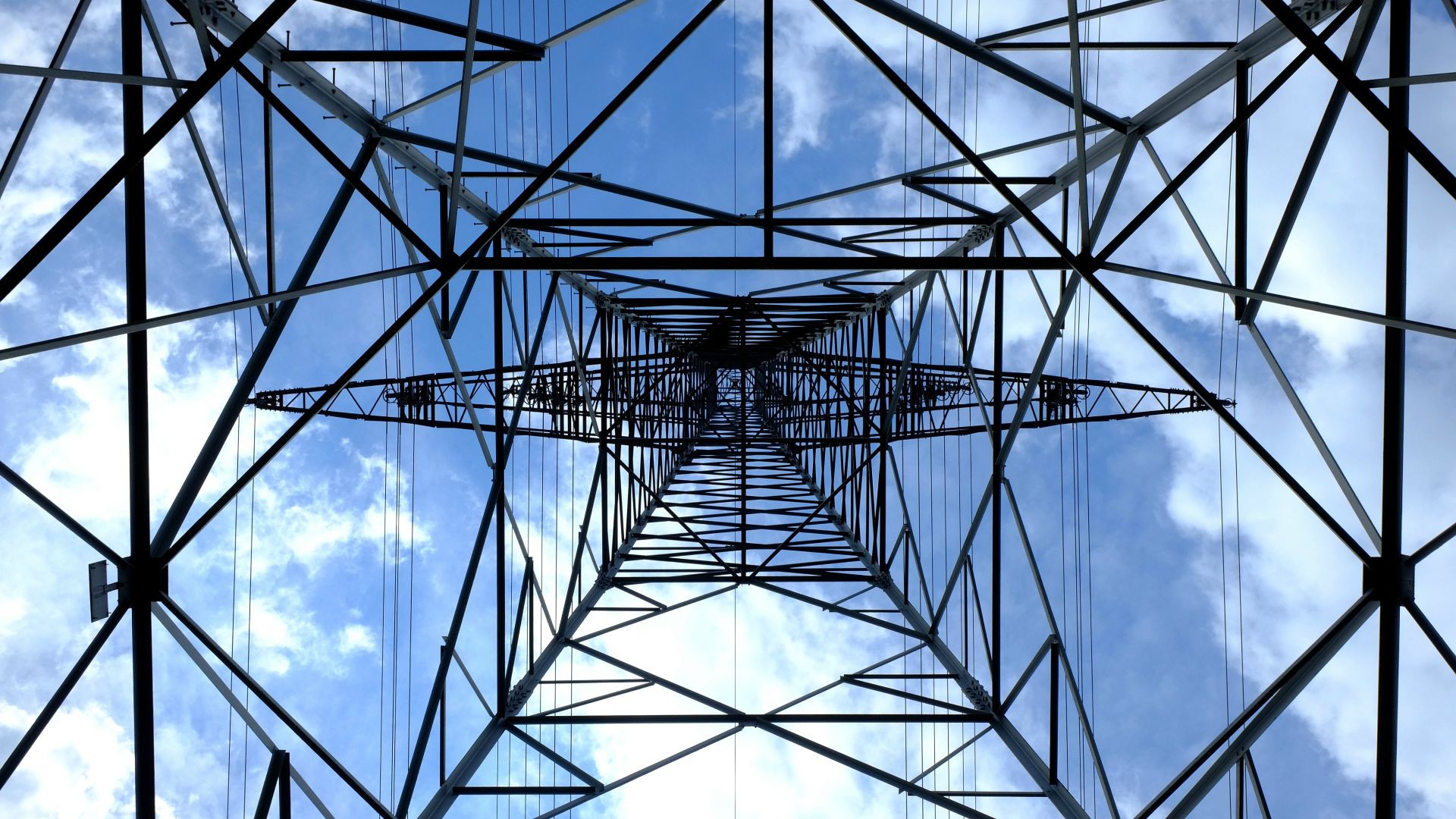

BHKW Pfaffenhofen is engaged in the production of electricity and heat based on biomass. The company operates a 22 km heat distribution network.

The Danpower Group is a medium-sized heat supplier and contracting company based in Potsdam. Danpower is active in Germany and in the Baltic states. The majority interest of 84.9 % is owned by Stadtwerke Hannover AG. The company supplies customers with heat, electricity and cooling in the commerce as well as the housing industry.

CERASUS, founded in 2011 and based in Austria, is a holding company investing in domestic and foreign enterprises.

Oaklins team in Vienna advised the seller in this transaction. Prior to this, the team was mandated in 2012 by Hypo Alpe-Adria-Bank International AG to perform an independent business review for refinancing purposes of the target. Based on the outcome, our team was mandated to make an operative and financial restructuring and was asked to take over a trustee function for an envisaged sell-side process. After an insolvency plan process, the transaction was closed in April 2014.

Talk to the deal team

Related deals

Sindal Biogas A/S has been acquired by CIP

Sindal Biogas A/S, a large-scale Danish biogas plant owned by KK Invest ApS and DBC Invest, has been partly sold to Copenhagen Infrastructure Partners P/S (CIP).

Learn moreMuehlhan Wind Service has acquired a controlling interest in Endiprev

Muehlhan Wind Service has acquired a controlling interest in Endiprev, merging two wind industry leaders to create a global frontrunner in installation and maintenance services.

Learn moreLens has been acquired by Tenten Solar

Tenten Solar has acquired a majority stake in Lens. This is the first add-on for Tenten Solar since Smile Invest acquired the company in 2023. In the further consolidating solar market, this acquisition will realize a considerably stronger market position.

Learn more