Aerospace, Defense & Security

In the aerospace, defense and security industry, the competition for increased control of the supply chain — from OEMs to the aftermarket — is a matter of extremely large consolidations. With deals often reaching billions of dollars, making the right investment choice is crucial. Supported by a dedicated sector research team and long-standing relations within the commercial aerospace, defense and security industries, our experienced M&A professionals can help you find and secure the most lucrative deals, providing you with M&A, growth equity and ECM, debt advisory and corporate finance services.

Contact advisor

Electro Optic Systems has acquired the UK interceptor business of MARSS

Electro Optic Systems Holdings Limited (ASX: EOS) has acquired the UK-based interceptor unmanned aerial system business of MARSS Group for US$6.4 million (€5.5 million). The interceptor is a reusable electric drone effector guided by imaging sensors and AI, which EOS will integrate into its counter-drone portfolio for defense and critical infrastructure customers. EOS plans further investment to complete development.

Learn moreSentient Vision Systems has been acquired by Shield AI

Sentient Vision Systems has been acquired by global defense technology company Shield AI.

Learn morearchTIS has completed a US$13.9 million capital raise

archTIS Limited has raised US$13.9 million through a placement of approximately US$2.5 million and a fully underwritten accelerated non-renounceable entitlement offer of approximately US$11.5 million. The proceeds will be allocated to support the acquisition of Spirion LLC.

Learn more

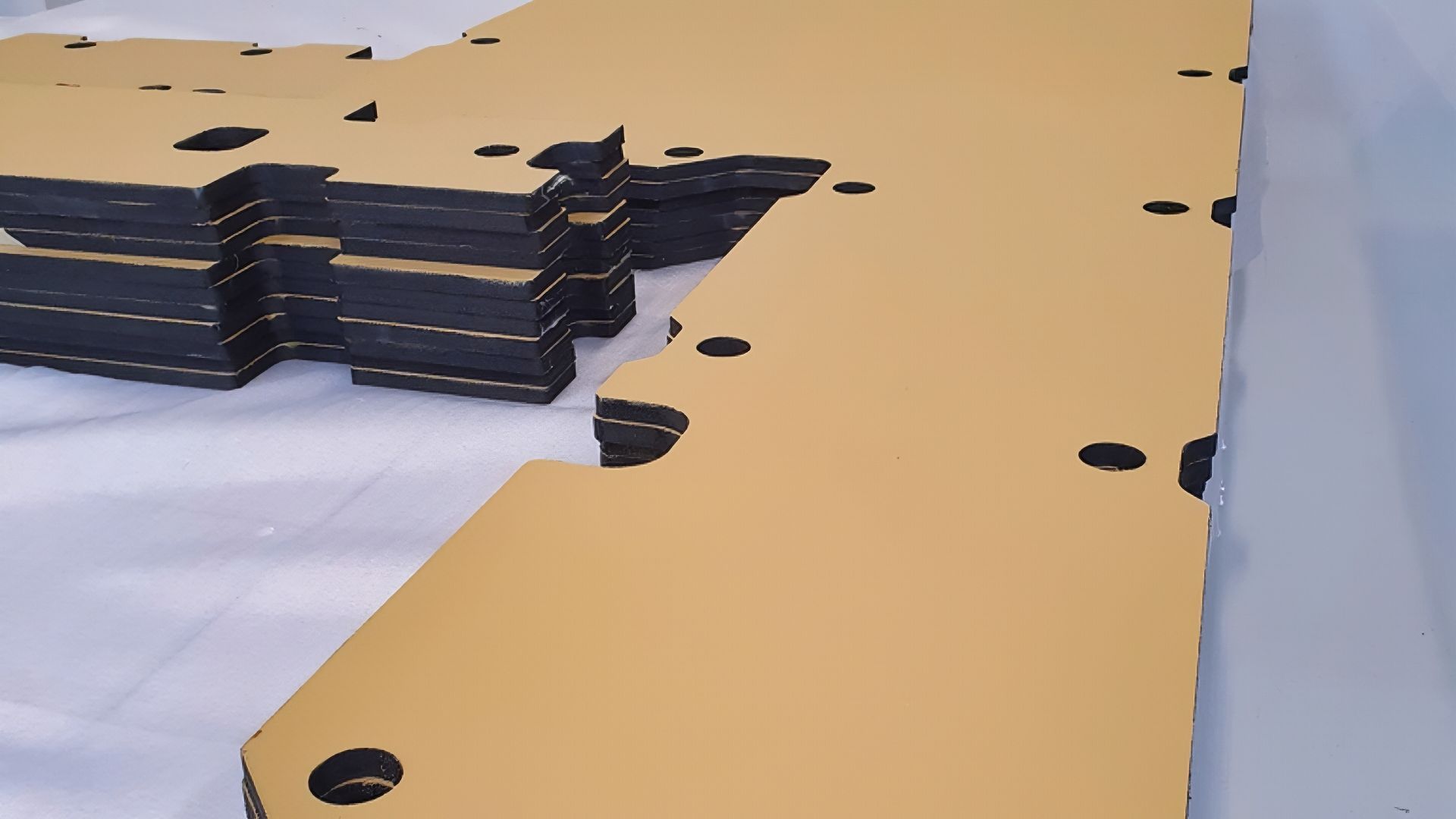

Erik Bundgaard Christensen

Founder and CEO, Scanfiber Composites

Read more

New chapters, global ambitions: mid-market M&A in Q4

QUARTERLY M&A ACTIVITY: In Q4 2025, Oaklins' clients completed 93 transactions across sectors and regions, highlighting how business leaders are using M&A to drive growth, succession and strategic change.

Learn more