Industrie Polieco - M.P.B. has sold a minority stake to RedFish Longterm Capital

T.P. Holding Srl, the company controlled by the Tonelli family, has sold Industrie Polieco - M.P.B. SpA to RedFish Longterm Capital SpA.

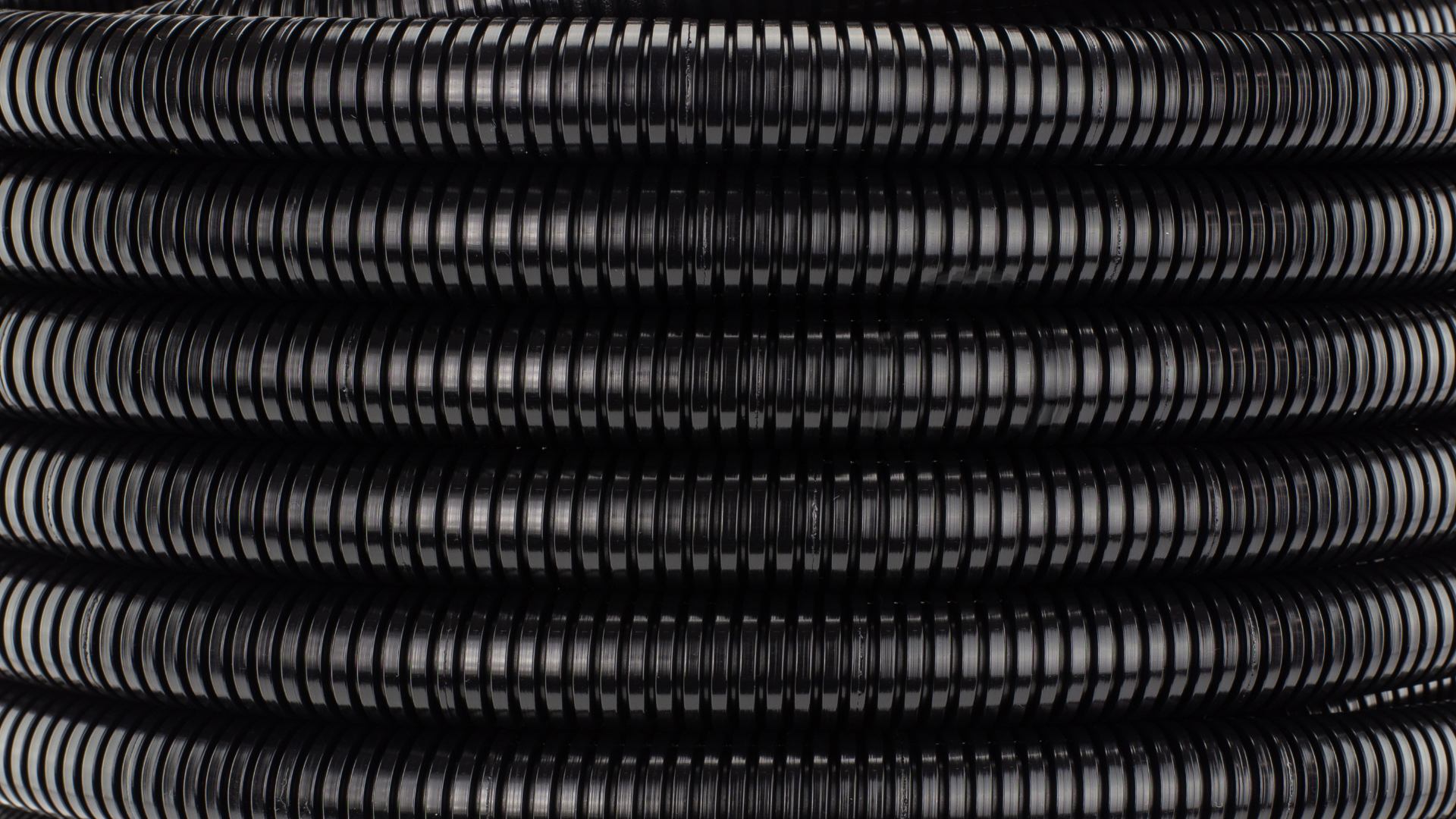

Industrie Polieco - M.P.B. is a leading European company in the production of corrugated pipe systems and manhole covers in composite material. It is also among the key players globally in the oil and gas and packaging sectors for manufacturing compounds and adhesives.

RedFish Longterm Capital operates as an investment company. It engages in the acquisition of long-term stakes in small- and medium-sized Italian companies operating mainly in the precision mechanics, aeronautics, railways, agrifood, information and communication technology, oil and gas and telecommunications industries.

Oaklins Italy’s parent company Banca Akros acted as financial advisor of T.P. Holding Srl and Industrie Polieco - M.P.B. SpA.

Talk to the deal team

Related deals

Dolmans Landscaping Group has welcomed Foreman Capital as a new shareholder to support further growth

Dolmans Landscaping Group, a leading full-service provider of landscaping services, has welcomed Foreman Capital as a new shareholder. By partnering with Foreman Capital, which has extensive experience in building stronger companies in the maintenance of public spaces, Dolmans can accelerate its growth trajectory across core verticals and further professionalize the business.

Learn morePresight Solutions has been acquired by Banyan Software

Banyan Software, a leading acquiror and operator of mission-critical software businesses, has entered Norway with the acquisition of Presight Solutions AS, a SaaS company delivering advanced software for safety, operational integrity and regulatory compliance in high-risk industries. The transaction marks a new chapter for Presight, strengthening its ability to scale while preserving the product focus, sector expertise and customer trust built since its founding in 2003.

Learn moreBackspin has completed a mandatory public tender offer for the shares of Spindox

Backspin S.p.A. has completed a mandatory public tender offer for Spindox S.p.A.

Learn more