KSS Energia has obtained strategic advice in connection with a potential acquisition

The management of KSS Energia Oy has obtained strategic advice in connection with a potential acquisition.

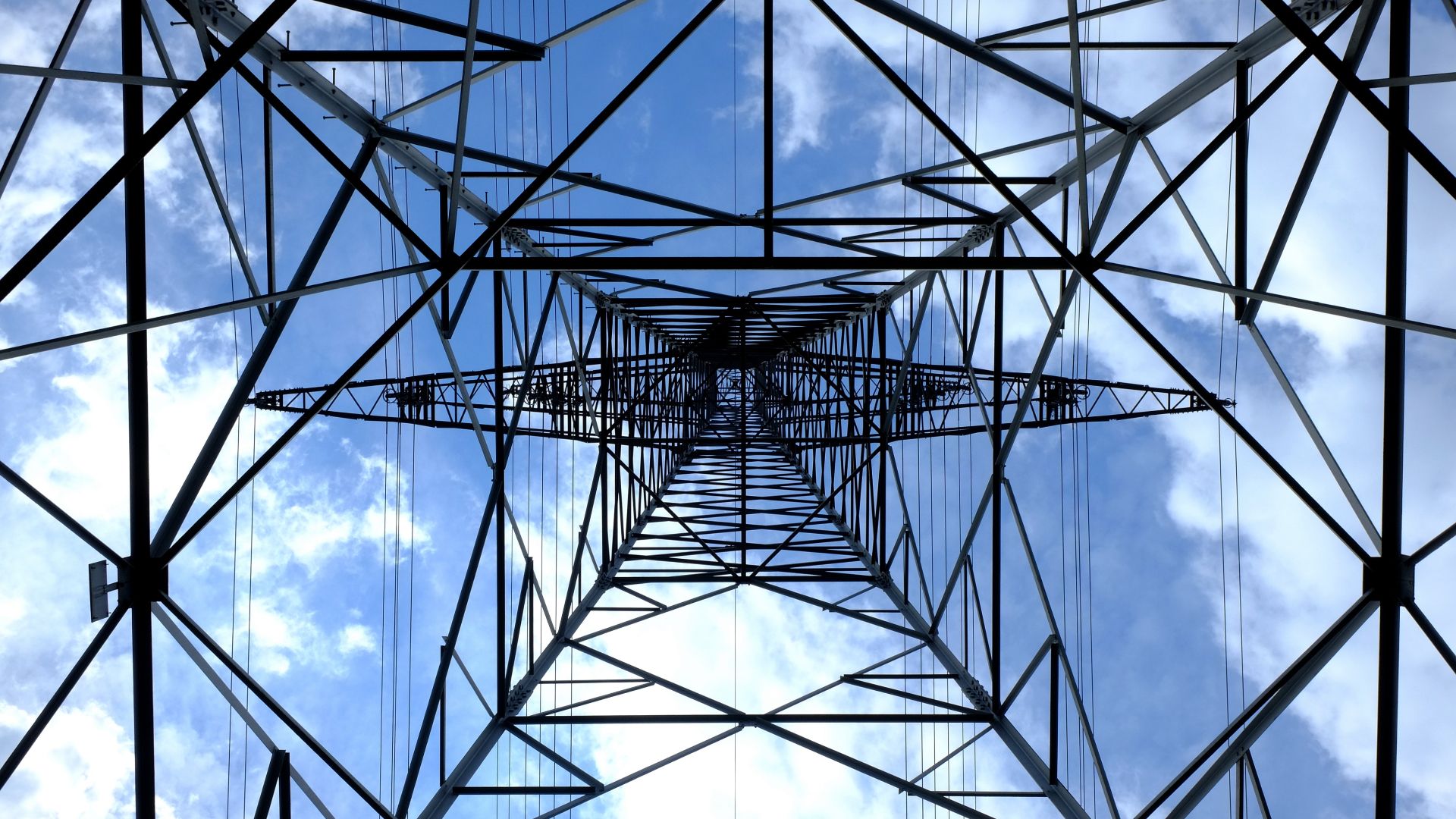

KSS Energia is a Finnish energy group that produces and develops services for its energy network customers and sells electricity and energy expertise in and outside the Kouvola region in Finland. Established in 1974, KSS Energia is currently owned entirely by the city of Kouvola. KSS Energia Group consists of its parent company, KSS Energia Oy and its subsidiaries, KSS Verkko Oy, KSS Lämpö Oy, KSS Rakennus Oy and Suomen Energia-Urakointi Oy. KSS Energia is an active producer and seller of electricity, district heat and natural gas. The Group sells 1,500GWh of electricity annually.

Oaklins’ team in Finland provided strategic advisory services to KSS Energia in connection with the potential acquisition of the Finland-based energy sector player.

Talk to the deal team

Related deals

Top Systems teams up with Holland Capital to create the premier Dutch battery-based solutions provider

Holland Capital, a Netherlands-based private equity firm, has acquired a stake in Top Systems, a leading provider of complete battery-based power solutions, with a unique value-added services proposition.

Learn moreEVIO has raised funds from Lince Capital for its international expansion

EVIO has secured a second fundraising round lead by Lince Capital, a Portuguese private equity firm, in order to fund its international expansion and reinforce its commercial activity.

Learn moreTotalEnergies and SHV Energy have sold PitPoint.LNG to ViGo Bioenergy

TotalEnergies and SHV Energy have agreed to sell PitPoint.LNG, a Netherlands-based operator of state-of-the-art LNG refueling stations, to ViGo Bioenergy, a Germany-based developer and operator of refueling stations for alternative fuels. With this strategic acquisition, ViGo Bioenergy expands its international station network for alternative fuels and strengthens its European bio-LNG position.

Learn more