LHN Logistics has raised S$5.0m (US$3.6 million) in gross proceeds

LHN Logistics Limited has completed a fundraising to partially finance the construction of an ISO tank depot, expand the transportation fleet and acquire moving equipment.

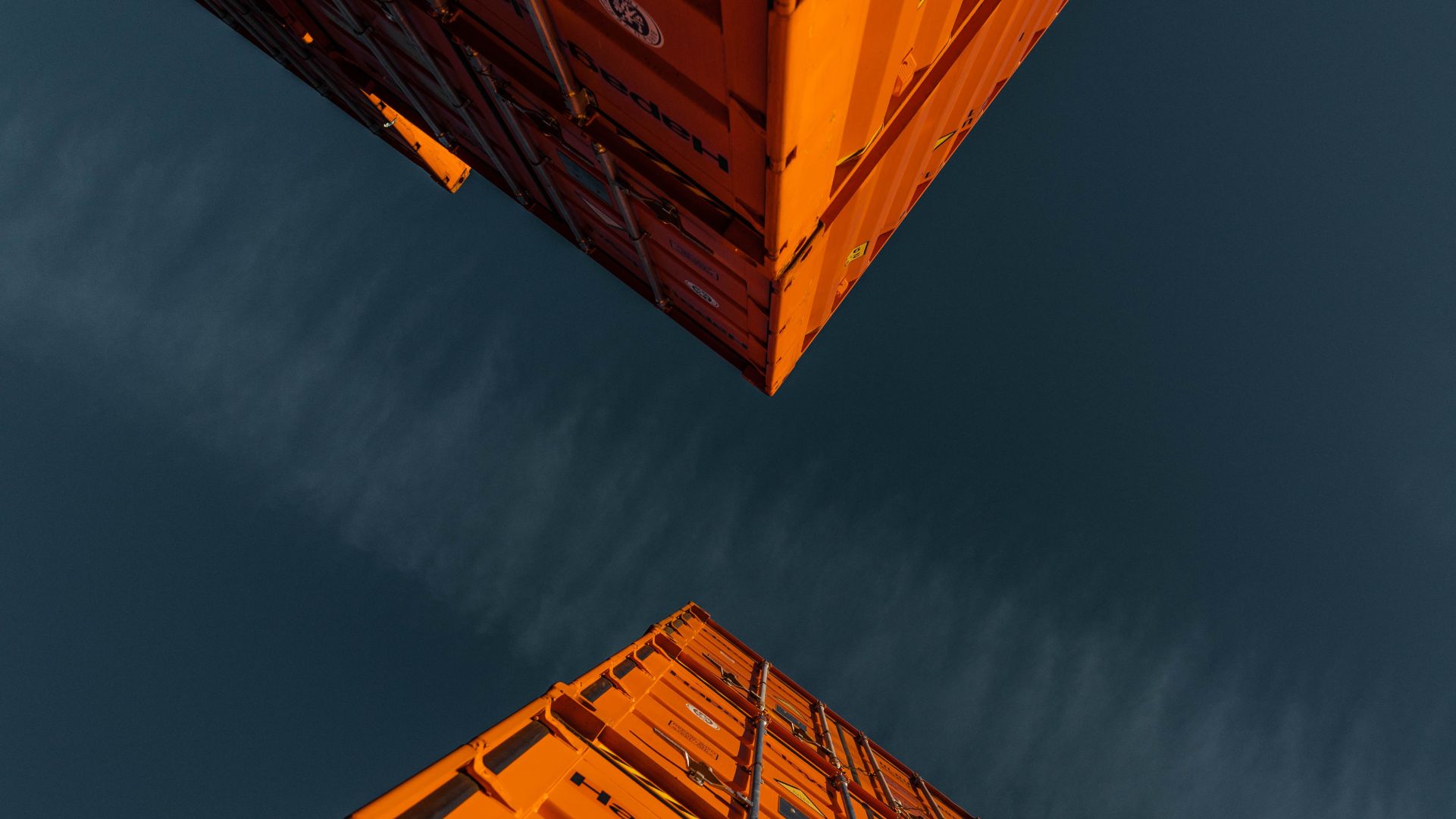

LHN Logistics is a services group with an operating history of approximately 19 years in two principal business segments, transportation and container depot services. Under its transportation unit, LHN Logistics provides ISO tank and container transportation for various petrochemical products, base oils, bitumen and bulk cargo to customers in Singapore and Malaysia, through its fleet of customized and licensed prime movers and trailers. Through its container depot services, LHN Logistics provides container depot management services in Singapore and container depot services to customers in Singapore and Thailand.

Oaklins’ team in Singapore acted as the sponsor, issue manager and co-placement agent for the admission of LHN Logistics to the Catalist Board (Catalist) of the Singapore Exchange Securities Trading Limited and the placement of 25,238,000 shares at S$0.20.

Talk to the deal team

Related deals

Xeros Technology Group has completed a placing, subscription and retail offer

Xeros Technology Group plc has raised funds to drive forward its commercialization strategy.

Learn moreVarsteel, Ltd. has acquired Pacific Steel, Inc.

Pacific Steel, Inc. has been acquired by Varsteel, Ltd.

Learn morePCI Pal has completed an equity raise

PCI Pal has completed a fundraising. Funds will be allocated towards several key areas, with a significant portion directed towards supporting its continued expansion in the US, focusing on marketing efforts, product marketing and enhancing engagement with key partners.

Learn more