Power & Pumps has been acquired by Motion & Control Enterprises

The shareholders of Power & Pumps, Inc. have sold the company to Motion & Control Enterprises (MCE).

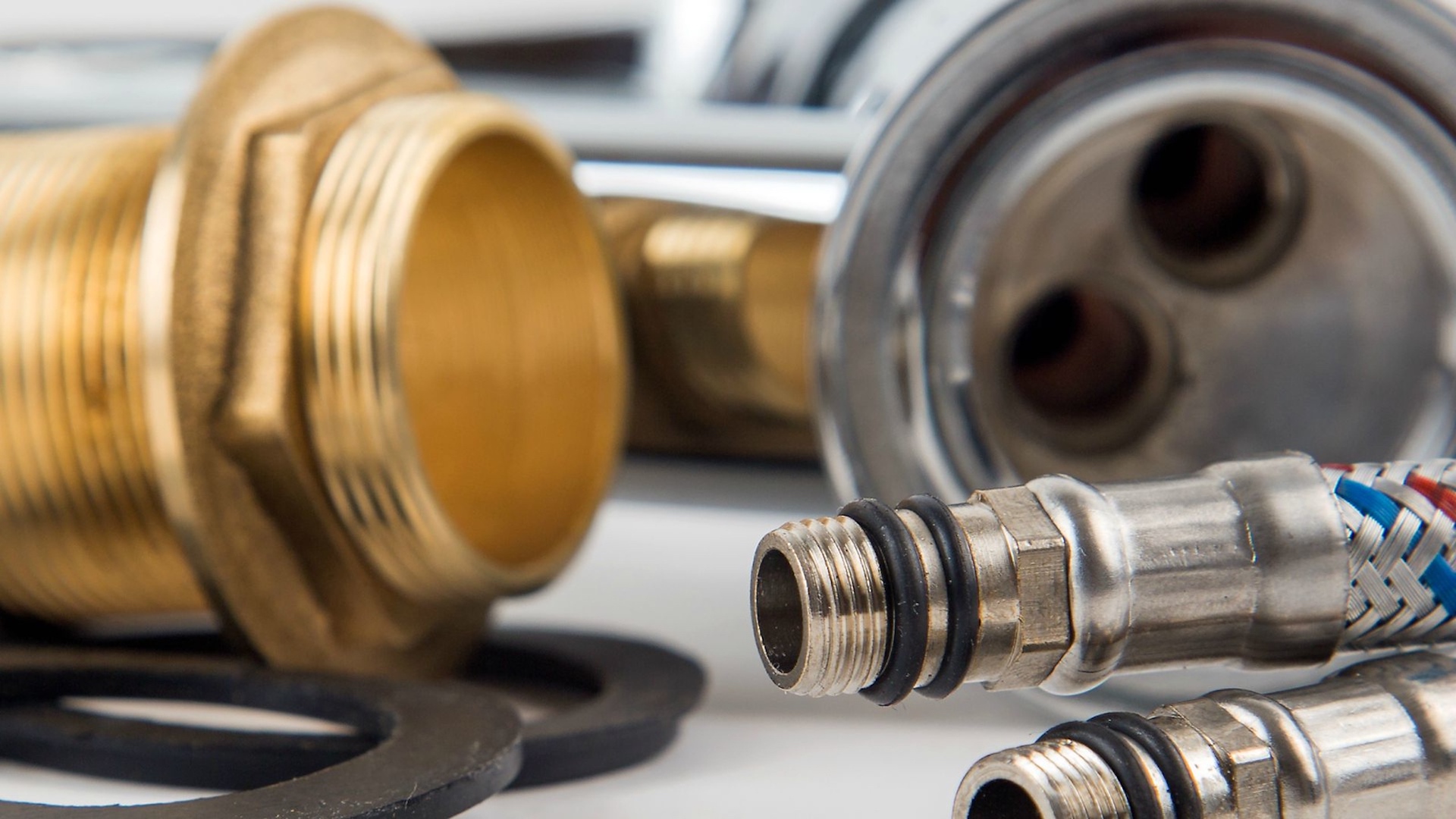

Power & Pumps is a leading distributor of power transmission products, pumps, electric motors and drives, and other related equipment from some of the industry’s top manufacturers, serving both the industrial and municipal water/waste water markets in Florida and Georgia. Headquartered in Jacksonville, Florida, the company is also the master distributor in North America for All Prime Pumps, a line of self-priming pumps sold to municipal and industrial end-users and resellers. The company also performs repairs and other value-services for its customer base.

Founded in 1951, MCE is a leading supplier of technical fluid power, automation, flow control, compressed air and lubrication products, repair and services, and bespoke solutions. It serves more than 23,000 MRO and OEM customers from 38 facilities located in 13 states. MCE is majority-owned by Frontenac, a Chicago-based private equity firm that invests in middle market buyout transactions in consumer, industrial and services markets.

Oaklins Heritage in Jacksonville served as the intermediary and exclusive financial advisor to the seller in this transaction.

David Williams

Owner, Power & Pumps, Inc.

Talk to the deal team

Related deals

Dolmans Landscaping Group has welcomed Foreman Capital as a new shareholder to support further growth

Dolmans Landscaping Group, a leading full-service provider of landscaping services, has welcomed Foreman Capital as a new shareholder. By partnering with Foreman Capital, which has extensive experience in building stronger companies in the maintenance of public spaces, Dolmans can accelerate its growth trajectory across core verticals and further professionalize the business.

Learn moreBackspin has completed a mandatory public tender offer for the shares of Spindox

Backspin S.p.A. has completed a mandatory public tender offer for Spindox S.p.A.

Learn moreCenterbridge Partners has announced a minority interest investment in Pure Cremation

Centerbridge Partners, L.P. has announced a structured minority interest investment in Pure Cremation. The investment includes both loan and equity instruments and is subject to regulatory approval, with completion expected in the first half of 2026.

Learn more