Reobijn and Final Plastics have been acquired by a private investor

The shareholder of Reobijn and Final Plastics, two Netherlands-based providers of plastic injection molding services, has sold the companies to Paul Harkema, a Dutch private investor with over nine years of experience in the injection molding industry.

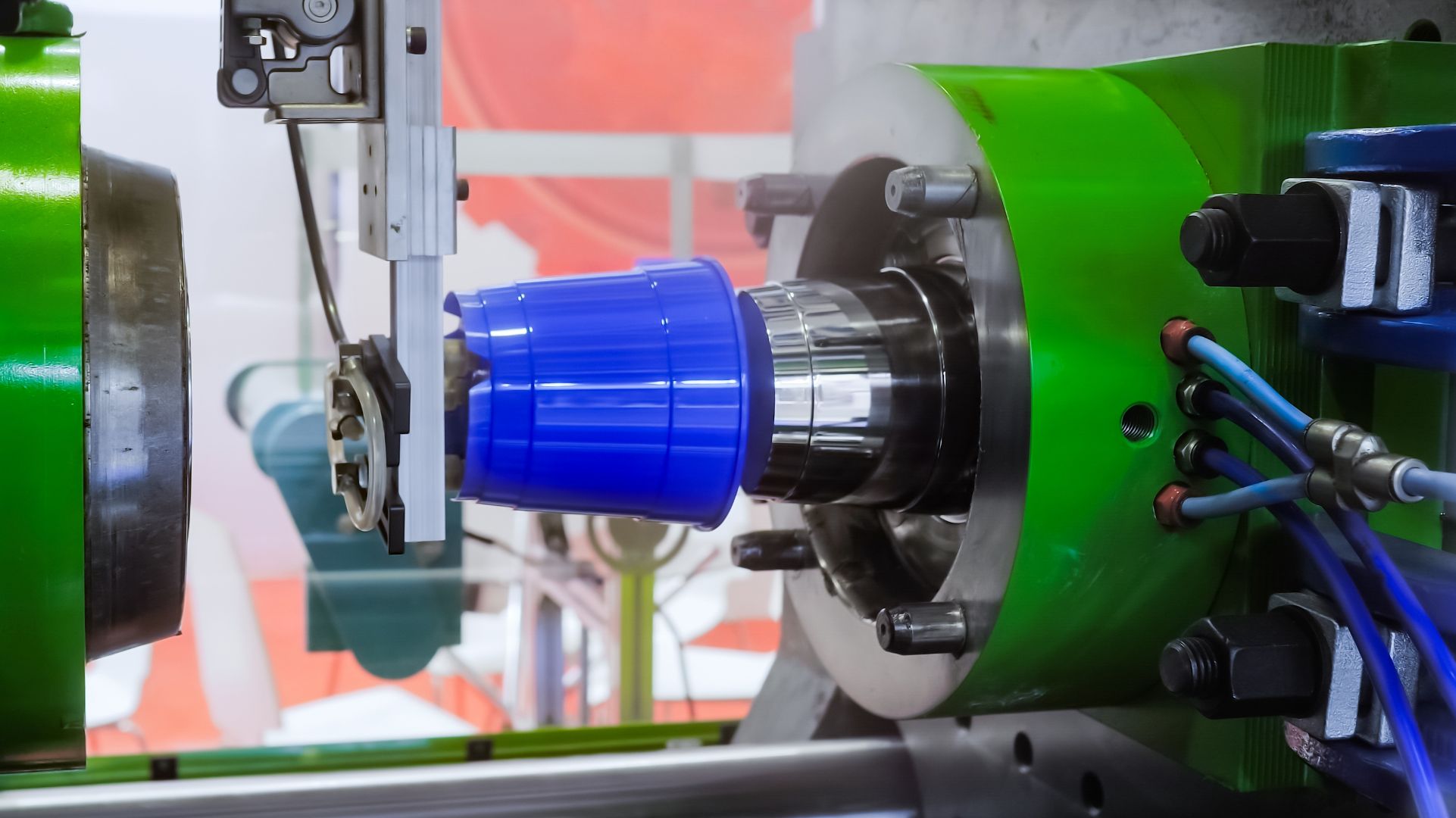

Established in 1959, Reobijn provides plastic injection molding services ranging from product design to injection molding and post-processing. The company serves a diverse customer base across multiple sectors, including electrotechnics and energy transition, heating, ventilation and air conditioning (HVAC), consumer products and automotive.

Founded in 1977, Final Plastics offers injection molding services throughout the entire production process, from mold design to production and logistics. The company manufactures a broad array of products across multiple sectors, including technical and industrial components, household and consumer goods, as well as boiler and sanitary items.

Oaklins’ team in the Netherlands acted as the exclusive sell-side advisor to the shareholder of Reobijn and Final Plastics. This transaction emphasizes Oaklins’ strong track record and expertise in the industrial machinery and components sector.

Talk to the deal team

Rainier Smeink

Oaklins Netherlands

Related deals

The assets of IMG have been acquired by SLV Mecklenburg-Vorpommern

The assets of Ingenieurtechnik und Maschinenbau GmbH (IMG) have been acquired by SLV Mecklenburg-Vorpommern GmbH (SLV-MV) through an asset deal as part of IMG’s insolvency proceedings.

Learn moreLauak Group has sold a majority stake to Wipro Infrastructure Engineering

After careful strategic reflection to secure the group’s future, Lauak Group’s shareholders have chosen an industrial partnership, in line with the ongoing consolidation trend in the market. Attracted by opportunities for innovation and international expansion, the Charritton family, founders and long-term shareholders, regard Wipro Infrastructure Engineering as a trusted industrial partner. The historical shareholders remain minority stakeholders, and the current CEO continues to lead Lauak.

Learn moreQuantum Base has completed a fundraise

Quantum Base Holdings plc (AIM: QUBE) has successfully completed a US$5.7 million fundraise.

Learn more