PFB Corporation has been acquired by The Riverside Company

The private shareholders of PFB Corporation (TSX:PFB) (PFB) have sold the company to The Riverside Company, a US-based private equity sponsor.

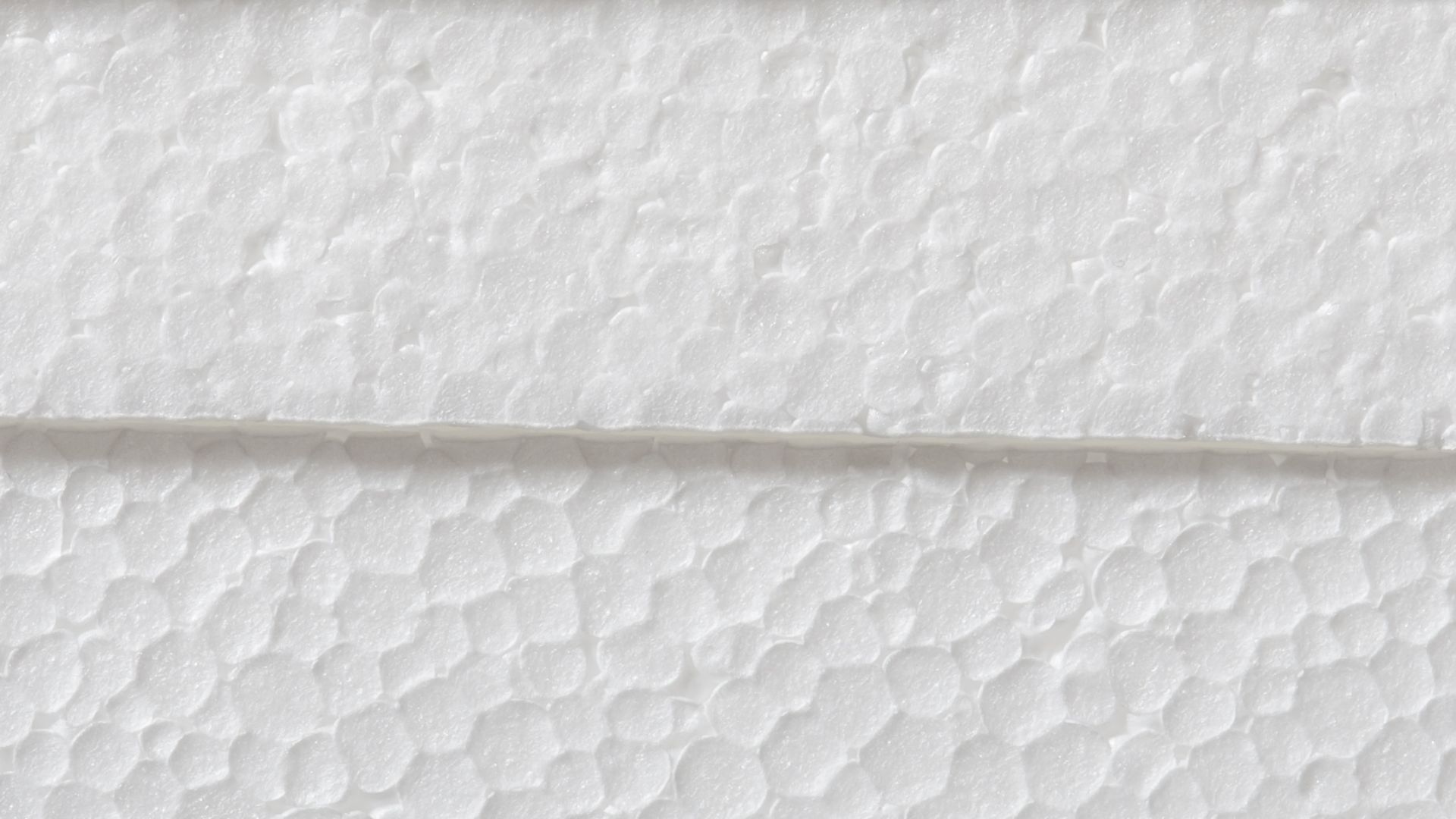

PFB, based in Calgary, Canada, is the largest and only vertically integrated EPS producer in North America, with a proven management team, broad geographic footprint, innovative products and brands addressing major end-markets, and a history of successful strategic acquisitions. PFB has developed leading brands in each of its product categories and markets. These include insulation products (Plasti-Fab), insulating concrete forms (Advantage ICF), geofoam blocks, structural components consisting of foam insulation core encased between wood boards to create structural insulated panels or SIPs (Insulspan), and design and project management of custom homes that incorporate the company’s EPS insulation and SIPs (PrecisionCraft, Riverbend and PointZero). PFB building products are used in both new and renovation markets in residential, commercial, industrial and infrastructure projects.

The Riverside Company is a global investment firm focused on being one of the leading private capital options for investors, business owners and employees at the smaller end of the middle market by seeking to fuel transformative growth and create lasting value. Since its founding in 1988, Riverside has made more than 800 investments. The firm’s international private equity and structured capital portfolios include more than 140 companies.

Oaklins’ team in Los Angeles acted as the exclusive financial advisor to PFB.

Contacter l'équipe de la transaction

Jeremiah Mann

Oaklins Intrepid

Eduard Bagdasarian

Oaklins Intrepid

Ana Alvarenga

Oaklins Intrepid

Kyle Kearney

Oaklins Intrepid

Transactions connexes

Dolmans Landscaping Group has welcomed Foreman Capital as a new shareholder to support further growth

Dolmans Landscaping Group, a leading full-service provider of landscaping services, has welcomed Foreman Capital as a new shareholder. By partnering with Foreman Capital, which has extensive experience in building stronger companies in the maintenance of public spaces, Dolmans can accelerate its growth trajectory across core verticals and further professionalize the business.

En apprendre plusGuard has strengthened its Danish platform with the acquisition of Holtec

Guard Automation AS, a leading Nordic provider of automation services, insight and process optimization, has acquired Holtec AS, a Danish engineering and automation company. The acquisition strengthens Guard’s presence in Denmark and supports its strategy of combining strong local expertise with digital platforms. Together with X Automation, Holtec will form a strong Danish automation platform, enabling knowledge sharing, best-practice transfer and enhanced capabilities across the Nordics.

En apprendre plusBackspin has completed a mandatory public tender offer for the shares of Spindox

Backspin S.p.A. has completed a mandatory public tender offer for Spindox S.p.A.

En apprendre plus