SUHNER Group has acquired a minority stake in Jellypipe

As part of a start-up financing, SUHNER Group has acquired a minority stake in Jellypipe AG.

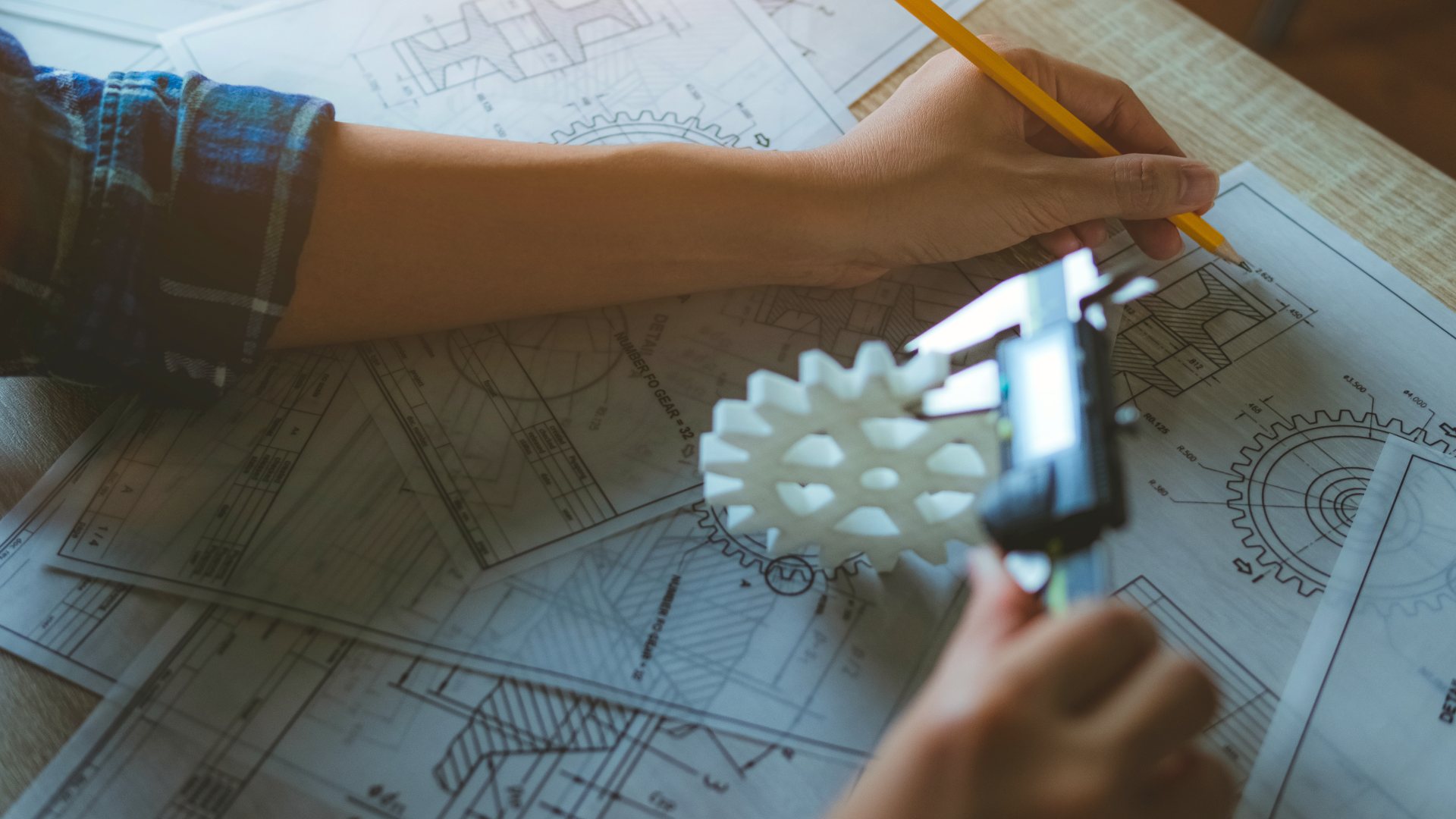

The globally active SUHNER offers its customers comprehensive solutions for mission-critical metal components and workpieces through its three divisions: abrasive, machining and components. With state-of-the-art technology, leading know-how and a comprehensive understanding of industrial manufacturing, SUHNER Group helps its customers to achieve better product performance and optimized manufacturing processes, from design to series production.

Jellypipe is a leading start-up in the B2B digital on-demand manufacturing marketplace platform for 3D-printed components and workpieces. Its in-house developed e-commerce platform brings customers, industry and 3D-print partners together and allows digitalized offer and order processes.

With the aim of participating in technological progress, Oaklins was mandated by the SUHNER Group’s shareholders to identify and examine acquisition opportunities. As a result, the group acquired a minority stake in Jellypipe AG. Oaklins’ team in Switzerland acted as the exclusive buy-side advisor to the shareholders of SUHNER Group in the transaction.

Jürg Suhner

Chairman of the Board, SUHNER Group

Contacter l'équipe de la transaction

Christoph Walker

Oaklins Switzerland

Transactions connexes

Tecnosafra has been acquired by Tranorte

Tecnosafra Sistemas Mecanizados Ltda. has been acquired by Tranorte reinforcing their commitment to delivering agricultural equipment and high-quality service to producers across their regions. The integration expands geographic coverage, strengthens after-sales capabilities and enhances access to agriculture technologies, parts availability and field support teams.

En apprendre plusGCT GmbH has been acquired by CTC India and JoReiCo GmbH

GCT GmbH has been acquired by CTC India Pvt. Ltd. and JoReiCo GmbH from Extramet AG, gaining access to a broader network of expertise, enhanced resources and a global sales network. With its extensive experience in diamond coating and its broad client base in the printed circuit board (PCB) tool market, GCT brought new momentum and specialist knowledge to its buyers.

En apprendre plusClearfield, Inc. has divested Nestor Cables Oy

Clearfield, Inc. has divested its subsidiary Nestor Cables Oy.

En apprendre plus