Luceda Photonics has been acquired by Semitronix

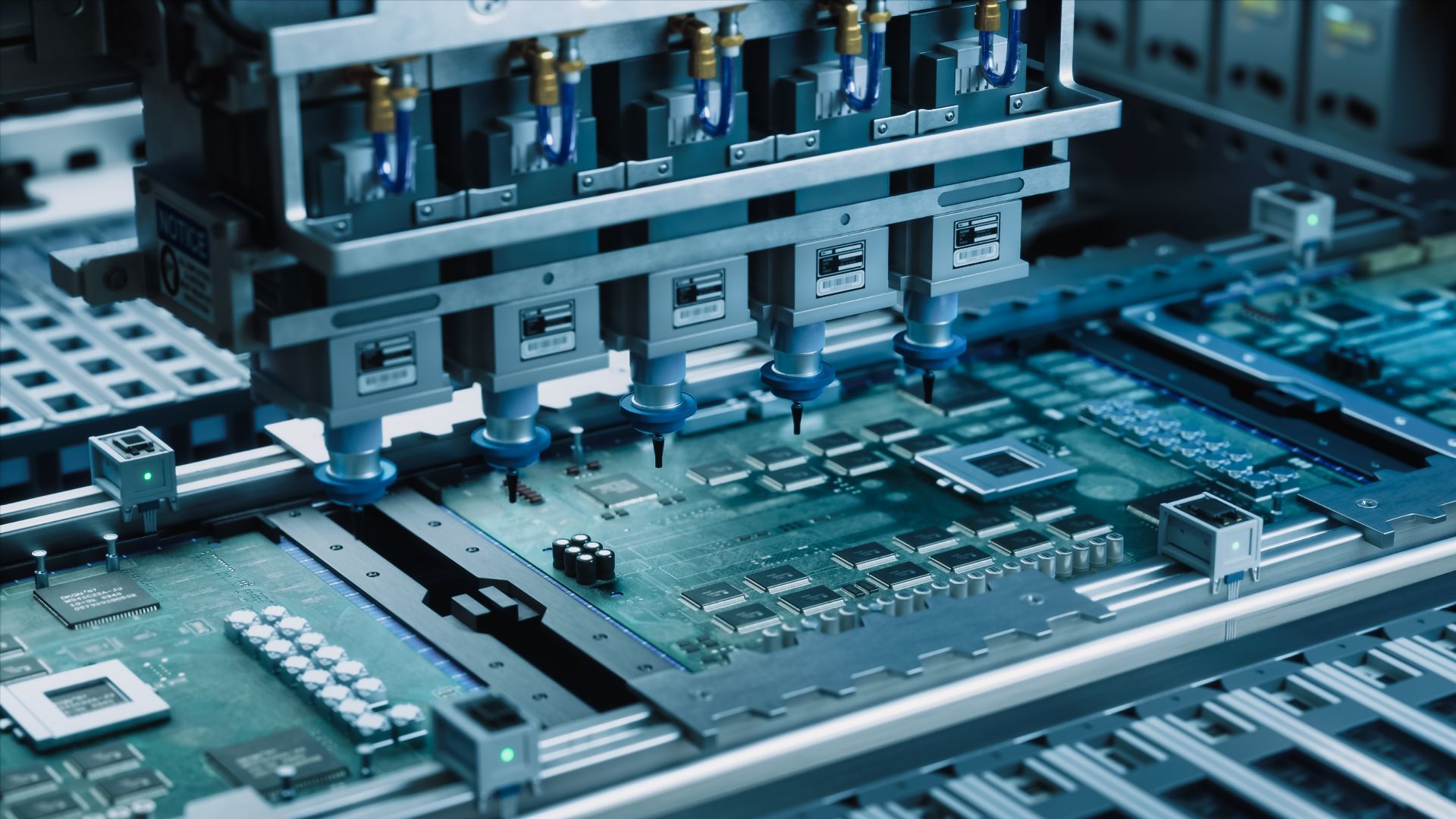

Luceda Photonics has been acquired by Chinese-listed Semitronix. This acquisition creates a unique end-to-end offering in the integrated photonics market, combining Luceda’s expertise in photonic chip design with Semitronix’s capabilities in electronic design automation (EDA), data analytics, wafer testing and yield optimization for the production of integrated photonics, specifically silicon photonics chips.

Luceda Photonics is a leading provider of design software for photonic integrated circuits (PICs), empowering engineers to achieve first-time-right designs and accelerate the path to high-yield mass production. Founded in 2014 as a spin-off from Ghent University, the company is headquartered in Ghent, Belgium, with a growing international team including a presence in Shanghai. Luceda’s innovative platform bridges the gap between design and manufacturing, supporting customers across telecom, datacom, sensing and quantum technologies. With a mission to simplify and scale photonic chip development, Luceda is shaping the future of integrated photonics through cutting-edge tools, deep expertise and global collaboration.

SMTX Technologies Singapore Pte. Ltd. is a Singapore-registered entity and a vital part of Semitronix Corporation (SZSE: 301095), a publicly listed technology company headquartered in Hangzhou, China. Semitronix specializes in yield enhancement, data analytics and wafer testing for semiconductor manufacturing. Leveraging deep expertise in chip yield improvement and rapid electrical monitoring technology, the company serves the evolving needs of foundries, IDMs and design houses across Asia and beyond. Semitronix is committed to delivering cutting-edge solutions that improve product yield and quality, accelerate process development and drive operational efficiency in the complex semiconductor landscape.

The sellers are a group of shareholders, including multiple private individuals, IMEC, the world’s leading independent nanoelectronics R&D hub, and PMV, a public investment company that advises, guides and finances sustainable area development and real estate projects of social or historical relevance.

Oaklins’ team in Belgium acted as the exclusive financial advisor to the sellers in this transaction.

Pieter Dumon and Erwin De Baetselier

Co-founders and management, Luceda Photonics

Contacter l'équipe de la transaction

Tom Van de Meirssche

Oaklins KBC Securities

Bart Delusinne

Oaklins KBC Securities

Nicolas Ockier

Oaklins KBC Securities

Transactions connexes

Middlecon has been acquired by Nion

Middlecon has been acquired by Nion, a digital consultancy backed by Stella Capital. The acquisition strengthens Nion’s capabilities in data management and advanced analytics, enabling it to undertake larger and more complex data-driven initiatives for its customers. The partnership with Nion provides Middlecon with a strong foundation for continued growth and expansion.

En apprendre plusPresight Solutions has been acquired by Banyan Software

Banyan Software, a leading acquiror and operator of mission-critical software businesses, has entered Norway with the acquisition of Presight Solutions AS, a SaaS company delivering advanced software for safety, operational integrity and regulatory compliance in high-risk industries. The transaction marks a new chapter for Presight, strengthening its ability to scale while preserving the product focus, sector expertise and customer trust built since its founding in 2003.

En apprendre plusBackspin has completed a mandatory public tender offer for the shares of Spindox

Backspin S.p.A. has completed a mandatory public tender offer for Spindox S.p.A.

En apprendre plus