Ebidco has completed a voluntary public tender offer for the warrants of Eles Semiconductor Equipment

Ebidco S.r.l. has completed a voluntary public tender offer for the warrants of Eles Semiconductor Equipment S.p.A.

Ebidco is an acquisition vehicle owned by Xenon Private Equity. It was established for the purpose of acquiring the warrants of Eles Semiconductor Equipment through a tender offer.

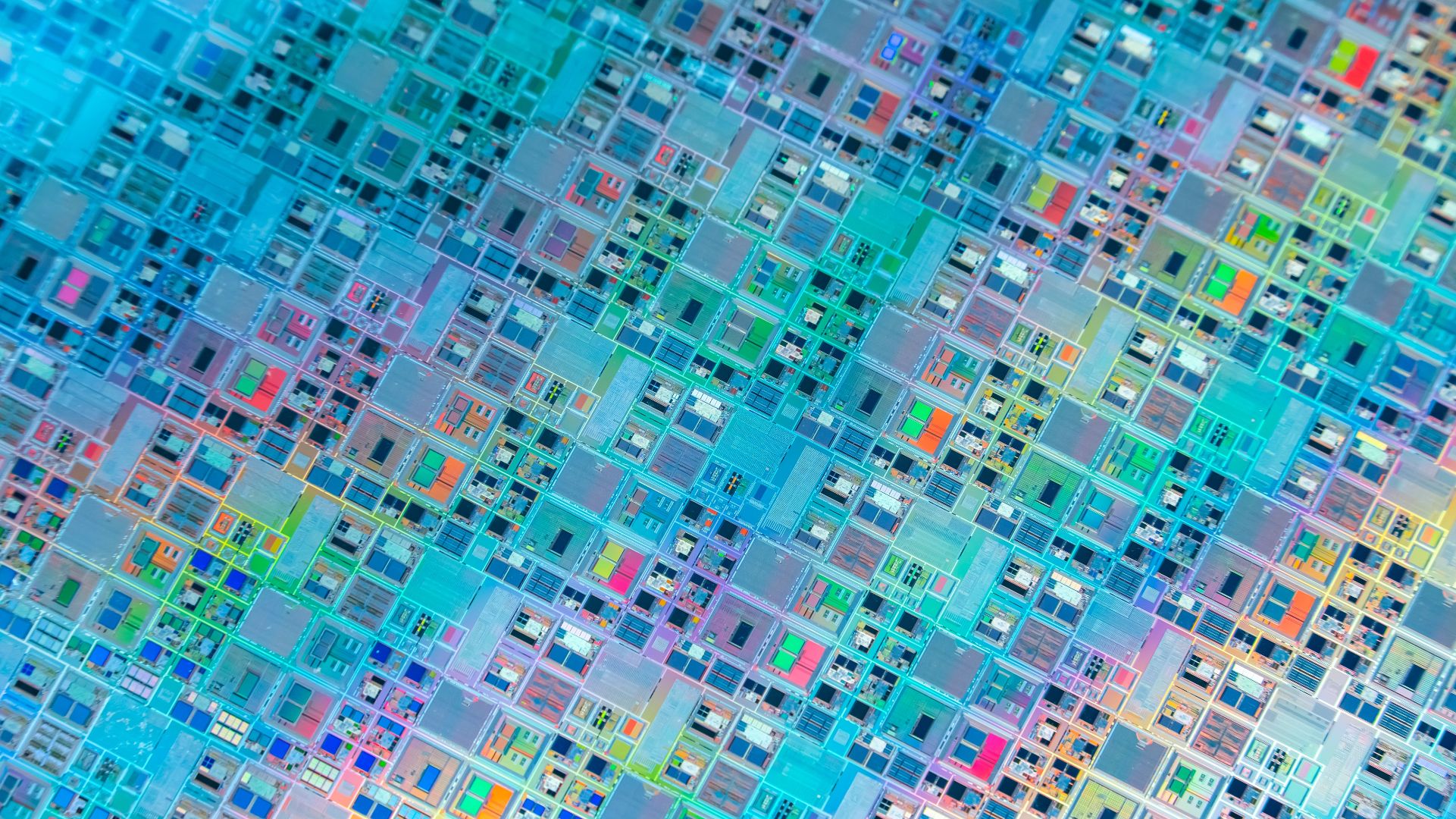

Eles Semiconductor Equipment specializes in the design and manufacture of performance test systems and equipment for the semiconductor industry. The company offers solutions for assessing the reliability of semiconductor integrated circuits and electronic modules. It is also involved in test system configuration and engineering activities. Given its status as a publicly listed company, the warrants of Eles Semiconductor Equipment had a widely dispersed shareholder base.

Oaklins Italy’s parent company, Banca Akros, served as the appointed broker for the collection of warrants in Ebidco’s voluntary public tender offer for 100% of Eles Semiconductor Equipment’s warrants.

Contacter l'équipe de la transaction

Transactions connexes

Backspin has completed a mandatory public tender offer for the shares of Spindox

Backspin S.p.A. has completed a mandatory public tender offer for Spindox S.p.A.

En apprendre plusLauak Group has sold a majority stake to Wipro Infrastructure Engineering

After careful strategic reflection to secure the group’s future, Lauak Group’s shareholders have chosen an industrial partnership, in line with the ongoing consolidation trend in the market. Attracted by opportunities for innovation and international expansion, the Charritton family, founders and long-term shareholders, regard Wipro Infrastructure Engineering as a trusted industrial partner. The historical shareholders remain minority stakeholders, and the current CEO continues to lead Lauak.

En apprendre plusThe assets of IMG have been acquired by SLV Mecklenburg-Vorpommern

The assets of Ingenieurtechnik und Maschinenbau GmbH (IMG) have been acquired by SLV Mecklenburg-Vorpommern GmbH (SLV-MV) through an asset deal as part of IMG’s insolvency proceedings.

En apprendre plus