Exact, Inc. has been acquired by Chancey Metal Products

The shareholders of Exact, Inc. have sold the company to Chancey Metal Products.

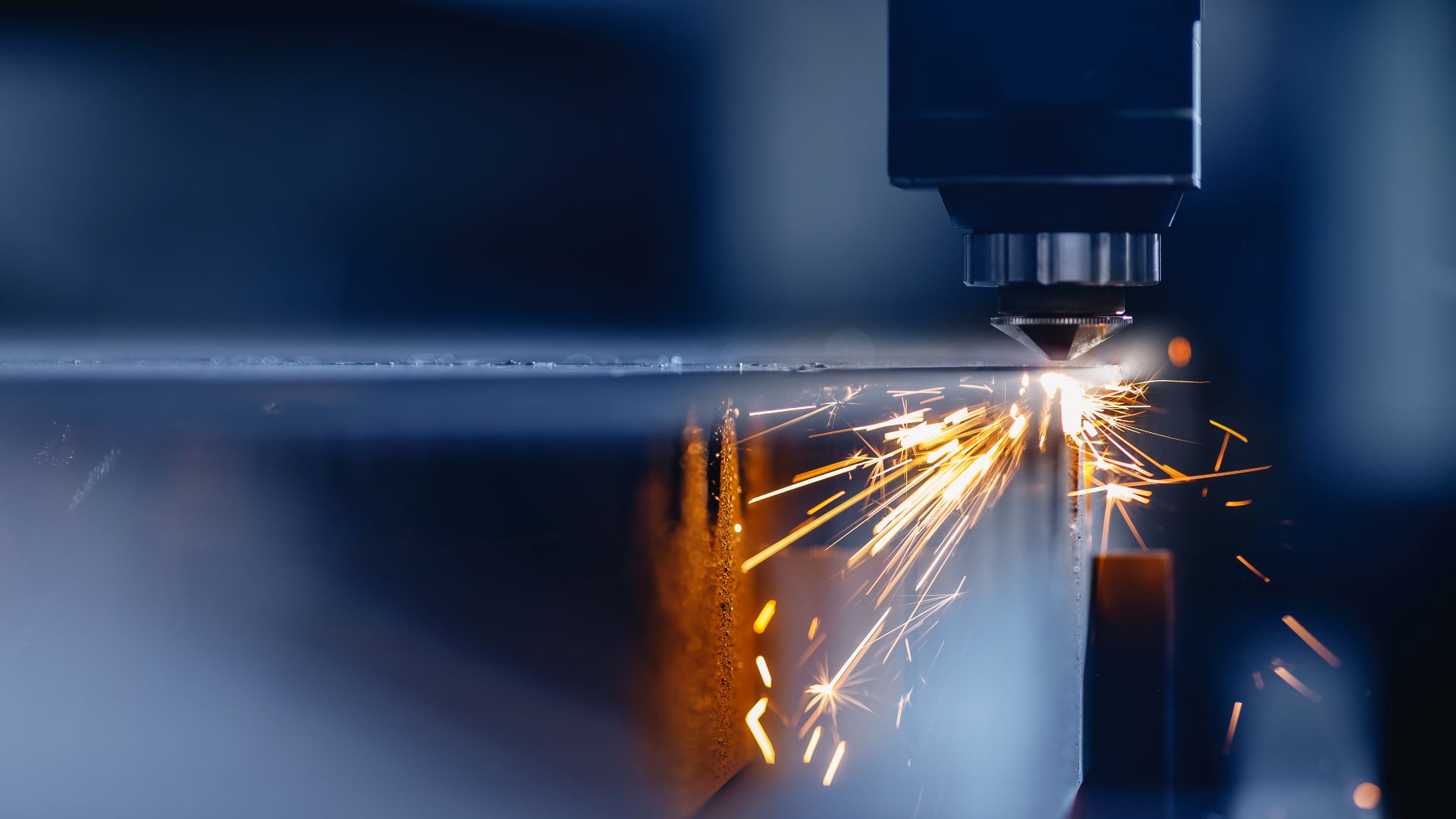

Exact was founded in 1964 in Jacksonville, Florida, as a manufacturer of precision sheet metal and provides assembly for the electronic and communication industry. The company offers CNC (computer numerical control) machining and punching, laser cutting, zinc plating and mechanical assemblies.

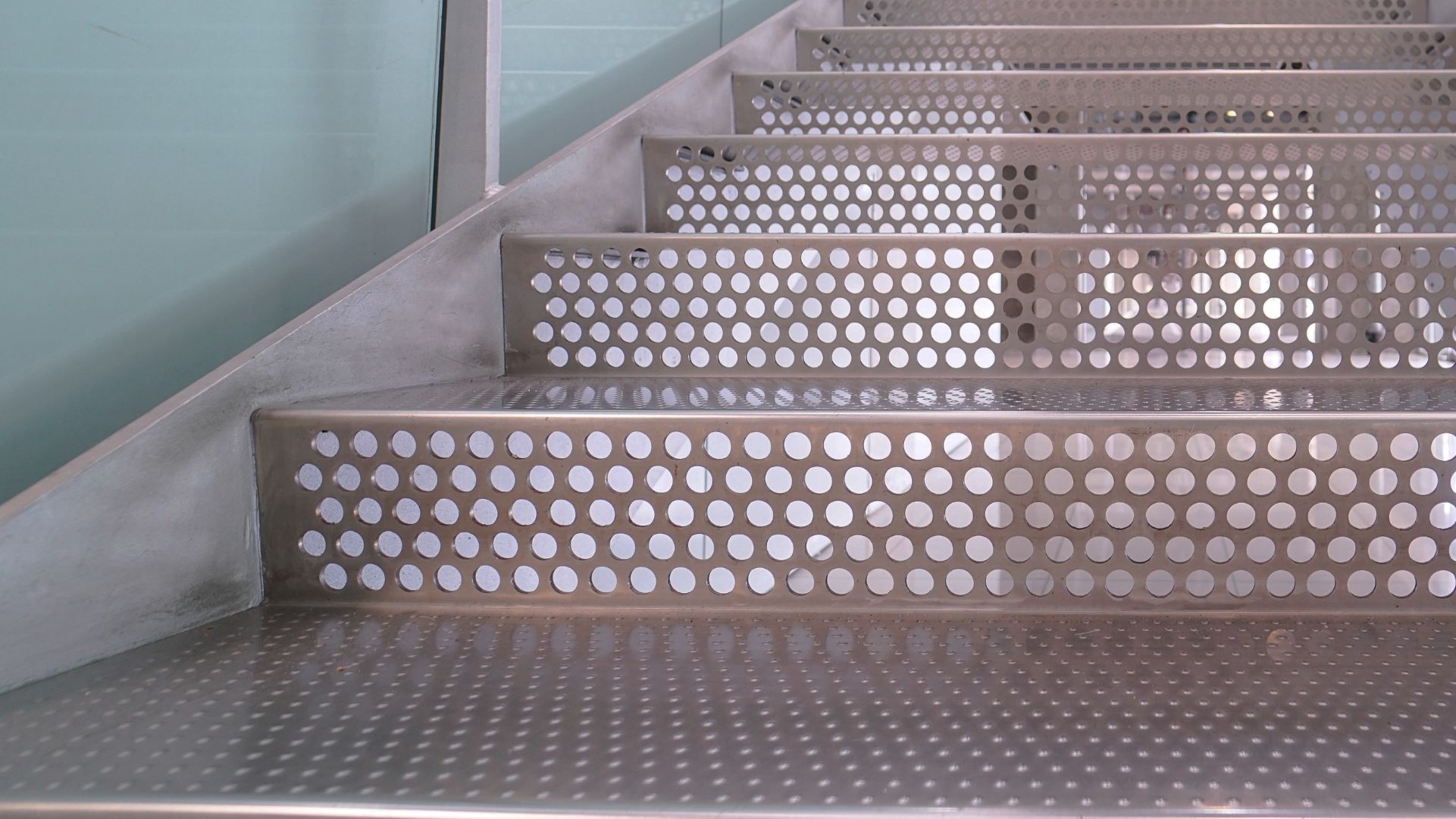

Chancey is a Jacksonville-based fabricator and installer of metal stair and railing systems. The acquisition of Exact is its fifth acquisition over the past four years. Prior to its most recent acquisition, Chancey acquired fellow Jacksonville companies CF Machine & Tool, FabTech Supply, and SS Metals and Plastics. Chancey is a portfolio company of Indigo South Capital, a private family office located that invests in public and private equities, venture capital opportunities and real estate.

Oaklins Heritage in Jacksonville served as the intermediary and exclusive financial advisor to the seller in this transaction.

Will Allen

President, Exact, Inc.

Talk to the deal team

Related deals

East Metal has been acquired by management and private investors

The Latvia-based metalworking company East Metal has been acquired from its former Danish owner, East Metal Holding, through a management buy-out (MBO) by a group of private investors, the current owners of Valpro, in partnership with the local management team. Financing for the transaction was provided by Signet Bank.

Learn moreQuantum Base Holdings plc has completed its official admission to AIM

Quantum Base began trading on the London Stock Exchange’s AIM market under the ticker QUBE following a US$6.4 million (£4.8 million) fundraising round. The company develops Q-ID tags, a quantum-based authentication technology designed to prevent counterfeiting by leveraging atomic-level randomness. Proceeds from the listing will fund product development and commercial expansion, including new operational and commercial hires.

Learn moreDoosan Skoda Power has been listed on the Prague Stock Exchange with a US$104 million initial public offering

Doosan Skoda Power and its parent company, Doosan Power Systems, have placed just over US$114 million (€100 million) of the company’s shares, of which US$31.4 million (€27.6 million) supported a 10% capital increase and US$72.4 million (€63.7 million), representing 23% of the pre-transaction share capital, was returned to the selling shareholder. This amount includes US$10.5 million (€9.2 million) in greenshoe shares, equivalent to 10% of the base deal.

Learn more