STENHØJ Holding A/S has divested STENHØJ Hydraulik A/S to Pentaco Partners A/S

STENHØJ Holding A/S has sold STENHØJ Hydraulik A/S to Pentaco Partners A/S.

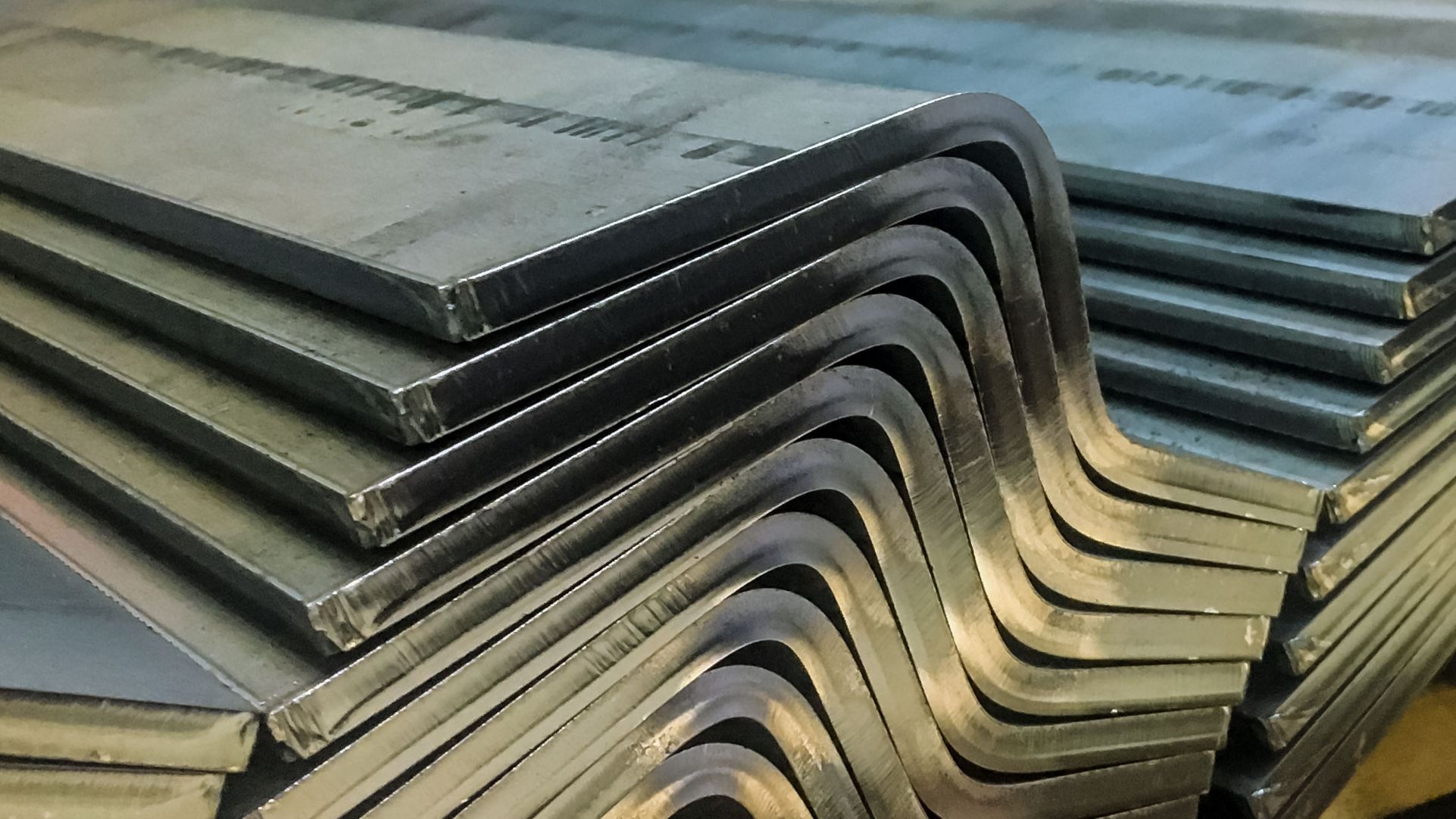

STENHØJ Hydraulik is well regarded in the global automotive industry for offering reliable high-end products to its customers. Its product portfolio includes advanced electro-mechanical broaching machines, hydraulic presses and bending machines, individually customized to the end user. The company’s core operation is based on advanced engineering capabilities to design tailor-made machinery within the sheet metal processing industries.

Pentaco Partners is a Danish investment company with a key focus on investing in Danish companies with an attractive market potential and competent management teams. Pentaco works in close collaboration with existing management to further develop the companies, with a long term investment horizon in place.

STENHØJ Holding is a Danish family-owned company located in Jutland. It was founded in 1917 and has developed into a leading product and services supplier for the automotive aftermarket. The group has sales exceeding US$110 million and over 500 employees.

Oaklins’ team in Denmark advised STENHØJ Holding in connection with the divestiture of STENHØJ Hydraulik to Pentaco Partners. The team handled the full sale process, including identification of buyer and final negotiation.

Søren Madsen

CEO and Shareholder of STENHØJ Holding A/S

Sprechen Sie mit dem Deal Team

Transaktionen

Thrive Freeze Dry has successfully sealed the acquisition deal with Paradiesfrucht GmbH

Paradiesfrucht GmbH, a gobal freeze dryer of fruits, fruit preparations, drops, powders and granulates, has been acquired by Thrive Freeze Dry (Thrive), a portfolio company of Entrepreneurial Equity Partners (e2p) and Mubadala Capital. The transaction is expected to close in 2024, subject to customary closing conditions, including antitrust approval.

Mehr erfahrenPerkbox has been acquired by Great Hill Partners

Molten Ventures has sold Perkbox to Great Hill Partners.

Mehr erfahrenArculus Cyber Security has been acquired by Bridewell

The shareholders of Arculus Cyber Security (Arculus) have sold the business to Bridewell. The deal will bolster Bridewell’s growing roster of accreditations as well as strengthen its public sector footprint, enabling the expansion of its end-to-end cyber security offering for clients across the globe.

Mehr erfahren