Every Man Jack has been acquired by The Carlyle Group

Every Man Jack has received a majority equity investment from The Carlyle Group.

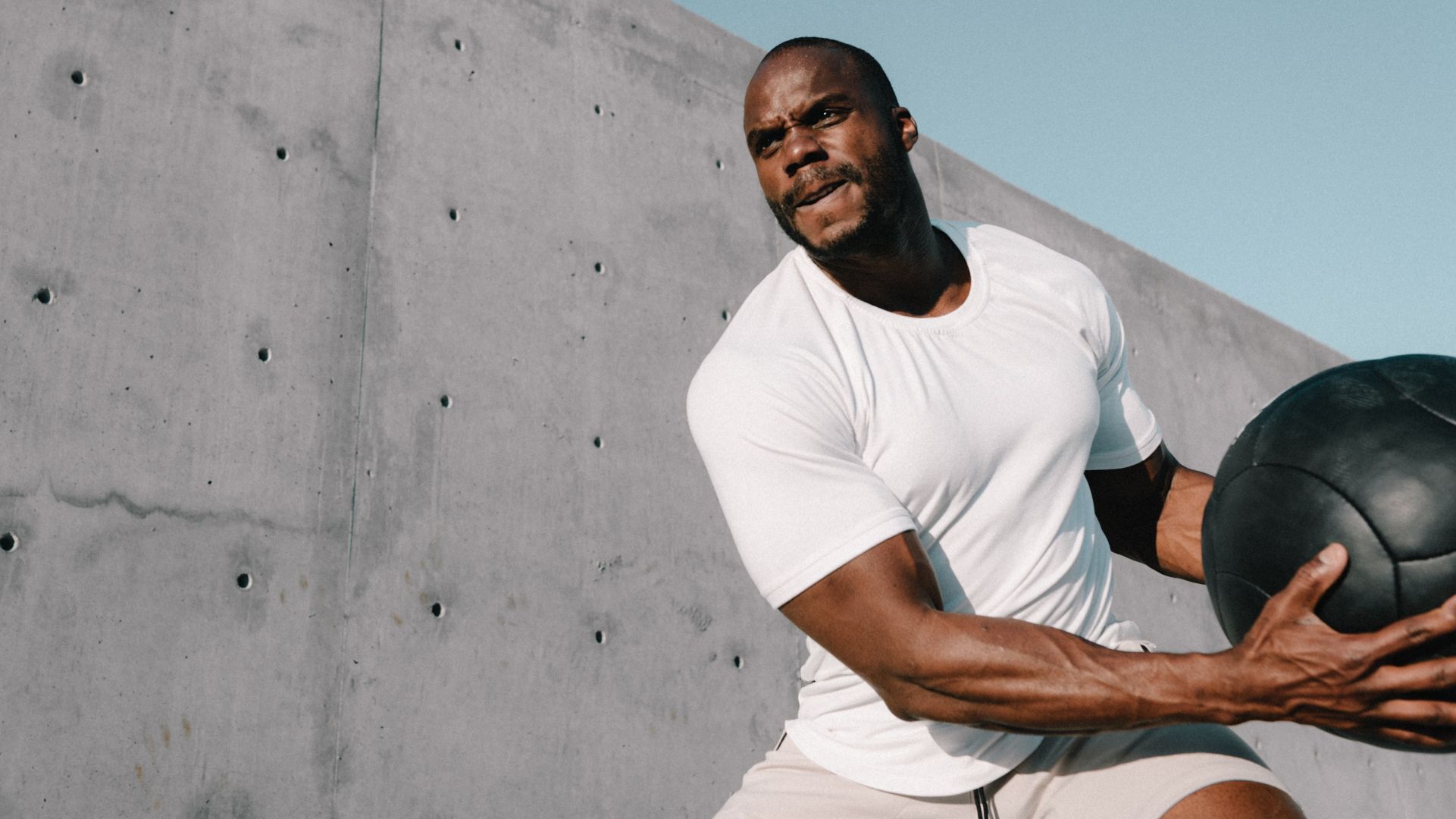

Every Man Jack is one of the largest independent personal care and grooming brands formulated exclusively for men, with a full range of body, hair, deodorant, beard, shaving and skincare products. Focused on naturally derived and plant-based ingredients, Every Man Jack offers affordable and accessible clean personal care and grooming alternatives, all without compromising on performance. A first mover in the natural category, Every Man Jack sells online and via major retail partners in the mass, natural, grocery and drug channels in the USA and Canada. The investment by The Carlyle Group will help Every Man Jack accelerate its mission to deliver innovative, naturally derived personal care products to an increasing number of consumers and retailers globally.

With 29 offices across five continents and more than 1,800 professionals worldwide, The Carlyle Group leverages its global network to deliver its best thinking and drive positive change.

Oaklins’ team in Los Angeles acted as the exclusive financial advisor to Every Man Jack in this transaction.

Sprechen Sie mit dem Deal Team

Gary S. Rabishaw

Oaklins Intrepid

Steven Davis

Oaklins Intrepid

Transaktionen

Thrive Freeze Dry has successfully sealed the acquisition deal with Paradiesfrucht GmbH

Paradiesfrucht GmbH, a gobal freeze dryer of fruits, fruit preparations, drops, powders and granulates, has been acquired by Thrive Freeze Dry (Thrive), a portfolio company of Entrepreneurial Equity Partners (e2p) and Mubadala Capital. The transaction is expected to close in 2024, subject to customary closing conditions, including antitrust approval.

Mehr erfahrenPerkbox has been acquired by Great Hill Partners

Molten Ventures has sold Perkbox to Great Hill Partners.

Mehr erfahrenArculus Cyber Security has been acquired by Bridewell

The shareholders of Arculus Cyber Security (Arculus) have sold the business to Bridewell. The deal will bolster Bridewell’s growing roster of accreditations as well as strengthen its public sector footprint, enabling the expansion of its end-to-end cyber security offering for clients across the globe.

Mehr erfahren