Keystone Fund has issued bonds

Keystone Fund has raised funds to develop and refinance the company.

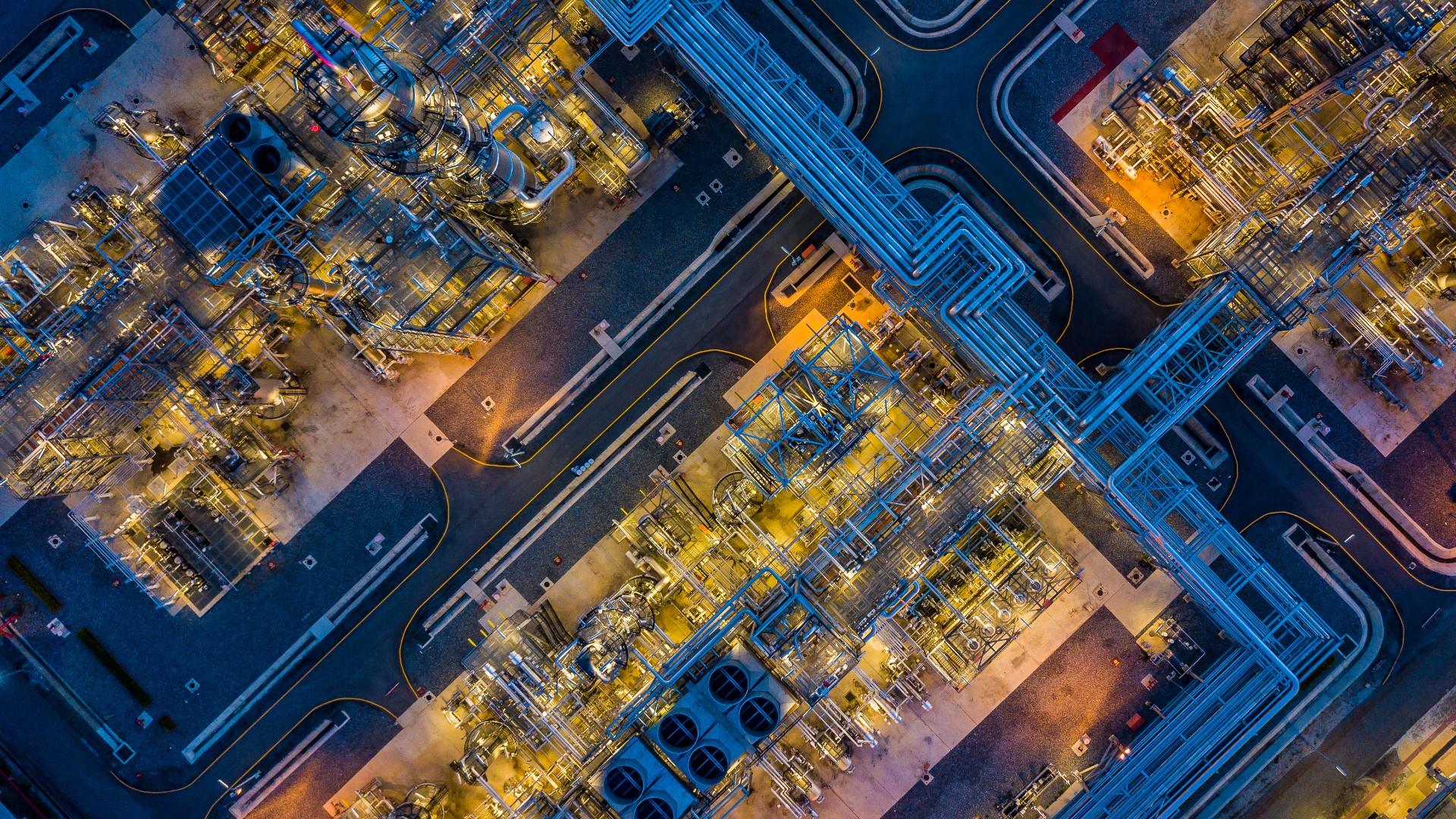

Keystone Fund is an Israeli infrastructure investment fund established in 2019 as part of the government’s policy to promote and encourage investments in infrastructure, including water desalination, wastewater and waste projects, energy infrastructure, transportation and communication projects. Keystone’s goal is to form and establish a balanced and diverse investment portfolio that will offer its investors a long-term return, with as little risk and fluctuation as possible.

Oaklins’ team in Israel advised the company and acted as a member of the distributors’ consortium.

Sprechen Sie mit dem Deal Team

Transaktionen

Top Systems teams up with Holland Capital to create the premier Dutch battery-based solutions provider

Holland Capital, a Netherlands-based private equity firm, has acquired a stake in Top Systems, a leading provider of complete battery-based power solutions, with a unique value-added services proposition.

Mehr erfahrenEVIO has raised funds from Lince Capital for its international expansion

EVIO has secured a second fundraising round lead by Lince Capital, a Portuguese private equity firm, in order to fund its international expansion and reinforce its commercial activity.

Mehr erfahrenAmot Investments Ltd. has issued bonds

Amot Investments Ltd. has raised funds to refinance the company for further development.

Mehr erfahren