Ireland-based Galway Tool & Mould has been acquired by SyBridge Technologies

Leading precision tooling manufacturer Galway Tool & Mould has been acquired by SyBridge Technologies, a global industrial technology company. The acquisition expands SyBridge’s presence in the high precision life sciences end-market.

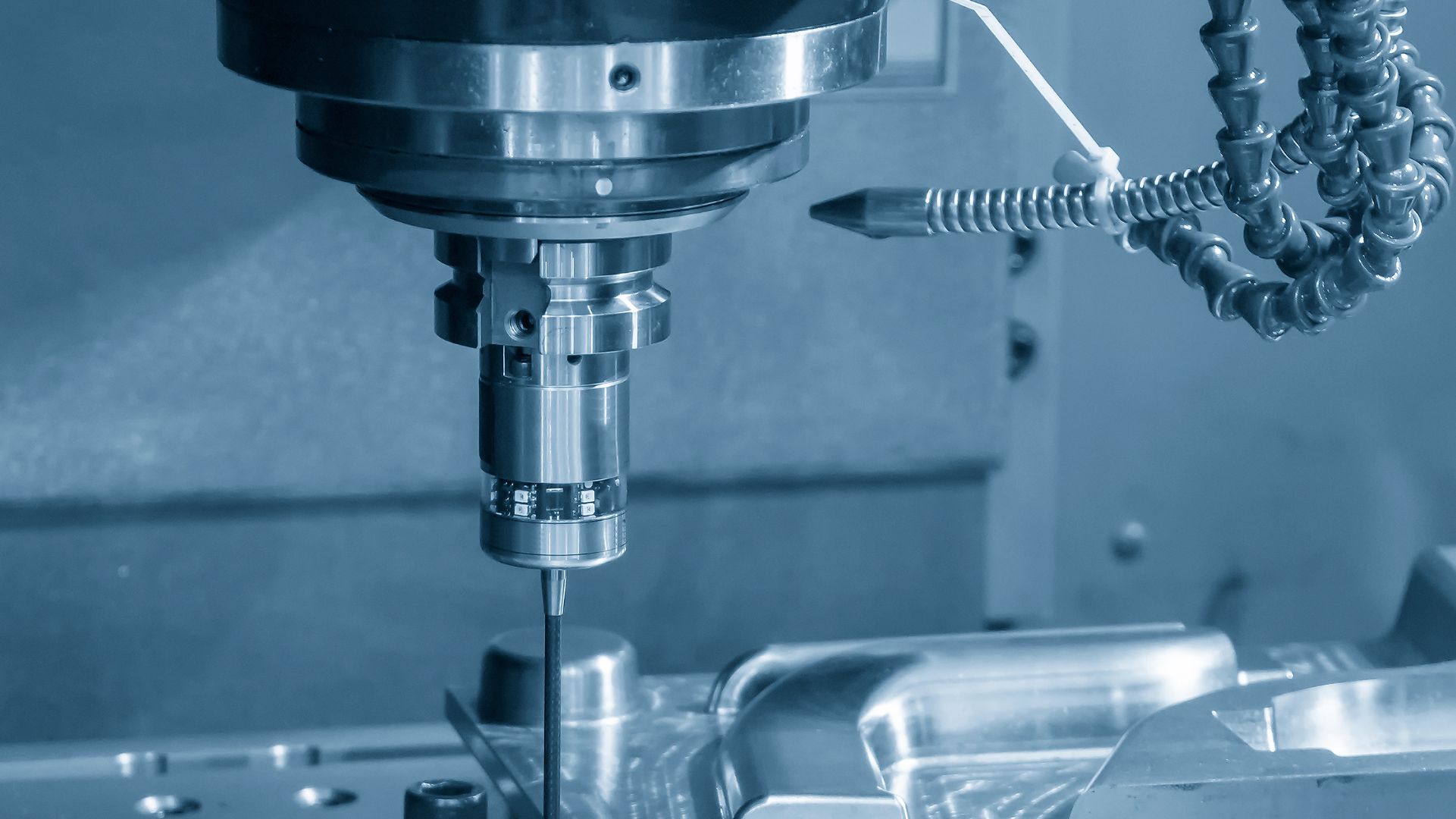

Galway Tool & Mould (GTM) designs and manufactures outstandingly precise, high-performance, cost-effective injection molds. GTM brings the client’s concept through to complex injection mold solutions. Over 30 years of reliability, innovation and superior quality has made GTM the preferred partner to many of the world’s leading pharmaceutical and medical device manufacturers.

SyBridge Technologies was established in 2019 by New York-based private equity firm Crestview Partners to create a global technology leader that provides value-added design and manufacturing solutions across multiple industries. SyBridge is the combination of more than 13 acquisitions made to combine different products, services and technologies into a singular technology-enabled solution. SyBridge is based in Southfield, Michigan, and has operations in the United States, Canada, Mexico and Ireland.

Oaklins’ team in Ireland acted as the exclusive M&A advisor to the shareholder of GTM on the sale of the company to SyBridge Technologies. It is another example of Oaklins in Ireland identifying a North American purchaser searching for an Irish platform to gain access to the large and lucrative EU market.

Talk to the deal team

Related deals

The assets of IMG have been acquired by SLV Mecklenburg-Vorpommern

The assets of Ingenieurtechnik und Maschinenbau GmbH (IMG) have been acquired by SLV Mecklenburg-Vorpommern GmbH (SLV-MV) through an asset deal as part of IMG’s insolvency proceedings.

Learn moreLauak Group has sold a majority stake to Wipro Infrastructure Engineering

After careful strategic reflection to secure the group’s future, Lauak Group’s shareholders have chosen an industrial partnership, in line with the ongoing consolidation trend in the market. Attracted by opportunities for innovation and international expansion, the Charritton family, founders and long-term shareholders, regard Wipro Infrastructure Engineering as a trusted industrial partner. The historical shareholders remain minority stakeholders, and the current CEO continues to lead Lauak.

Learn moreQuantum Base has completed a fundraise

Quantum Base Holdings plc (AIM: QUBE) has successfully completed a US$5.7 million fundraise.

Learn more