FrenchFood Capital has acquired JV La Française

FrenchFood Capital, a private equity firm focused on food businesses, has acquired JV La Française.

FrenchFood Capital is a private equity firm headquartered in Paris providing equity capital to innovative, fast-growing and value-added SMEs in the food sector with tickets between US$5 million and US$15 million. It supports entrepreneurs in their growth projects in France and abroad, while adopting an environmental, societal and balanced governance approach.

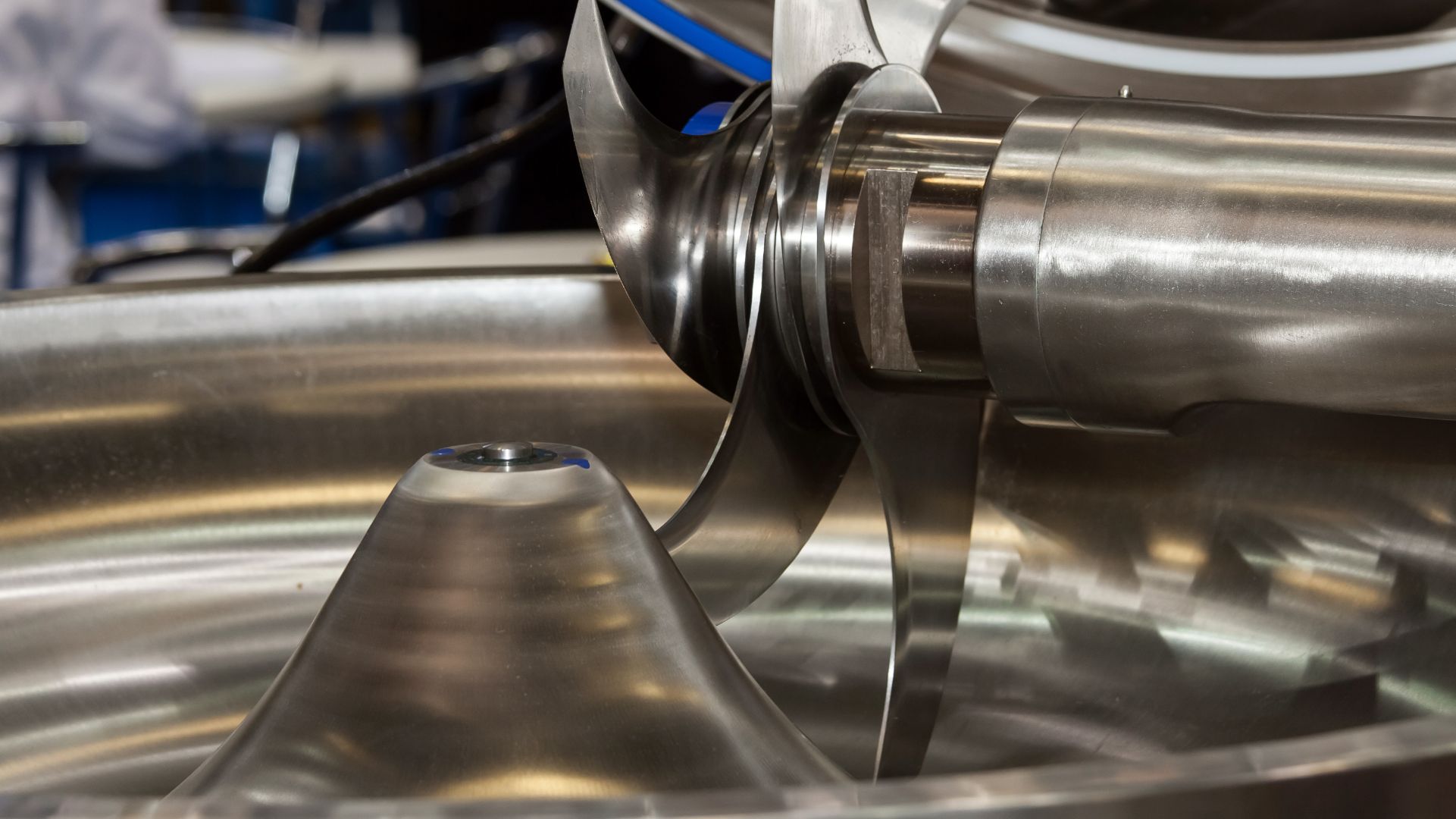

Founded in 1992, JV Groupe specializes in the supply of industrial equipment for the food industry as well as associated value-added services. It assists its customers with all their production equipment needs, from equipment design and selection to the supply of industrial equipment and spare parts management. While addressing the equipment needs of food processors active in the meat/delicatessen and bakery/pastry end-markets, the company targets two categories of clients: industrial and semi-industrial customers—often blue-chip players in France via the JV network—and artisanal retailers, SMEs and on-farm processors through the ADP network, with strong geographical proximity.

Oaklins’ team in France advised FrenchFood Capital in this transaction.

Contáctese con el equipo de la transacción

Transacciones relacionadas

TEAM Safety Services Limited has been acquired by Vadella Group

TEAM Safety Services Limited, a leading UK-based health, safety and fire safety consultancy, has been acquired by Vadella Group, a specialist provider of inspection-led compliance services for the built environment.

Aprenda másTecnosafra has been acquired by Tranorte

Tecnosafra Sistemas Mecanizados Ltda. has been acquired by Tranorte reinforcing their commitment to delivering agricultural equipment and high-quality service to producers across their regions. The integration expands geographic coverage, strengthens after-sales capabilities and enhances access to agriculture technologies, parts availability and field support teams.

Aprenda másSunrise Eggs has been acquired by Agrova International

Sunrise Eggs, one of the UK’s best-established independent egg producers and distributors, has joined Agrova International AS, a European poultry and agri-foods group.

Aprenda más