Synergyc has been acquired by One Equity Partners (OEP) via its platform entity Kirey Group

One Equity Partners (OEP) has completed the simultaneous acquisition of Kirey Group and Synergyc with the clear goal to create a Pan-European IT Service champion.

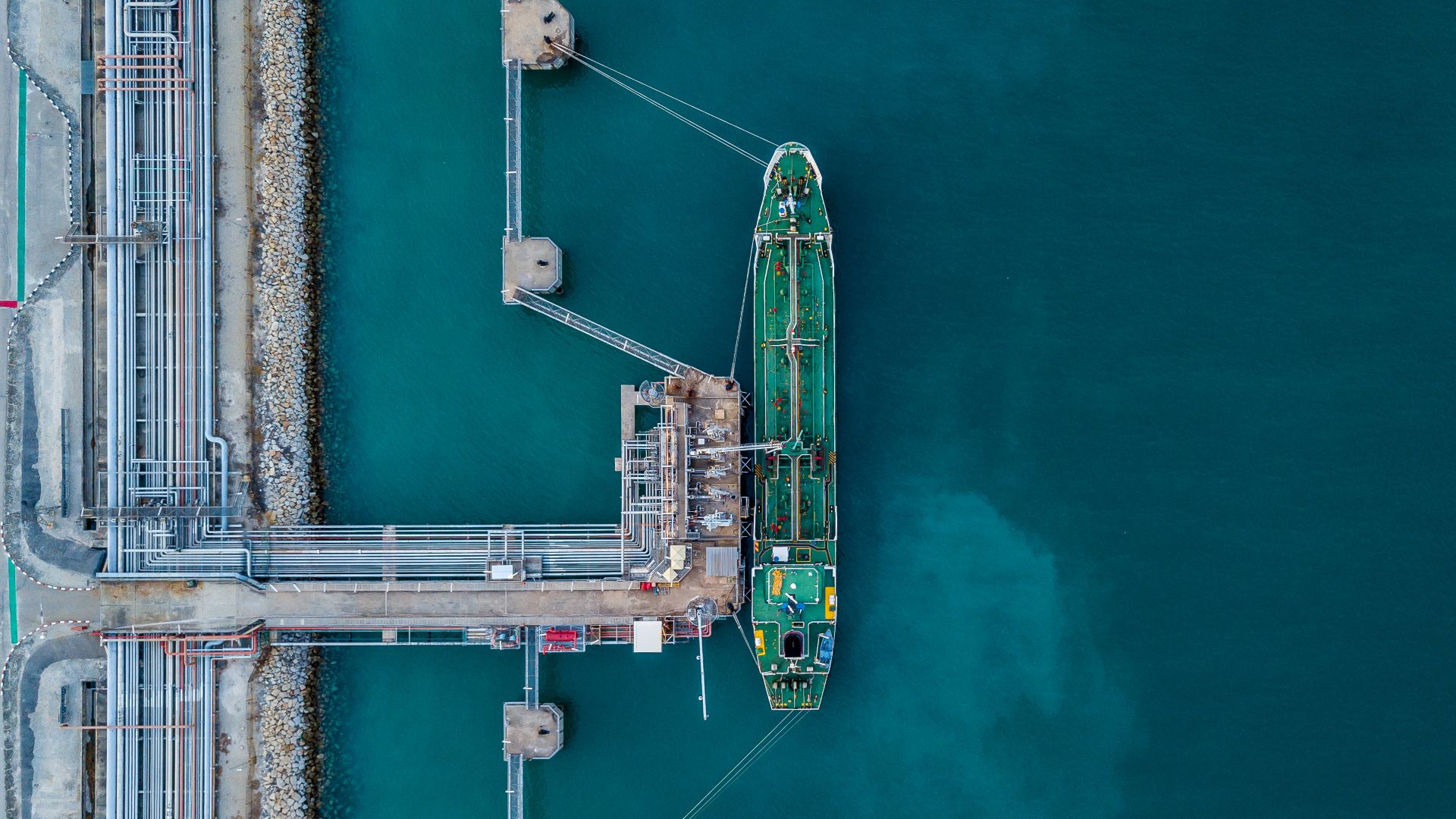

Synergyc is a progressive, growth-oriented professional services and consulting company servicing blue-chip enterprises from its headquarters in Sofia, Bulgaria. The company is focused on solutions that help its clients optimize organizational structures, decrease risk and costs and achieve greater operational efficiencies. Synergyc has a proven track record of leading and delivering transformative IT and finance services within the commodities and energy, oil and gas, and technology services sectors.

Kirey Group is an Italian IT systems integrator and technology solutions player that supports companies through digital transformation, offering customized solutions, strategic consulting and a full range of IT services. With over 950 employees, Kirey Group has offices in Italy, Spain, Portugal, Romania, Serbia, Croatia and Kenya.

OEP is a US-based middle-market, private equity firm focused on the industrial, healthcare and technology sectors in North America and Europe. The firm seeks to build market-leading companies by identifying and executing transformative business combinations. OEP is a trusted partner with a differentiated investment process, a broad and senior team, and an established track record generating long-term value for its partners. Since inception, the firm has completed more than 300 transactions worldwide. OEP, founded in 2001, spun out of JP Morgan in 2015. The firm has offices in New York, Chicago, Frankfurt and Amsterdam.

Oaklins’ team in Bulgaria acted as the exclusive M&A advisor to Synergyc by managing the overall sale process, including due diligence and negotiations, and provided assistance until closing.

P. Joseph Lazarus

Founder and CEO, Synergyc

Talk to the deal team

Related deals

Dolmans Landscaping Group has welcomed Foreman Capital as a new shareholder to support further growth

Dolmans Landscaping Group, a leading full-service provider of landscaping services, has welcomed Foreman Capital as a new shareholder. By partnering with Foreman Capital, which has extensive experience in building stronger companies in the maintenance of public spaces, Dolmans can accelerate its growth trajectory across core verticals and further professionalize the business.

Learn moreMiddlecon has been acquired by Nion

Middlecon has been acquired by Nion, a digital consultancy backed by Stella Capital. The acquisition strengthens Nion’s capabilities in data management and advanced analytics, enabling it to undertake larger and more complex data-driven initiatives for its customers. The partnership with Nion provides Middlecon with a strong foundation for continued growth and expansion.

Learn morePresight Solutions has been acquired by Banyan Software

Banyan Software, a leading acquiror and operator of mission-critical software businesses, has entered Norway with the acquisition of Presight Solutions AS, a SaaS company delivering advanced software for safety, operational integrity and regulatory compliance in high-risk industries. The transaction marks a new chapter for Presight, strengthening its ability to scale while preserving the product focus, sector expertise and customer trust built since its founding in 2003.

Learn more