Listan, a leading provider of high-performance computer components, has been acquired by Afinum

The three founders of Listan GmbH have sold a majority stake in the company to Afinum.

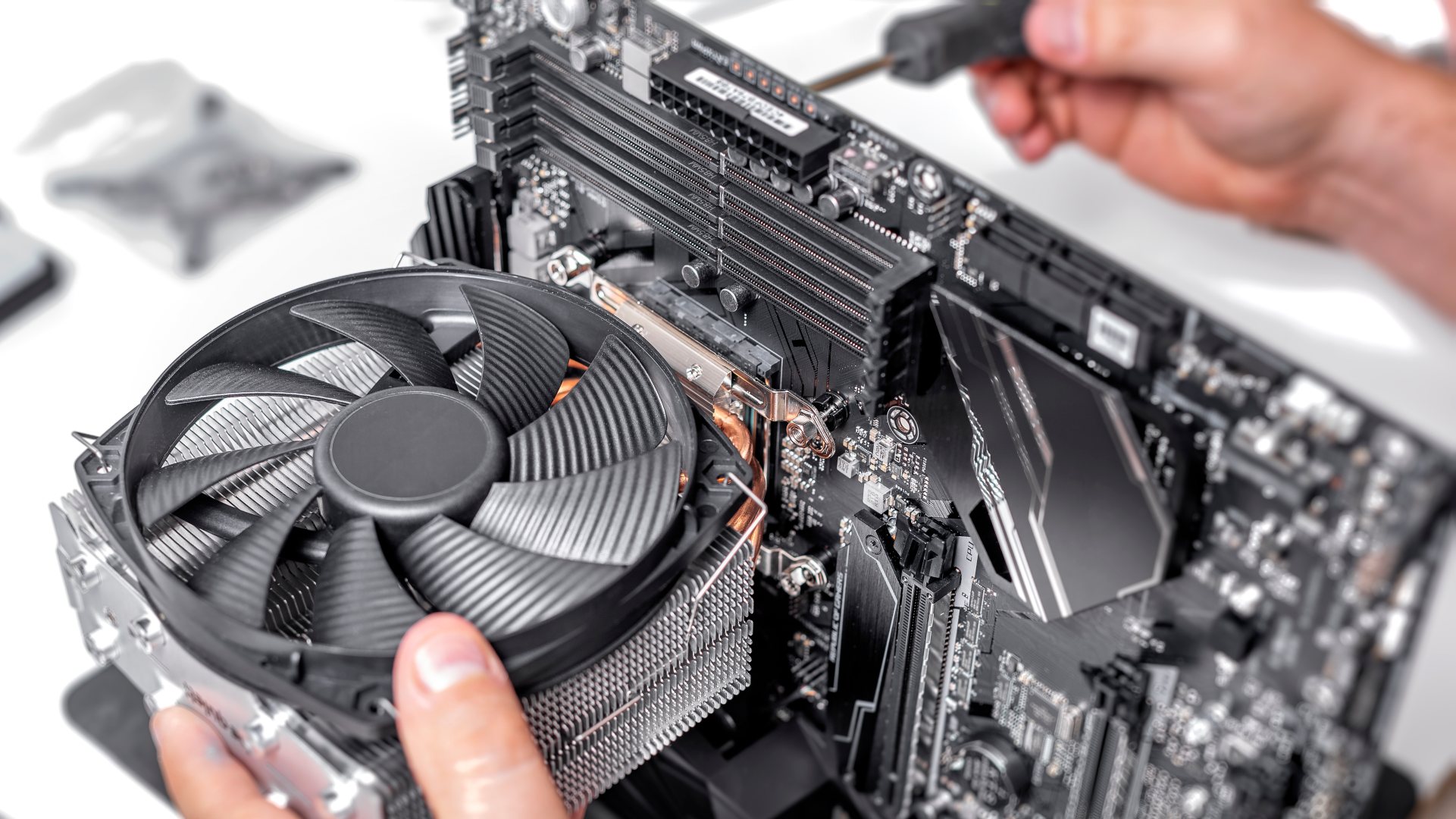

Listan, through its brands “be quiet!” and “Xilence”, provides high-performance PC components targeted at performance gamers and computer enthusiasts. Based on products with superior features such as extremely low noise and heat emission levels, industry-leading product quality and award-winning design, the company has gained trust and brand awareness among its relevant distribution channels and its end customers. Since its foundation in 2000, Listan has become one of the market leaders in the DACH region and has successfully initiated its geographical expansion in Europe and globally.

Afinum is an independent investment firm owned by its management team, with offices in Munich, Zurich and Hong Kong, specializing in the acquisition of shareholdings in financially sound and successful mid-market companies in the German speaking region as well as in neighboring countries in Europe.

Throughout the whole process, Oaklins’ team in Germany acted as the lead advisor to the three founders of Listan. Oaklins advised in the preparation of the sale process and due diligence as well as the approach and parallel negotiations with potential financial investors until closing.

Talk to the deal team

Related deals

TEAM Safety Services Limited has been acquired by Vadella Group

TEAM Safety Services Limited, a leading UK-based health, safety and fire safety consultancy, has been acquired by Vadella Group, a specialist provider of inspection-led compliance services for the built environment.

Learn moreNiscon Inc. has been acquired by SGPS ShowRig

Niscon Inc. has been successfully acquired by SGPS ShowRig, a global provider of staging, rigging and automation for live entertainment. The acquisition reinforces SGPS Showrig’s commitment to pushing the boundaries of innovation in the entertainment industry. By adding Niscon’s unique motion-control technology to its portfolio, SGPS Showrig strengthens its ability to deliver cutting-edge, precision-driven solutions.

Learn moreSunrise Eggs has been acquired by Agrova International

Sunrise Eggs, one of the UK’s best-established independent egg producers and distributors, has joined Agrova International AS, a European poultry and agri-foods group.

Learn more