OmniMax International has acquired Millennium Metals

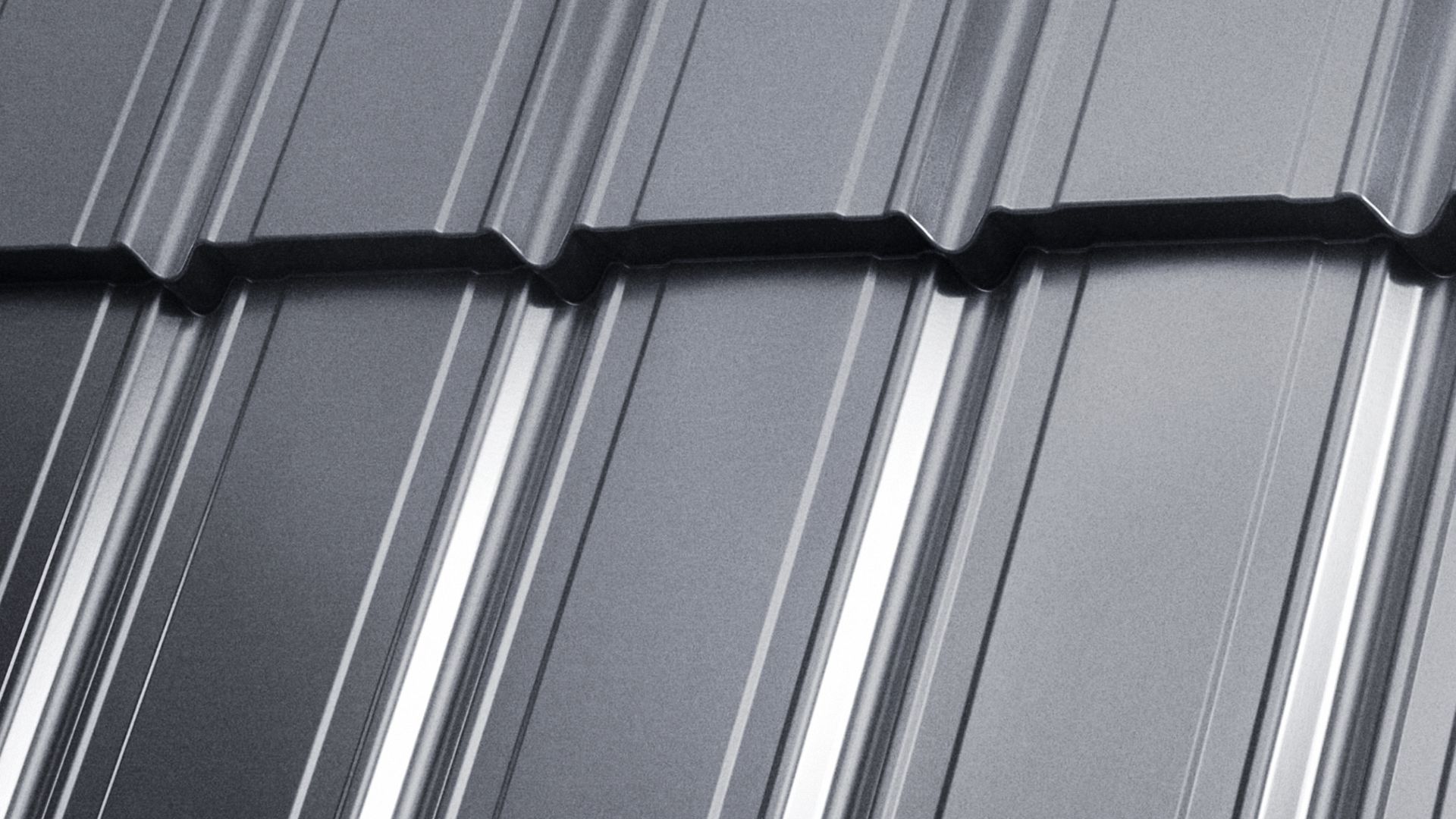

OmniMax International, a leading North American manufacturer of building products, has acquired Millennium Metals, a prominent roofing accessories manufacturer based in Jacksonville, Florida. This strategic acquisition expands OmniMax’s portfolio, bolsters its market presence and strengthens its leadership in the residential roofing accessories market across Florida and the Southeastern United States.

With a history of innovation and excellence, OmniMax operates 12 manufacturing facilities across the USA and Canada, and is known for its industry-leading brands such as Amerimax, Berger, Verde and Flamco. Backed by Strategic Value Partners, LLC (SVP), OmniMax has consistently pursued growth through strategic acquisitions and product expansion. SVP has teams of investment professionals, business development executives, operating partners and an advisory council of former senior bank executives and chairpersons. It’s headquartered in Greenwich, CT and has operations in London, Tokyo and New York.

Millennium Metals has built a 25-year legacy of delivering quality roofing accessories and exceptional service to its regional customer base. Joining OmniMax provides Millennium with enhanced manufacturing capabilities and a broader product offering to deliver unparalleled quality, service and value to their customers, while also creating new opportunities for employees and stakeholders.

As OmniMax’s buy-side advisor, Oaklins Heritage in Jacksonville identified Millennium Metals as a strategic target, guided the valuation and due diligence processes, and facilitated negotiations to ensure a seamless transaction. By leveraging market expertise and managing communications, Oaklins’ team in Jacksonville helped OmniMax secure a growth-enhancing acquisition that strengthens its portfolio and positions it for continued success in the roofing accessories market.

Mike Kuharski

Chief strategy and development officer, OmniMax International, LLC

Contáctese con el equipo de la transacción

Transacciones relacionadas

Dolmans Landscaping Group has welcomed Foreman Capital as a new shareholder to support further growth

Dolmans Landscaping Group, a leading full-service provider of landscaping services, has welcomed Foreman Capital as a new shareholder. By partnering with Foreman Capital, which has extensive experience in building stronger companies in the maintenance of public spaces, Dolmans can accelerate its growth trajectory across core verticals and further professionalize the business.

Aprenda másGuard has strengthened its Danish platform with the acquisition of Holtec

Guard Automation AS, a leading Nordic provider of automation services, insight and process optimization, has acquired Holtec AS, a Danish engineering and automation company. The acquisition strengthens Guard’s presence in Denmark and supports its strategy of combining strong local expertise with digital platforms. Together with X Automation, Holtec will form a strong Danish automation platform, enabling knowledge sharing, best-practice transfer and enhanced capabilities across the Nordics.

Aprenda másGSP Group has secured an upsized growth refinancing package from HSBC

The GSP Group has refinanced its growth facilities through an upsized financing package provided by HSBC.

Aprenda más