Siparex has acquired a majority stake in Sodikart

Evolem has sold Sodikart to Siparex Group.

Siparex Group is an independent French private equity specialist with US$3 billion capital under management. The group focuses on the development of companies and their transformation.

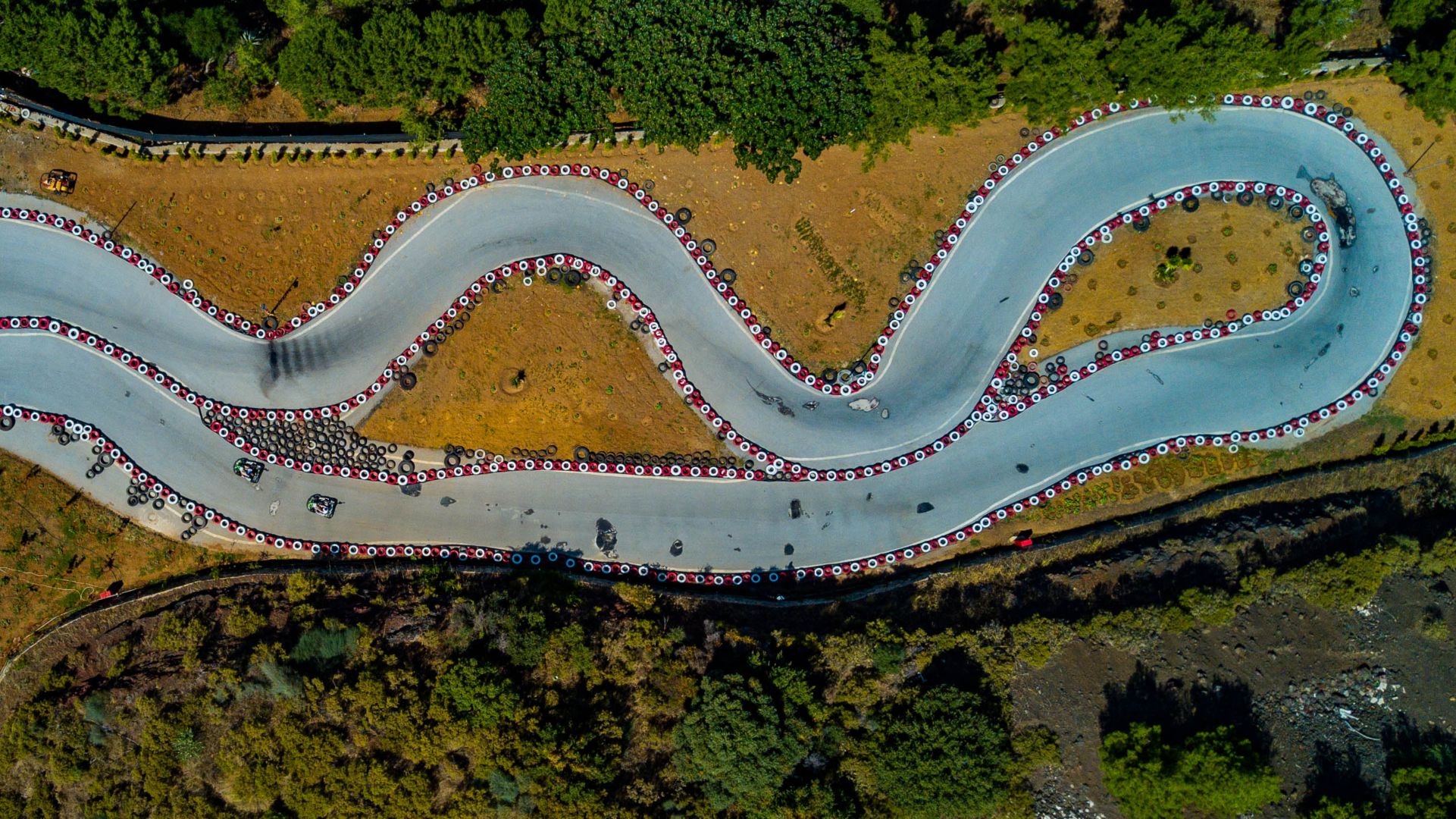

Founded in 1981, Sodikart is the world leading designer and manufacturer of karts for leisure and competition, the sale of accessories and spare parts, leisure center management and timing solutions, track design and event organization.

Evolem is a family office created in 1997 by Bruno Rousset, founder of April. It promotes entrepreneurs, employment, education and environment. Evolem supports SMEs to turn them into mid-cap companies, helps startups establish their model and supports non-profit projects to multiply their impact. Since its creation, Evolem has accompanied more than a hundred companies, which represents 6,000 jobs and nearly US$790 million total aggregate sales.

Oaklins’ team in France acted as the exclusive buy-side advisor to Siparex Group in this transaction.

Talk to the deal team

Related deals

Royal Reesink has sold Motrac Industries to Anders Invest

Royal Reesink and Anders Invest have completed the sale of Motrac Industries, a specialist in hydraulic and electrical engineering.

Learn moreUniKidz has partnered with Karmijn Kapitaal

Karmijn Kapitaal has acquired a majority stake in UniKidz, a talent development organization that provides a scientifically-based developmental approach through high-quality childcare. Through the partnership with Karmijn Kapitaal, UniKidz can take the next step in bringing their unique concept to even more children.

Learn moreÑaming, SL has been acquired by DeA Capital S.p.A.

Spain’s leading producer of sandwiches, fresh and ultra-fresh products, Ñaming, has sold a majority stake to Italian fund DeA Capital.

Learn more