Energy

The world demands a shift from traditional sources to renewables. However, strong opinions alone are not enough for the energy pendulum to swing. As long as demand is rising on both sides, many global companies need to innovate themselves on two fronts: invest in established infrastructure and streamline resource extraction, but also acquire new technology and refresh their brand. By utilizing their in-depth knowledge and established relationships in global markets, our industry specialists help you keep a strong foothold in today’s demand as well as guide you toward a sustainable future, providing you with M&A, growth equity and ECM, debt advisory and corporate finance services.

Contact advisor

SGW Metering has been acquired by ista SE

SGW Metering has been acquired by ista SE, enabling ista to strengthen its nationwide service infrastructure for smart meter installation and maintenance. With its network of highly qualified technicians and proven track record of annual meter exchanges, SGW Metering will provide ista with additional scale and operational capacity. The deal supports ista’s strategy of expanding its role as a full-service partner for energy suppliers, enhancing efficiency and customer service.

Learn moreE.Gruppe, a GIMV portfolio company, has acquired LET Gruppe from GFEP Family Equity

LET Gruppe, a leading German provider of customized electrical infrastructure and energy system solutions, is set to become part of E.GRUPPE, a fast-growing industrial platform backed by European investment firm GIMV. The parties have signed a definitive agreement under which E.GRUPPE will acquire 100% of the shares in LET Gruppe from GFEP Family Equity, which has supported the company’s growth and strategic development in recent years. The transaction is subject to regulatory approvals.

Learn moreSunlight Group has acquired a 51% stake in Lehmann Marine GmbH

Through its acquisition of a 51% stake in Lehmann Marine GmbH, Sunlight Group continues to strengthen its position in the growing energy solutions market, while expanding its portfolio of innovative technologies. With over 30 years of expertise in producing lead-acid and lithium-ion batteries, Sunlight Group has established itself as a leader in advanced battery technology.

Learn more

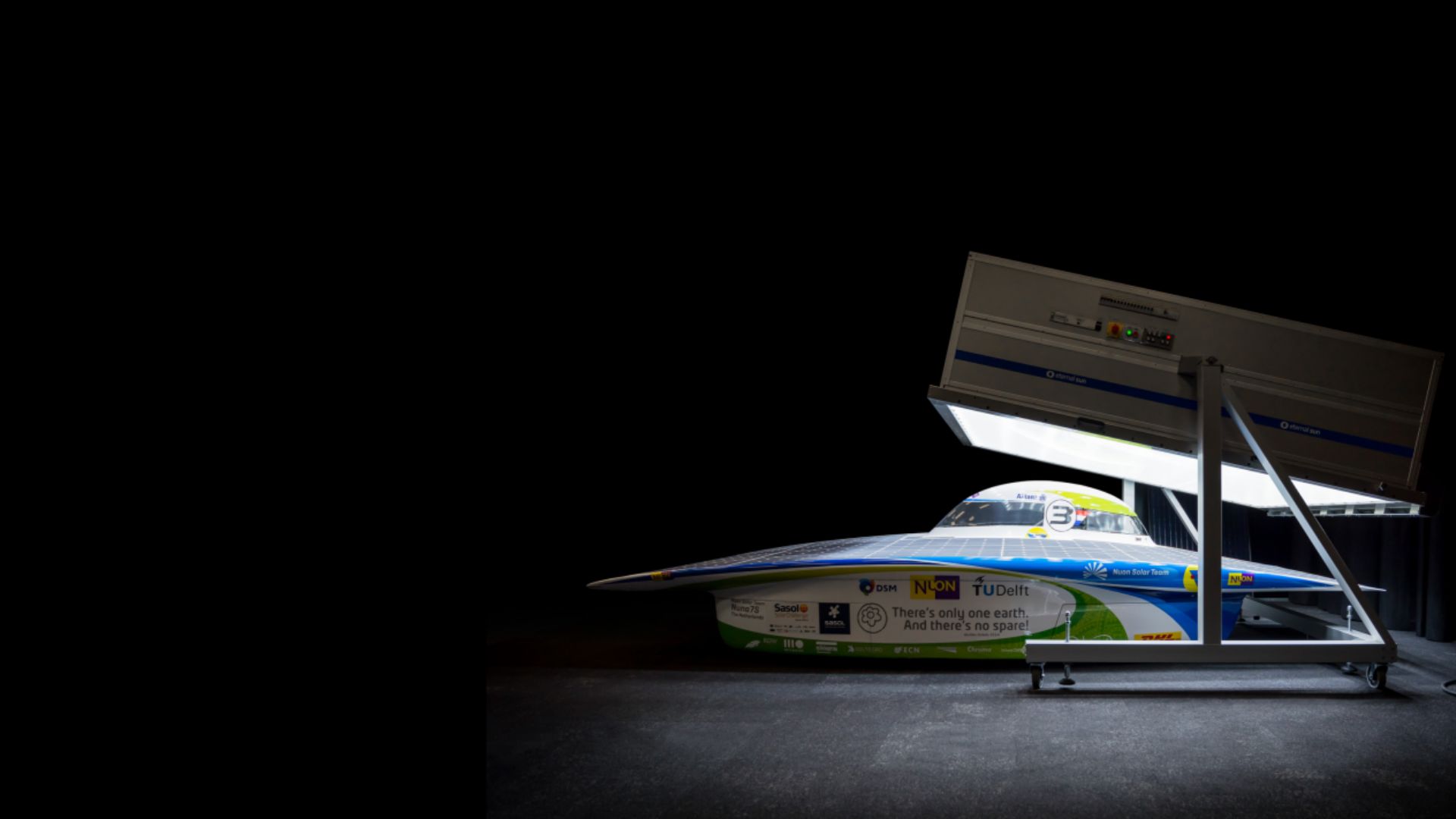

Stefan Roest

Founder and CTO, Eternal Sun

Read more

Oaklins Germany M&A Market Report - 2025

Despite ongoing uncertainties, the German M&A market remained remarkably resilient in 2025. With 2,586 reported transactions, deal activity was only 6% below the prior-year level and continued to exceed the long-term historical average by a wide margin.

Learn more