Elma Instruments A/S has been acquired by Indutrade AB

The private shareholders of Elma Instruments A/S have sold the company to Indutrade AB.

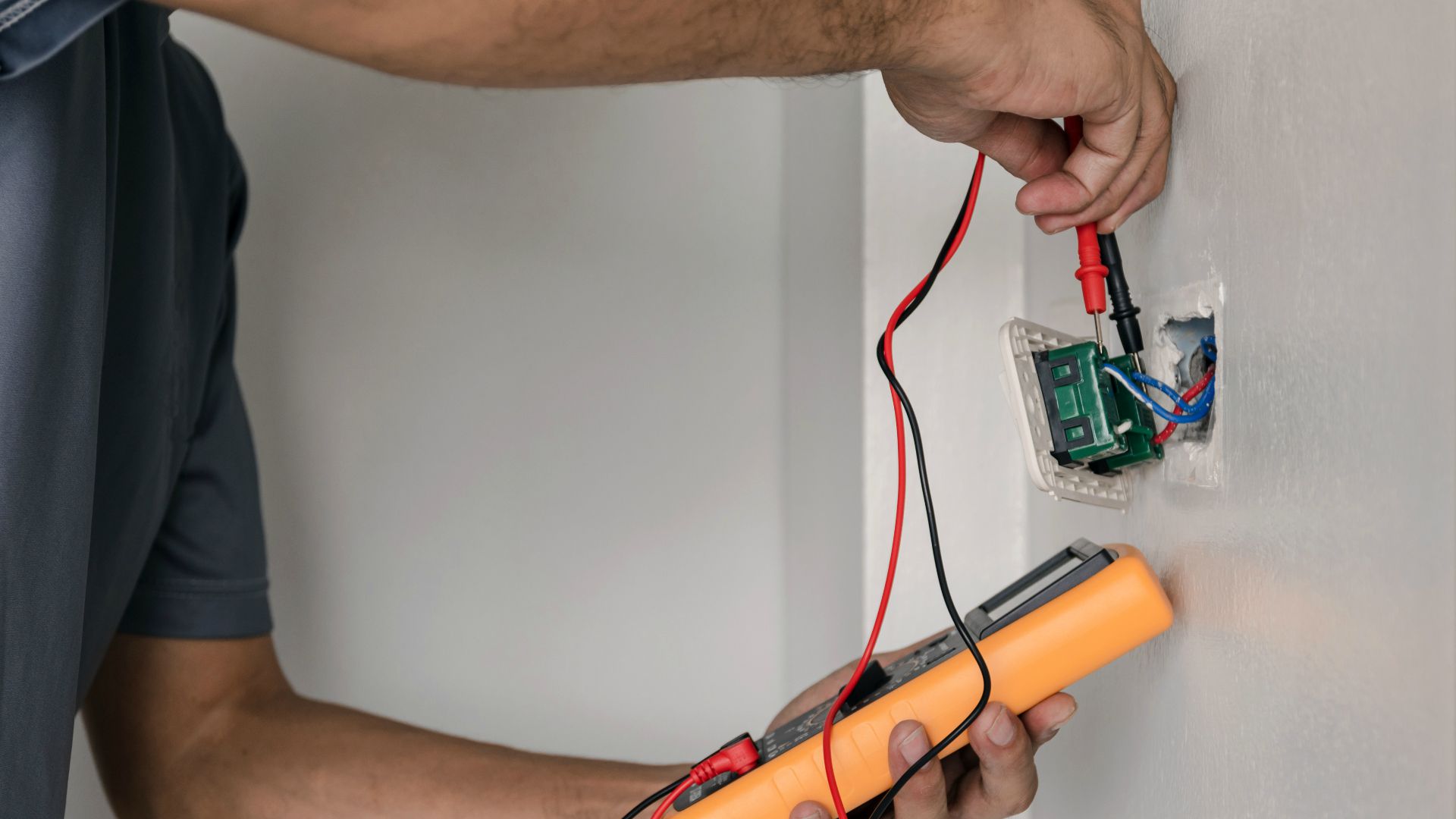

Elma Instruments is a leading distributor in Scandinavia offering a wide range of test and measurement equipment. Its customers are primarily technical wholesalers servicing the construction industry. The company also sells directly to large industrial companies, supported by its own e-commerce platform. In addition, Elma Instruments has several own-branded products and lines of own-developed products to complement an extensive range of supplier products.

Indutrade is an international industrial group that sells and develops high-tech components, systems and services. The company markets solutions that streamline customers’ systems and processes. With a decentralized structure, Indutrade operates through more than 200 subsidiaries with some 5,500 employees in 28 countries on four continents. The operations are divided into six business areas: engineering and equipment; flow technology; fluids and mechanical solutions; industrial components; measurement and sensor technology; and special products. The company is listed on Nasdaq Stockholm, with annual revenues of US$1.6 billion.

Oaklins’ team in Denmark acted as the exclusive financial advisor to the seller in this transaction. The team handled the full sale process, including negotiating with the buyer and structuring the deal. In the process, a select field of potential buyers were invited to evaluate the investment opportunity. Within Indutrade‘s industrial components business area, the company has found a perfect match strengthening the opportunity to accelerate its growth organically and through further acquisitions.

Lars Bendixen

CEO and Majority Shareholder, Elma Instruments A/S

Talk to the deal team

Related deals

Lauak Group has sold a majority stake to Wipro Infrastructure Engineering

After careful strategic reflection to secure the group’s future, Lauak Group’s shareholders have chosen an industrial partnership, in line with the ongoing consolidation trend in the market. Attracted by opportunities for innovation and international expansion, the Charritton family, founders and long-term shareholders, regard Wipro Infrastructure Engineering as a trusted industrial partner. The historical shareholders remain minority stakeholders, and the current CEO continues to lead Lauak.

Learn moreThe assets of IMG have been acquired by SLV Mecklenburg-Vorpommern

The assets of Ingenieurtechnik und Maschinenbau GmbH (IMG) have been acquired by SLV Mecklenburg-Vorpommern GmbH (SLV-MV) through an asset deal as part of IMG’s insolvency proceedings.

Learn moreEbidco has completed a voluntary public tender offer for the warrants of Eles Semiconductor Equipment

Ebidco S.r.l. has completed a voluntary public tender offer for the warrants of Eles Semiconductor Equipment S.p.A.

Learn more