Elma Instruments A/S has been acquired by Indutrade AB

The private shareholders of Elma Instruments A/S have sold the company to Indutrade AB.

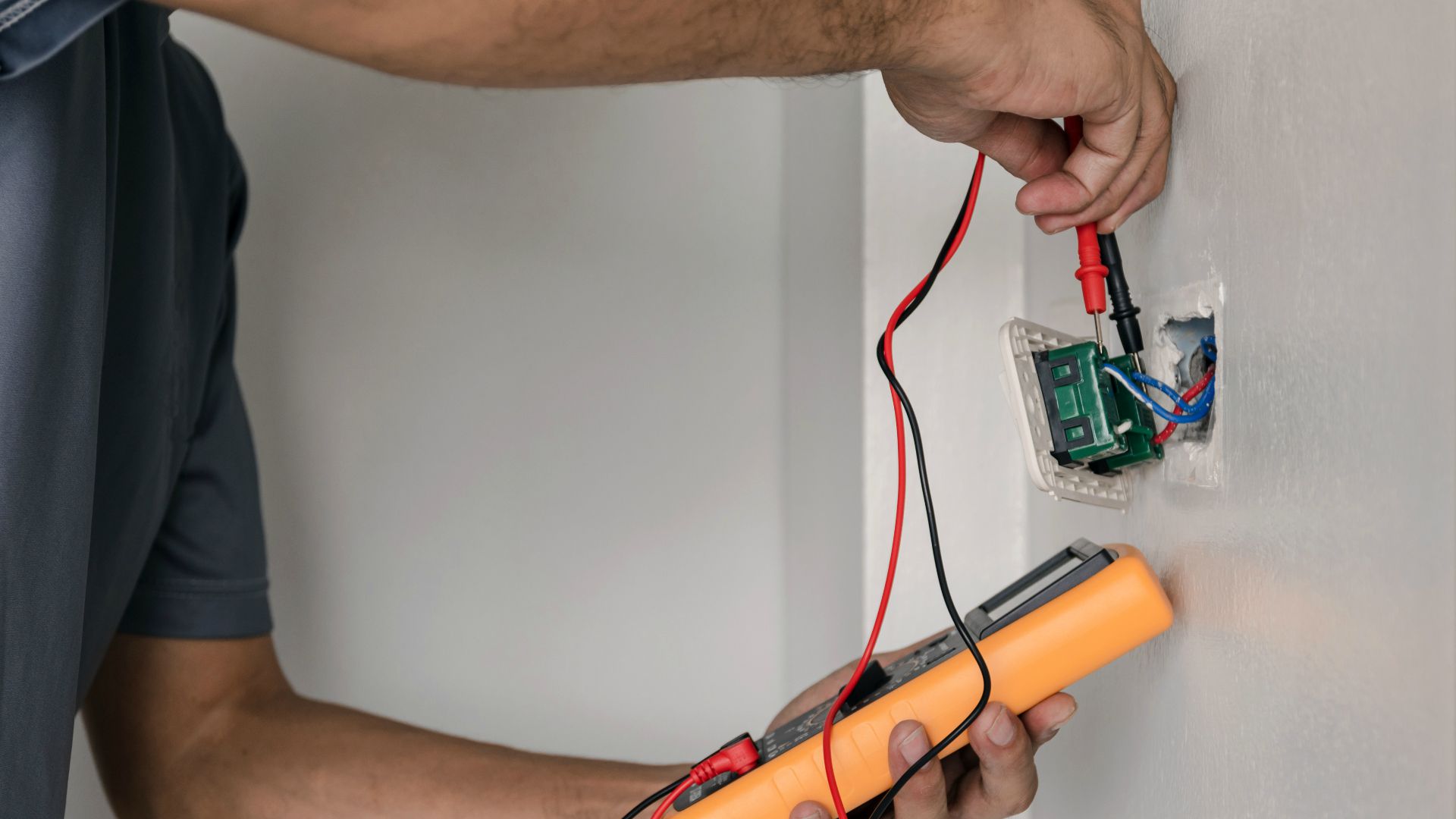

Elma Instruments is a leading distributor in Scandinavia offering a wide range of test and measurement equipment. Its customers are primarily technical wholesalers servicing the construction industry. The company also sells directly to large industrial companies, supported by its own e-commerce platform. In addition, Elma Instruments has several own-branded products and lines of own-developed products to complement an extensive range of supplier products.

Indutrade is an international industrial group that sells and develops high-tech components, systems and services. The company markets solutions that streamline customers’ systems and processes. With a decentralized structure, Indutrade operates through more than 200 subsidiaries with some 5,500 employees in 28 countries on four continents. The operations are divided into six business areas: engineering and equipment; flow technology; fluids and mechanical solutions; industrial components; measurement and sensor technology; and special products. The company is listed on Nasdaq Stockholm, with annual revenues of US$1.6 billion.

Oaklins’ team in Denmark acted as the exclusive financial advisor to the seller in this transaction. The team handled the full sale process, including negotiating with the buyer and structuring the deal. In the process, a select field of potential buyers were invited to evaluate the investment opportunity. Within Indutrade‘s industrial components business area, the company has found a perfect match strengthening the opportunity to accelerate its growth organically and through further acquisitions.

Lars Bendixen

CEO and Majority Shareholder, Elma Instruments A/S

Talk to the deal team

Related deals

Royal Reesink has sold Motrac Industries to Anders Invest

Royal Reesink and Anders Invest have completed the sale of Motrac Industries, a specialist in hydraulic and electrical engineering.

Learn moreSondrel secures a major investment

Sondrel has secured funding from Rox Equity Partners Ltd. through a subscription for new shares. The funds will enable the company to grow and expand its presence as one of the world’s leading providers of custom chip design and supply. In particular, it will help them rapidly develop their presence in the US.

Learn morePhen’X Technologies has sold a majority stake to Ciclad

The shareholders of Phen’X Technologies have completed a primary majority LBO with private equity fund Ciclad.

Learn more