STENHØJ Holding A/S has divested STENHØJ Hydraulik A/S to Pentaco Partners A/S

STENHØJ Holding A/S has sold STENHØJ Hydraulik A/S to Pentaco Partners A/S.

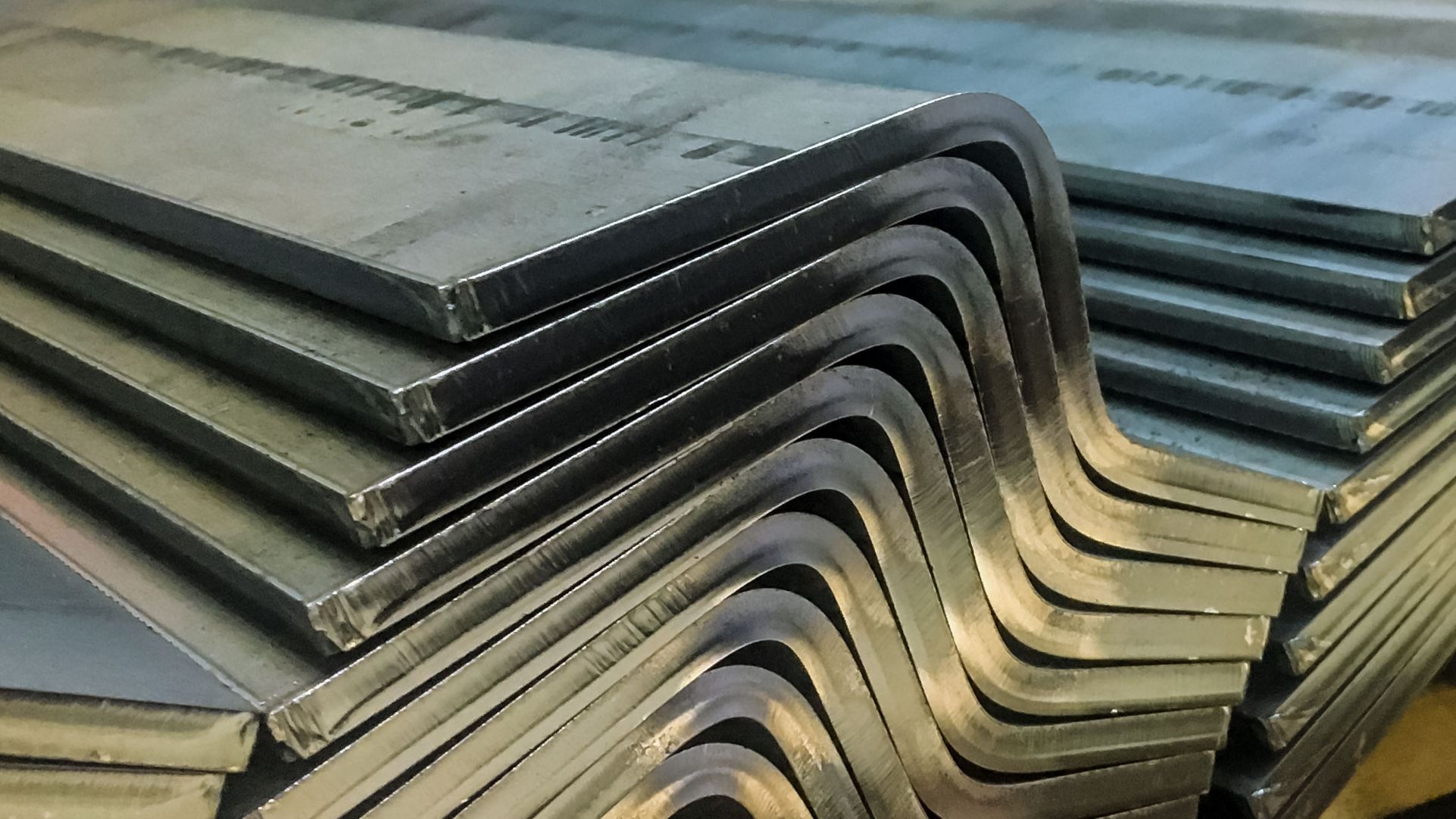

STENHØJ Hydraulik is well regarded in the global automotive industry for offering reliable high-end products to its customers. Its product portfolio includes advanced electro-mechanical broaching machines, hydraulic presses and bending machines, individually customized to the end user. The company’s core operation is based on advanced engineering capabilities to design tailor-made machinery within the sheet metal processing industries.

Pentaco Partners is a Danish investment company with a key focus on investing in Danish companies with an attractive market potential and competent management teams. Pentaco works in close collaboration with existing management to further develop the companies, with a long term investment horizon in place.

STENHØJ Holding is a Danish family-owned company located in Jutland. It was founded in 1917 and has developed into a leading product and services supplier for the automotive aftermarket. The group has sales exceeding US$110 million and over 500 employees.

Oaklins’ team in Denmark advised STENHØJ Holding in connection with the divestiture of STENHØJ Hydraulik to Pentaco Partners. The team handled the full sale process, including identification of buyer and final negotiation.

Søren Madsen

CEO and Shareholder of STENHØJ Holding A/S

Talk to the deal team

Related deals

Dolmans Landscaping Group has welcomed Foreman Capital as a new shareholder to support further growth

Dolmans Landscaping Group, a leading full-service provider of landscaping services, has welcomed Foreman Capital as a new shareholder. By partnering with Foreman Capital, which has extensive experience in building stronger companies in the maintenance of public spaces, Dolmans can accelerate its growth trajectory across core verticals and further professionalize the business.

Learn moreBackspin has completed a mandatory public tender offer for the shares of Spindox

Backspin S.p.A. has completed a mandatory public tender offer for Spindox S.p.A.

Learn moreValmiermuižas Alus has been acquired by Cēsu Alus

Valmiermuižas Alus has been acquired by Cēsu Alus AS through the purchase of 100% of its shares. The transaction enabled the founder’s exit and strengthened the company’s platform for continued growth within a consolidating Baltic beverage market.

Learn more