STENHØJ Holding A/S has divested STENHØJ Hydraulik A/S to Pentaco Partners A/S

STENHØJ Holding A/S has sold STENHØJ Hydraulik A/S to Pentaco Partners A/S.

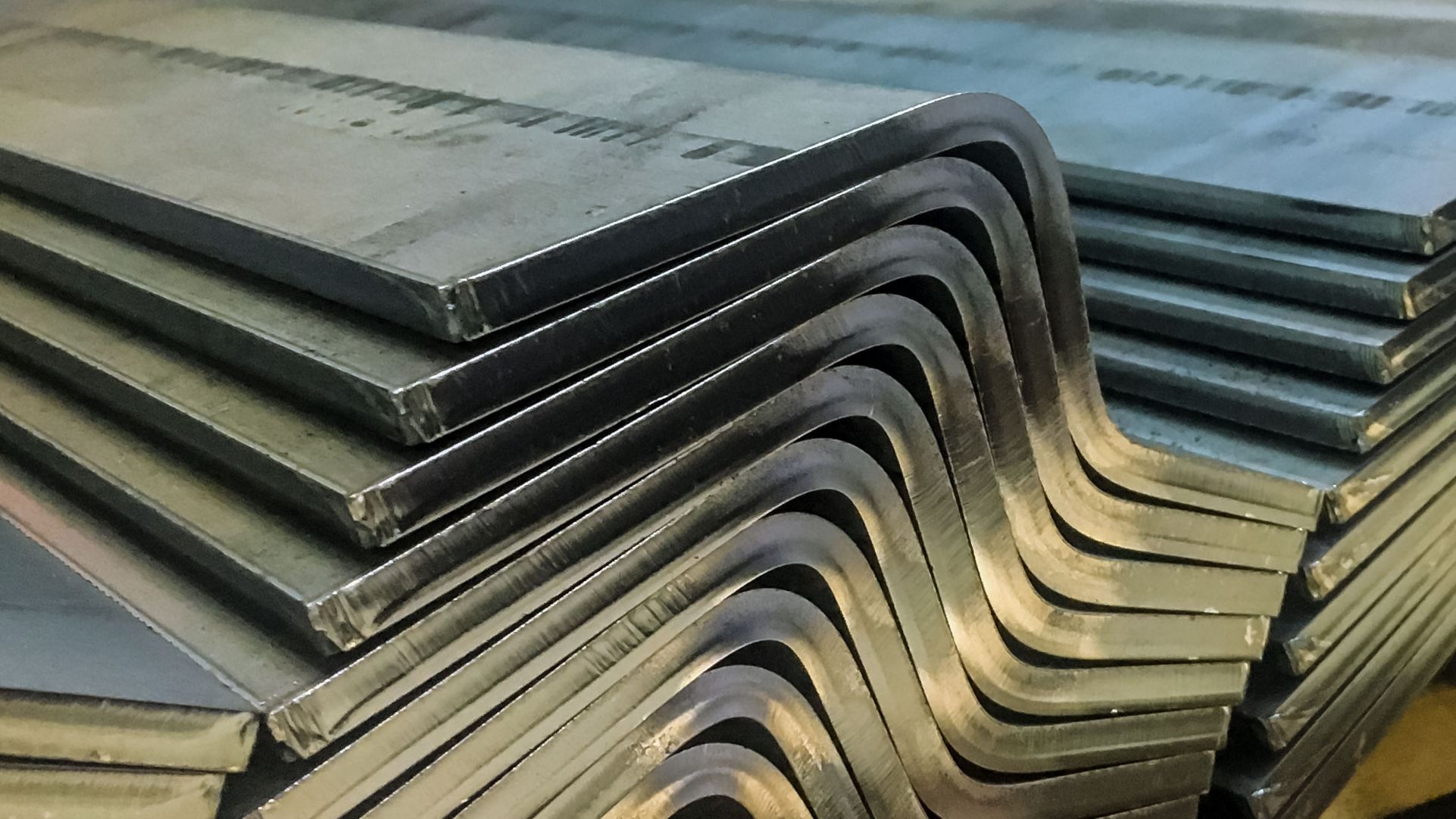

STENHØJ Hydraulik is well regarded in the global automotive industry for offering reliable high-end products to its customers. Its product portfolio includes advanced electro-mechanical broaching machines, hydraulic presses and bending machines, individually customized to the end user. The company’s core operation is based on advanced engineering capabilities to design tailor-made machinery within the sheet metal processing industries.

Pentaco Partners is a Danish investment company with a key focus on investing in Danish companies with an attractive market potential and competent management teams. Pentaco works in close collaboration with existing management to further develop the companies, with a long term investment horizon in place.

STENHØJ Holding is a Danish family-owned company located in Jutland. It was founded in 1917 and has developed into a leading product and services supplier for the automotive aftermarket. The group has sales exceeding US$110 million and over 500 employees.

Oaklins’ team in Denmark advised STENHØJ Holding in connection with the divestiture of STENHØJ Hydraulik to Pentaco Partners. The team handled the full sale process, including identification of buyer and final negotiation.

Søren Madsen

CEO and Shareholder of STENHØJ Holding A/S

Talk to the deal team

Related deals

Royal Reesink has sold Motrac Industries to Anders Invest

Royal Reesink and Anders Invest have completed the sale of Motrac Industries, a specialist in hydraulic and electrical engineering.

Learn moreÑaming, SL has been acquired by DeA Capital S.p.A.

Spain’s leading producer of sandwiches, fresh and ultra-fresh products, Ñaming, has sold a majority stake to Italian fund DeA Capital.

Learn moreUniKidz has partnered with Karmijn Kapitaal

Karmijn Kapitaal has acquired a majority stake in UniKidz, a talent development organization that provides a scientifically-based developmental approach through high-quality childcare. Through the partnership with Karmijn Kapitaal, UniKidz can take the next step in bringing their unique concept to even more children.

Learn more