IDP has been acquired by Nazca Capital

The founders of IDP have sold the company to Nazca Capital S.G.E.I.C., S.A.

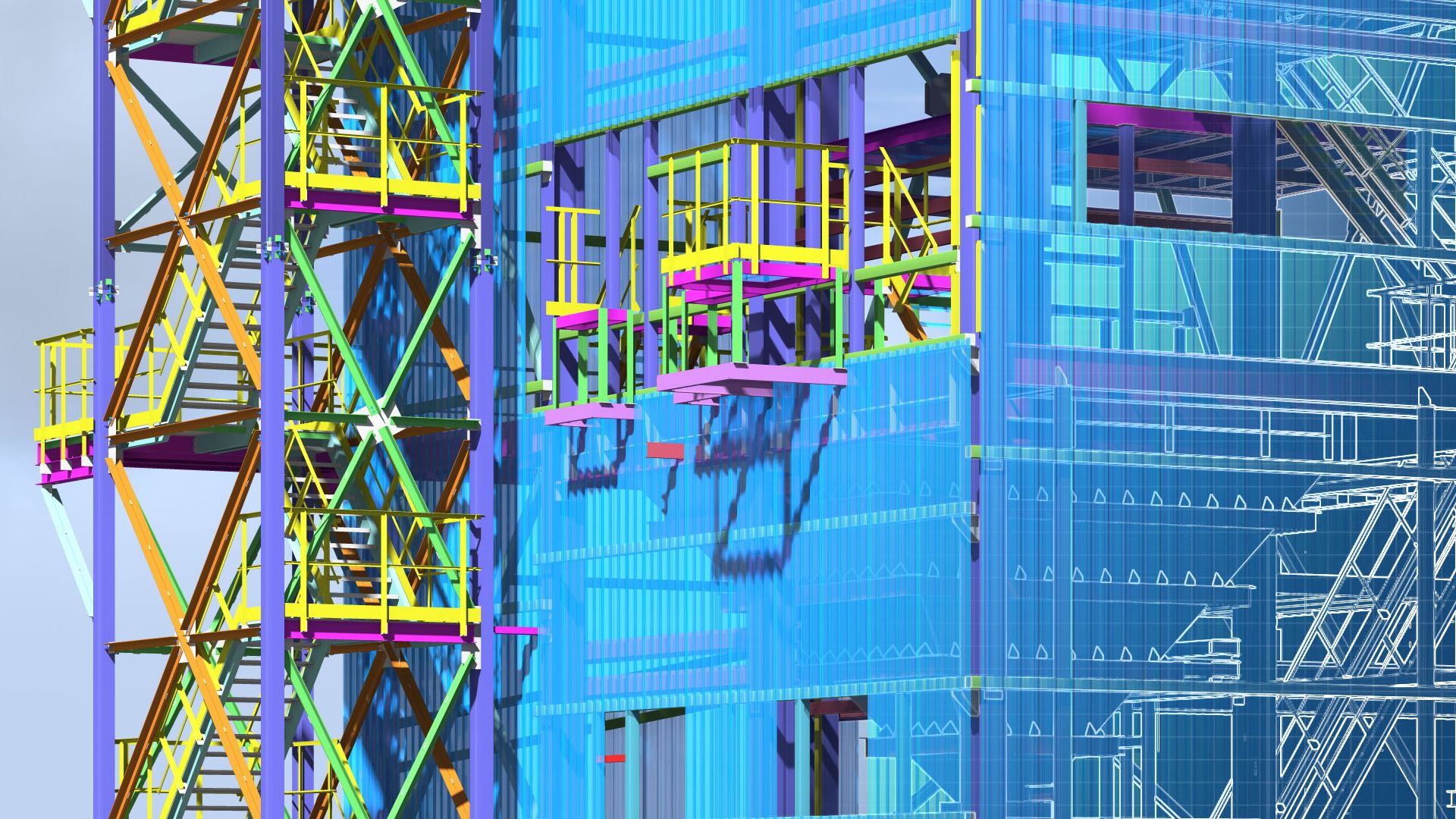

Established in 1998 and based in Barcelona, Spain, IDP specializes in providing engineering services based on building information modeling (BIM) methodology. This transaction allows IDP to incorporate a financial partner into its shareholding in order to accelerate the next phase of the company’s growth with a focus on national expansion.

Founded in 2001, Nazca Capital is a Spanish private equity fund, with approximately US$600 million under management. The firm focuses in the mid-market and has completed 70 transactions since its foundation.

Oaklins’ team in Spain acted as financial advisor to the founders of IDP in the structure and coordination of the sale process, negotiations and closing of the transaction.

Talk to the deal team

Related deals

iwell raises US$31 million to deploy its leading European smart battery storage solutions into new markets

iwell, a developer of smart energy management (EMS) and battery storage systems (BESS), has successfully closed a US$31 million (€27 million) funding round. The round was led by Meridiam, with Invest-NL and Rabobank participating, alongside existing investors.

Learn moreChequers Capital has acquired Gourmet Italian Food to strengthen presence in the ready meals sector

Chequers Partenaires S.A., acting as the management company of the private equity fund Chequers Capital XVIII SLP, together with management, has completed the acquisition of 100% of the share capital of Gourmet Italian Food S.p.A. (GIF). The company was previously owned by Alcedo SGR S.p.A. through the Alcedo IV Fund, FVS SGR S.p.A. through the Sviluppo PMI Fund, and minority shareholders.

Learn moreHe-Man Dual Controls has been acquired by Lagercrantz UK Limited

Lagercrantz UK Limited has acquired 100% of the shares in HM Holding Limited (He-Man Dual Controls), a leader in supplemental control systems for vehicles.

Learn more