Sondrel secures a major investment

Sondrel has secured funding from Rox Equity Partners Ltd. through a subscription for new shares. The funds will enable the company to grow and expand its presence as one of the world’s leading providers of custom chip design and supply. In particular, it will help them rapidly develop their presence in the US.

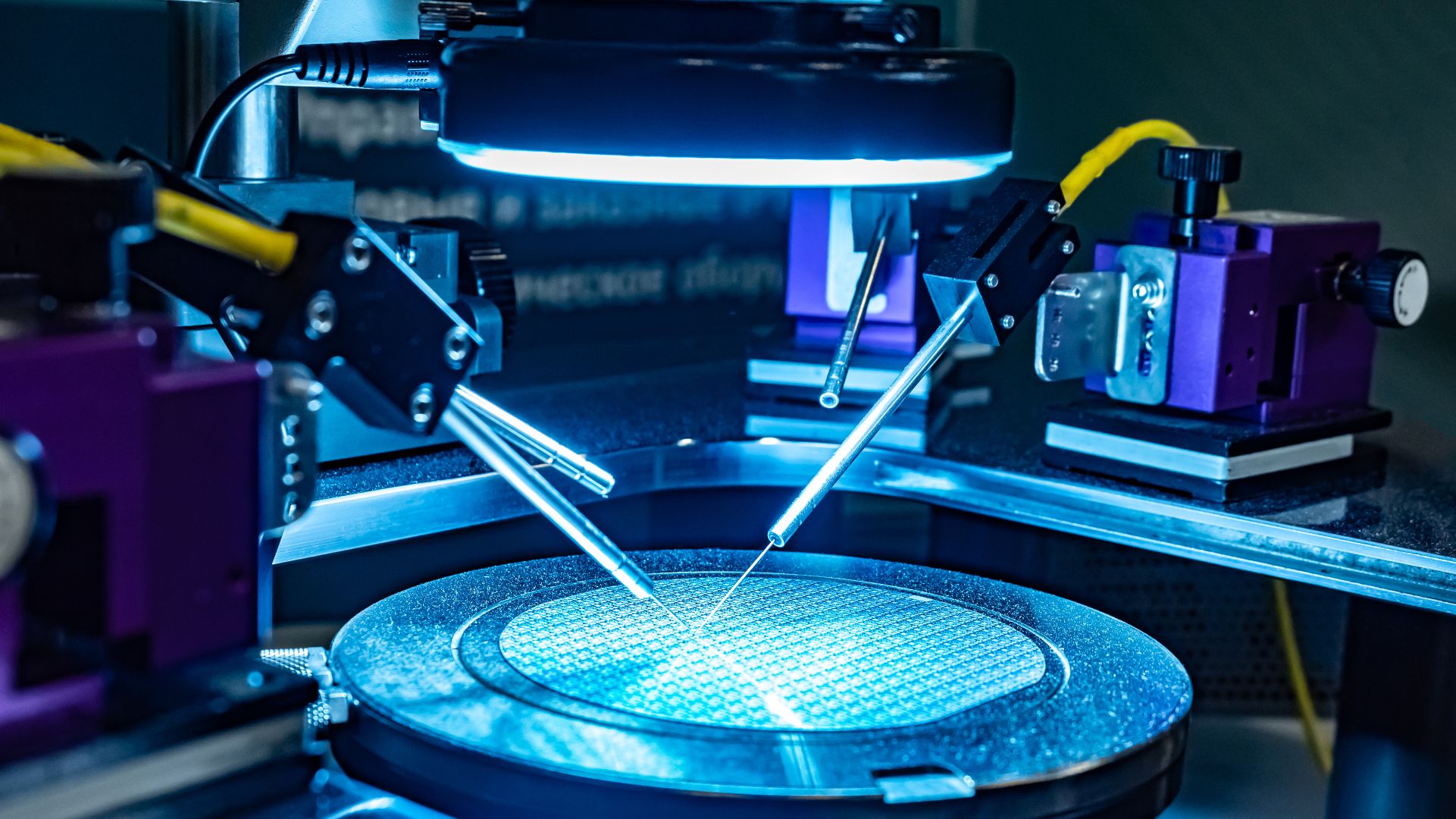

Founded in 2002, Sondrel is a UK-based provider of ultra-complex chips for leading global technology brands. The company offers a complete turnkey ASIC service, from architecture to silicon supply, and can design and supply the highest-spec chips built with the most advanced semiconductor technologies. The firm has design centers in the UK, Morocco and India, and sales representatives in Israel and the US.

Oaklins Cavendish, based in the UK, advised Sondrel on its US$10.9 million capital raising.

Contacter l'équipe de la transaction

Transactions connexes

The assets of IMG have been acquired by SLV Mecklenburg-Vorpommern

The assets of Ingenieurtechnik und Maschinenbau GmbH (IMG) have been acquired by SLV Mecklenburg-Vorpommern GmbH (SLV-MV) through an asset deal as part of IMG’s insolvency proceedings.

En apprendre plusLauak Group has sold a majority stake to Wipro Infrastructure Engineering

After careful strategic reflection to secure the group’s future, Lauak Group’s shareholders have chosen an industrial partnership, in line with the ongoing consolidation trend in the market. Attracted by opportunities for innovation and international expansion, the Charritton family, founders and long-term shareholders, regard Wipro Infrastructure Engineering as a trusted industrial partner. The historical shareholders remain minority stakeholders, and the current CEO continues to lead Lauak.

En apprendre plusMarco Peruana has been acquired by Zamine Perú

Marco Peruana S.A. has been acquired by Zamine Perú, a subsidiary of Marubeni Corporation, continuing the international consolidation of a global leader in the mining and industrial sectors. With its extensive track record, Marubeni represents the ideal partner to support Marco Peruana’s growth and further strengthen its leadership position in Peru.

En apprendre plus