Smiths Group plc has acquired Heating & Cooling Products

Smiths Group plc, a leading industrial technology company, has acquired Heating & Cooling Products Inc. (HCP), a US-based manufacturer of heating, ventilation and air conditioning (HVAC) solutions.

Founded in 1955 and headquartered in Ohio, Cleveland, HCP is a manufacturer of HVAC solutions. Its products serve the residential, multi-family and light commercial HVAC markets and are distributed in over 25 states in the US and in Canada.

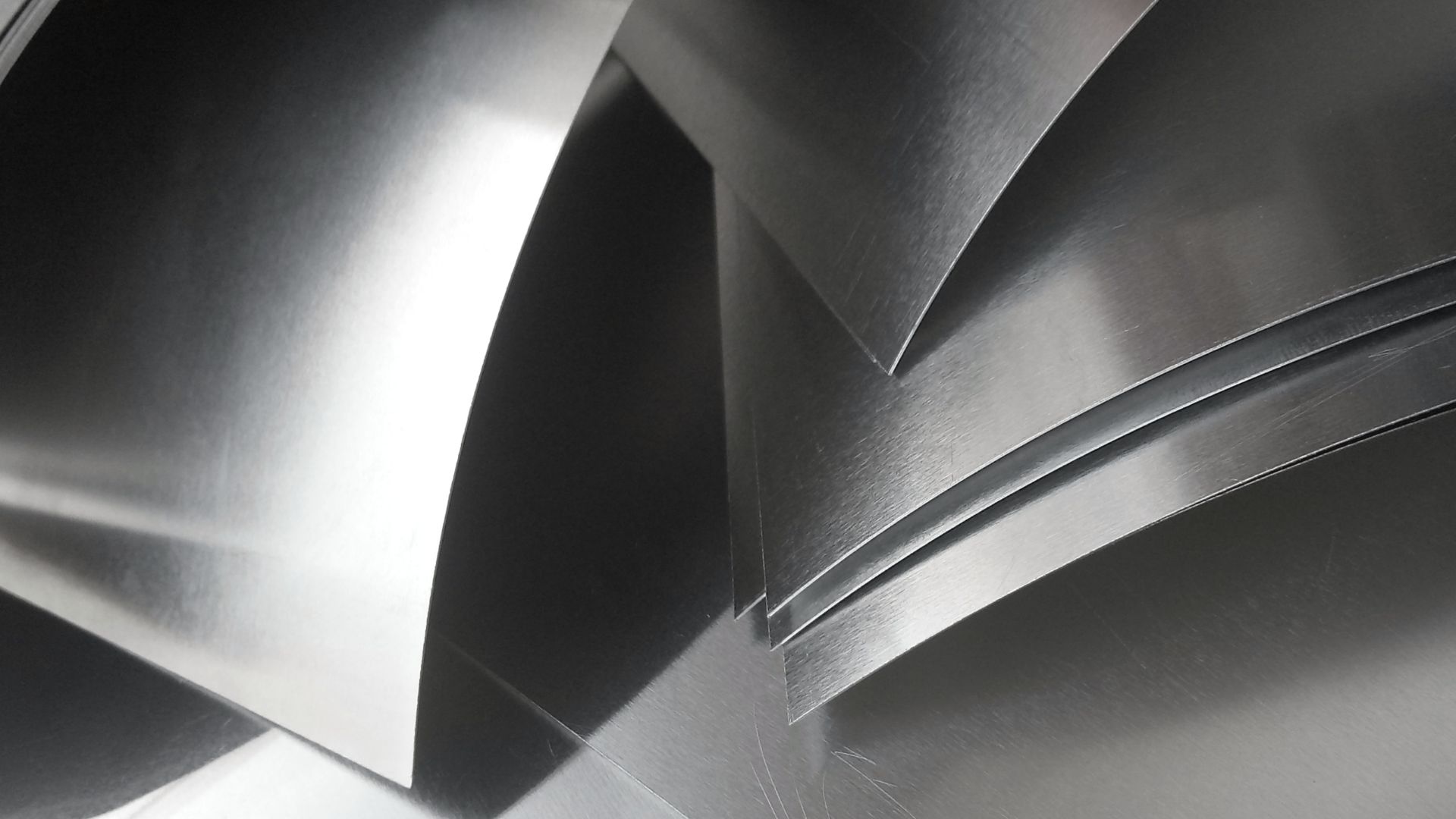

Smiths Group is a leading industrial technology company serving the medical technology, security and defense, general industrial, energy, and space and aerospace markets worldwide. Smiths acquired HCP for US$82m (approximately £65m) on a cash and debt-free basis. HCP’s unaudited revenue for the 12 months to 31 July 2023 was US$69m (approximately £55m). The company was purchased from a private seller in a proprietary transaction for less than 7x estimated 2023 EBITDA. It will be integrated into Smith’s Flex-Tek division. The addition of HCP will further expand Smiths Group’s presence in the North American HVAC market, enabling Smiths to serve customers with an even broader product range, including HCP’s patented axial and radial seal duct technology which improves energy efficiency.

Oaklins S&W, based in the UK, supported Citizens Capital Markets as sell-side advisor to HCP in this transaction. Given our HVAC sector leadership, we were asked to assist in the sale of HCP. As part of that role, we positioned the opportunity to Smiths Group plc. The sale adds to Oaklins’ transaction expertise in the HVAC sector.

Paul Keel

CEO, Smiths Group plc

Contacter l'équipe de la transaction

Transactions connexes

The former shareholders of Energie have divested the company to Horizon Equity Partners

The former shareholders of Energie have successfully divested their stake in the company to Horizon Equity Partners. The investment will support Energie in its next phase of strategic growth, focused on capturing market opportunities driven by the accelerating shift toward sustainable energy solutions, strengthening product development and R&D capabilities and consolidating the company’s expansion across Iberia and key European markets.

En apprendre plusMFG Partners and Merit Capital Partners have sold Elgen Manufacturing Company to Worthington Enterprises

MFG Partners and Merit Capital Partners have successfully completed the sale of Elgen Manufacturing Company to Worthington Enterprises (NYSE: WOR).

En apprendre plusLes Entreprises Esmer has sold a majority stake to a private Walloon holding

A private Walloon holding has acquired a majority stake in Les Entreprises Esmer.

En apprendre plus