BeDimensional S.p.A. has completed a fundraising

BeDimensional S.p.A. has completed a second US$10 million Series B investment round led by CDP Venture Capital through the Evoluzione fund and subscribed by Novacapital and Eni Next.

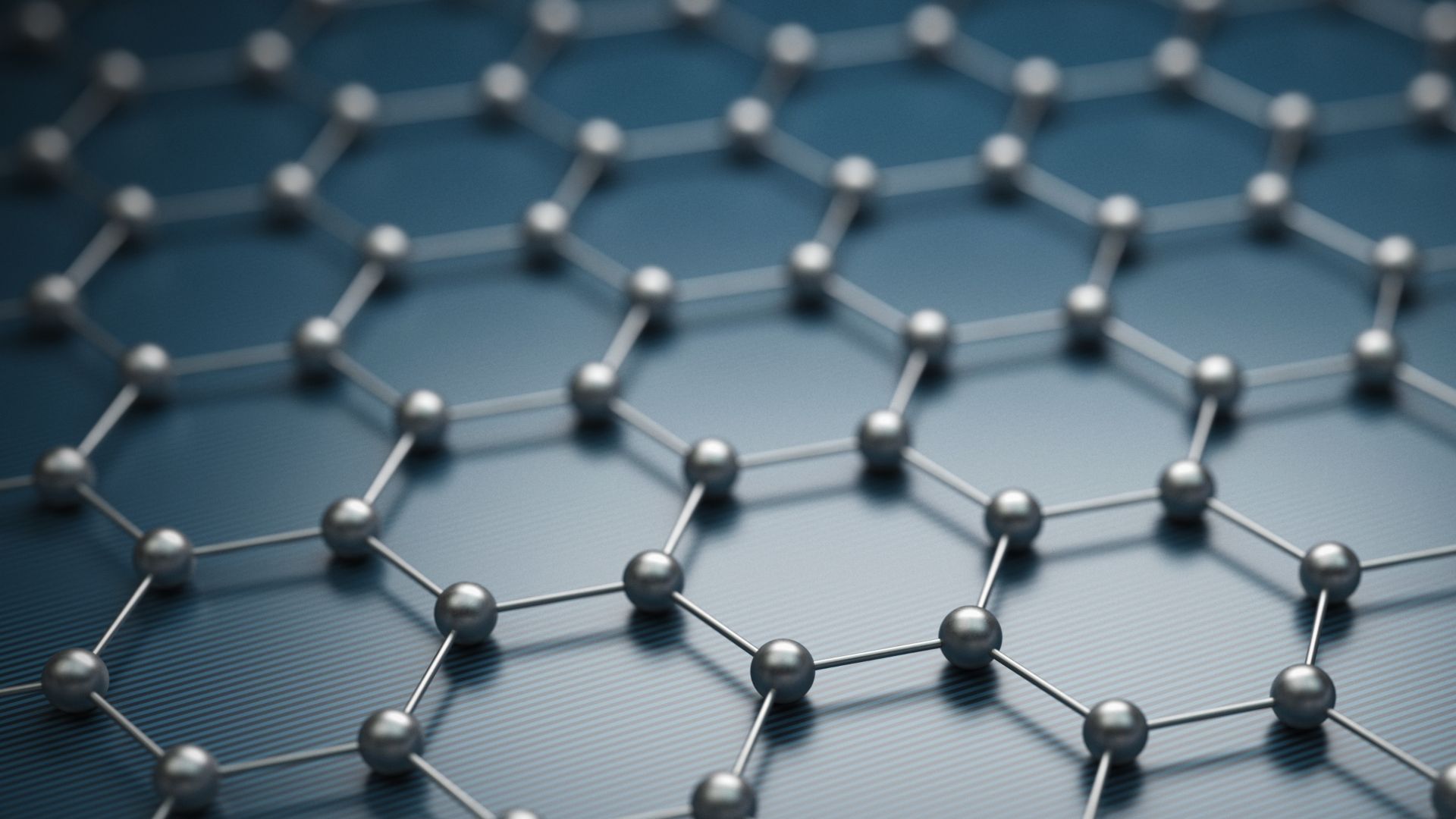

Founded in 2016 by two top Italian scientists, BeDimensional is a startup that operates in the chemical sector, producing innovative graphene (FLG) and two-dimensional materials composed of a number of atomic layers, between one and ten, with top performance and reliability. The process by which two-dimensional materials are obtained is the proprietary know-how of the company, which positions it in the top 10 companies worldwide active in the graphene industry in terms of patents per company. Currently, the two-dimensional materials are applied in three areas: lubricants, based on graphene and hexagonal boron nitride; energy, with a focus on Li-ion battery; and multi-functional coatings, with graphene-based electrically conductive adhesives and thermally conducting paints. BeDimensional is expected to generate a turnover of US$3 million in 2022 and US$35 million in 2025.

Oaklins Italy’s parent company Banca Akros acted as financial advisor to BeDimensional S.p.A.

Talk to the deal team

Related deals

Dolmans Landscaping Group has welcomed Foreman Capital as a new shareholder to support further growth

Dolmans Landscaping Group, a leading full-service provider of landscaping services, has welcomed Foreman Capital as a new shareholder. By partnering with Foreman Capital, which has extensive experience in building stronger companies in the maintenance of public spaces, Dolmans can accelerate its growth trajectory across core verticals and further professionalize the business.

Learn moreBackspin has completed a mandatory public tender offer for the shares of Spindox

Backspin S.p.A. has completed a mandatory public tender offer for Spindox S.p.A.

Learn moreCenterbridge Partners has announced a minority interest investment in Pure Cremation

Centerbridge Partners, L.P. has announced a structured minority interest investment in Pure Cremation. The investment includes both loan and equity instruments and is subject to regulatory approval, with completion expected in the first half of 2026.

Learn more