CVA EOS Srl has completed a mandatory public tender offer on Renergetica SpA

CVA EOS Srl has acquired Renergetica SpA.

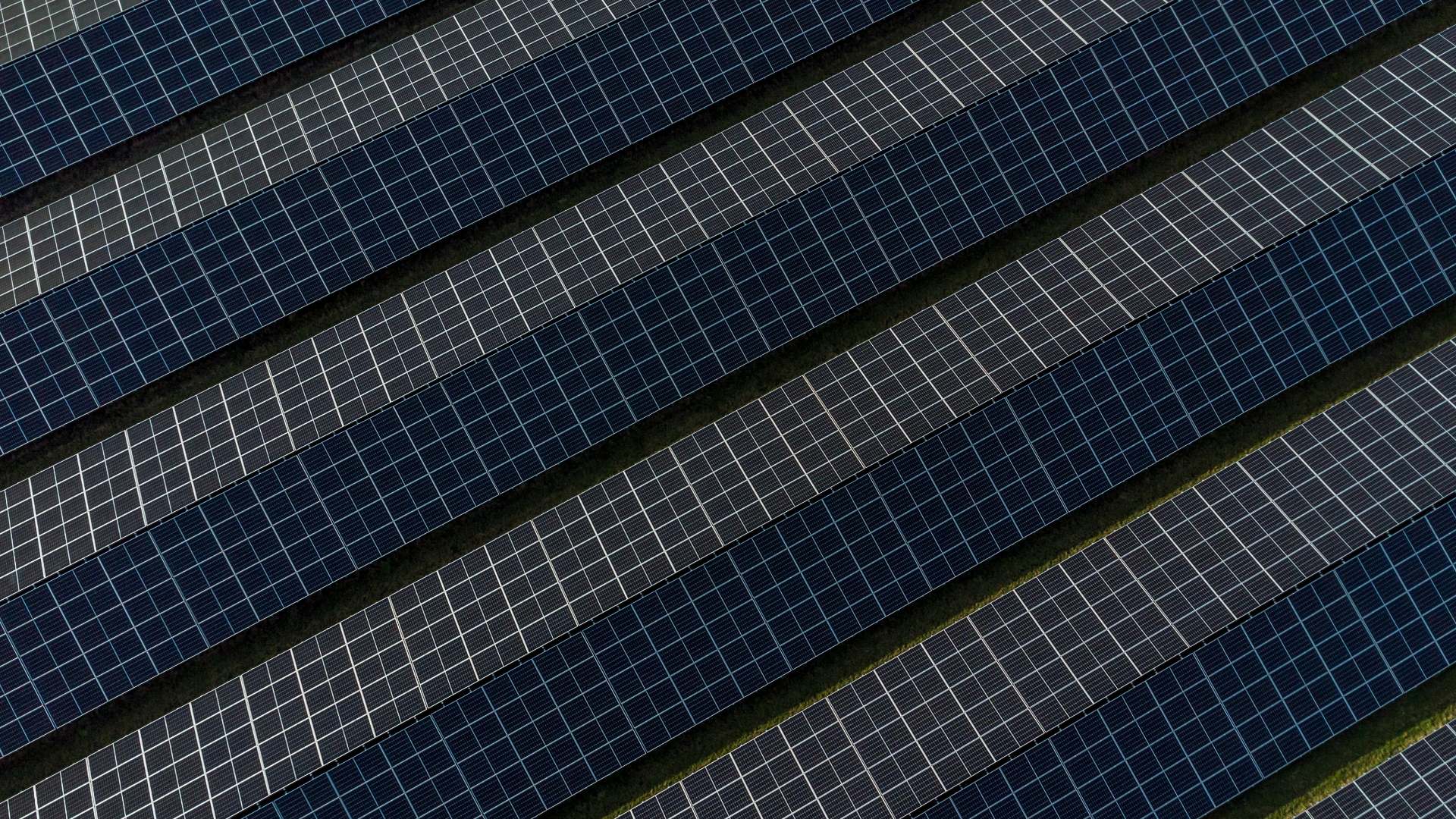

CVA EOS is a company operating in the wind and photovoltaic sector, wholly owned by CVA SpA (Compagnia Valdostana delle Acque).

Headquartered in Italy, Renergetica is a listed entity that designs engineering solutions for the renewable energy sector. The company specializes in the development of renewable energy plants, hybrid power generation systems and hybrid grids.

Oaklins Italy’s parent company Banca Akros acted as the financial advisor to CVA EOS and appointed broker in the collection of shares in the total mandatory public tender offer of 17.8% of Renergetica SpA by CVA EOS Srl.

Talk to the deal team

Related deals

Presight Solutions has been acquired by Banyan Software

Banyan Software, a leading acquiror and operator of mission-critical software businesses, has entered Norway with the acquisition of Presight Solutions AS, a SaaS company delivering advanced software for safety, operational integrity and regulatory compliance in high-risk industries. The transaction marks a new chapter for Presight, strengthening its ability to scale while preserving the product focus, sector expertise and customer trust built since its founding in 2003.

Learn moreBackspin has completed a mandatory public tender offer for the shares of Spindox

Backspin S.p.A. has completed a mandatory public tender offer for Spindox S.p.A.

Learn moreStrawberry Equities has sold Ecohz to Caely Renewables

Ecohz, a global renewable energy company, has been acquired by environmental commodity trading house Caely Renewables from Strawberry Equities. The transaction marks an important new chapter for Ecohz and brings together two organizations with complementary strengths, aligned in their commitment to accelerating the global energy transition.

Learn more