Astorg has had a PPA conducted for the acquisition of AutoForm

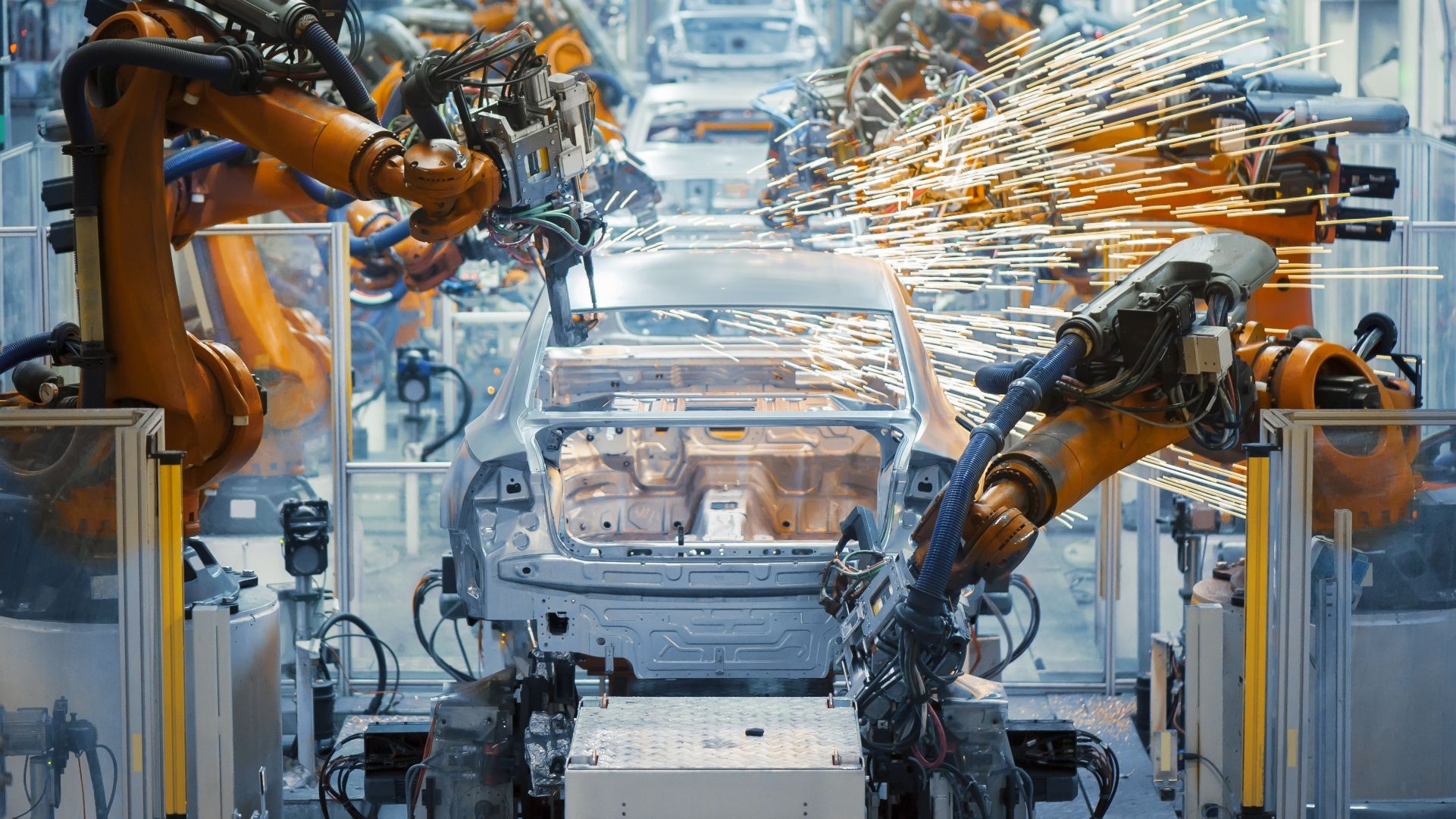

On 22 July 2016, the French private equity firm Astorg acquired AutoForm, the global market leader in engineering software for sheet metal forming processes in the automotive industry, for an undisclosed consideration. Subsequent to the transaction, a purchase price allocation (PPA) was conducted for accounting purposes.

Astorg is an independent private equity group with over US$5 billion of assets under management. The firm has offices in London, Paris and Luxembourg. Astorg acquires European companies with a global presence and sales. The company employs 360 people in 15 countries around the world.

AutoForm was founded in 1995 as a spin-off from the Swiss Federal Institute of Technology. It offers software solutions for the die-making and sheet metal forming industries along the entire process chain. Producing tremendous improvements in quality, time and cost, AutoForm is an acknowledged industry standard at virtually every automotive OEM and at leading suppliers of tooling, stamping and materials worldwide.

Oaklins' team in Switzerland advised Astorg and AutoForm during the post transaction phase and produced a PPA report in accordance with IFRS 3. The report contained the allocation of the consideration paid to all identifiable assets acquired and liabilities assumed.

Anton Haas

CFO, AutoForm

Talk to the deal team

Related deals

Dolmans Landscaping Group has welcomed Foreman Capital as a new shareholder to support further growth

Dolmans Landscaping Group, a leading full-service provider of landscaping services, has welcomed Foreman Capital as a new shareholder. By partnering with Foreman Capital, which has extensive experience in building stronger companies in the maintenance of public spaces, Dolmans can accelerate its growth trajectory across core verticals and further professionalize the business.

Learn moreMiddlecon has been acquired by Nion

Middlecon has been acquired by Nion, a digital consultancy backed by Stella Capital. The acquisition strengthens Nion’s capabilities in data management and advanced analytics, enabling it to undertake larger and more complex data-driven initiatives for its customers. The partnership with Nion provides Middlecon with a strong foundation for continued growth and expansion.

Learn morePresight Solutions has been acquired by Banyan Software

Banyan Software, a leading acquiror and operator of mission-critical software businesses, has entered Norway with the acquisition of Presight Solutions AS, a SaaS company delivering advanced software for safety, operational integrity and regulatory compliance in high-risk industries. The transaction marks a new chapter for Presight, strengthening its ability to scale while preserving the product focus, sector expertise and customer trust built since its founding in 2003.

Learn more