ADDEV Materials has acquired Supavia

ADDEV Materials SAS has acquired Supavia, thus completing its product offering dedicated to the military aerospace markets.

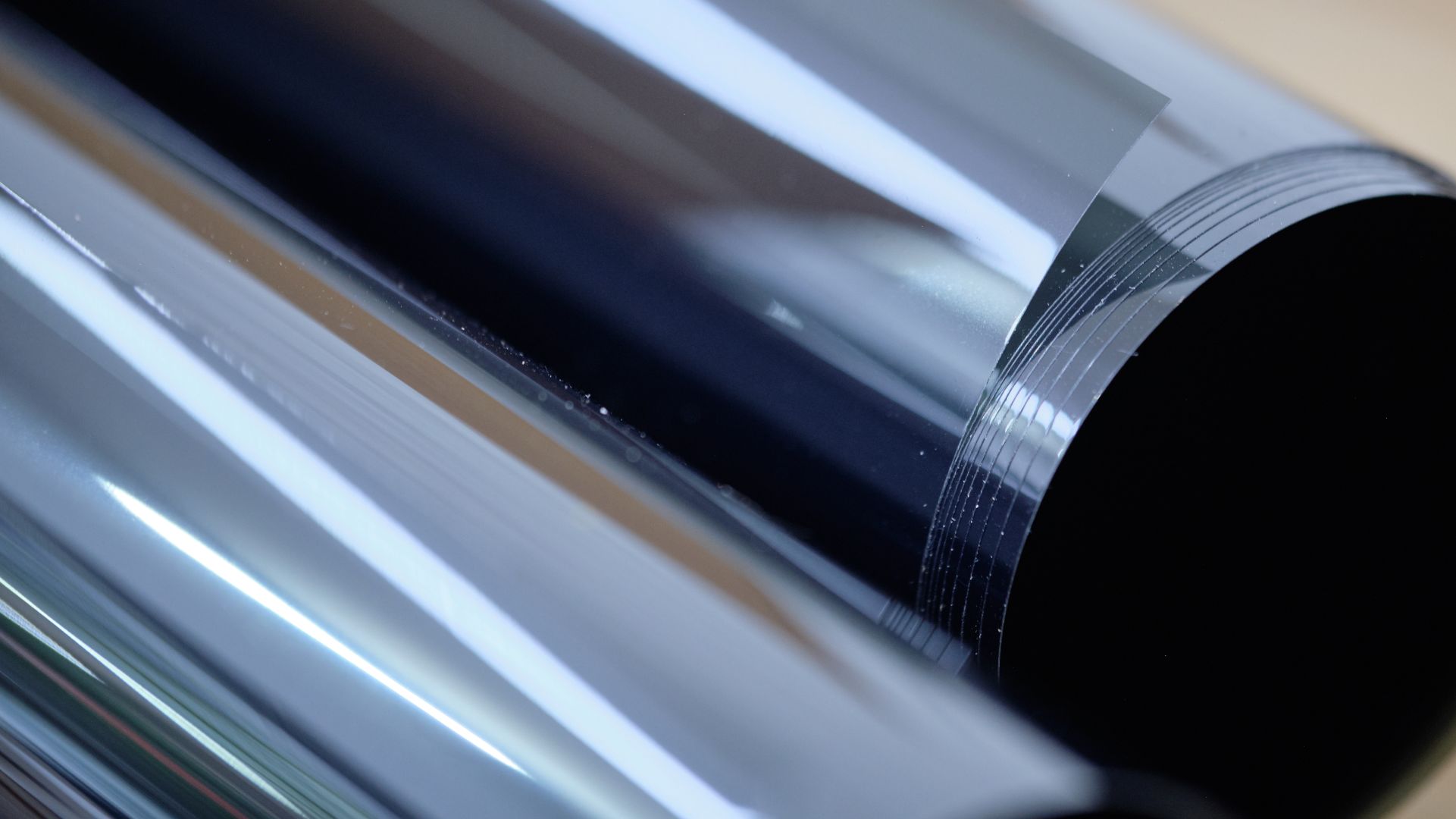

ADDEV Materials is an industrial specialist in converting and trading high performance materials, such as insulation products, technical films, adhesives, foams and glues for various industries, mainly for aerospace and defense, energy, automotive and medical. The company was founded in 2006 and is based in Lyon, France.

Headquartered in France and with 16 years of experience, Supavia is specialized in the distribution of adhesives, greases, oils, sealants and paints for the maintenance and manufacturing of civil and military aircraft and helicopters. Its expertise allows the company to meet the most demanding standards of the air force, aeronautical maintenance centers, airlines and maritime companies.

Oaklins’ team in France acted as advisor to ADDEV Materials in this transaction. As their partner in the implementation of its external growth strategy in France and internationally, Oaklins led the search for acquisition opportunities aimed at strengthening the group’s position after having successfully accompanied it in the acquisition of the British group Graytone in 2019. The French team identified Supavia as a recognized specialist in military aeronautics and led the merger process.

Talk to the deal team

Related deals

Thrive Freeze Dry has successfully sealed the acquisition deal with Paradiesfrucht GmbH

Paradiesfrucht GmbH, a gobal freeze dryer of fruits, fruit preparations, drops, powders and granulates, has been acquired by Thrive Freeze Dry (Thrive), a portfolio company of Entrepreneurial Equity Partners (e2p) and Mubadala Capital. The transaction is expected to close in 2024, subject to customary closing conditions, including antitrust approval.

Learn moreVarsteel, Ltd. has acquired Pacific Steel, Inc.

Pacific Steel, Inc. has been acquired by Varsteel, Ltd.

Learn morePerkbox has been acquired by Great Hill Partners

Molten Ventures has sold Perkbox to Great Hill Partners.

Learn more