iXO Private Equity will support LBA in the achievement of its development plan in France and internationally

La Barrière Automatique (LBA Group) has completed an LBO alongside iXO Private Equity.

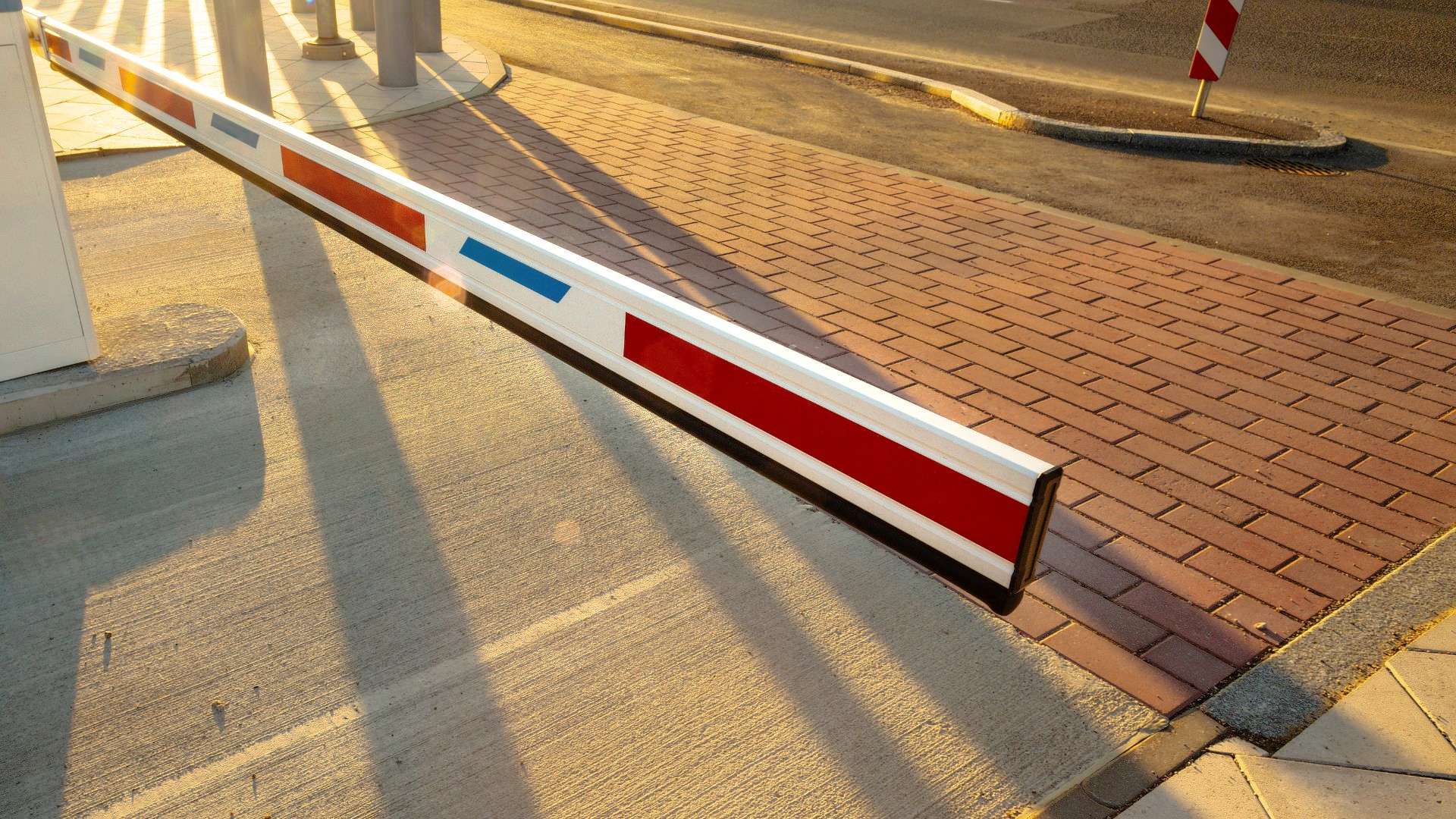

LBA Group is a security and access control specialist enabling the management of flows and the cohabitation of different mobilities. It designs, manufactures and distributes robust, high quality and reliable products, including automatic lifting barriers, pedestrian access turnstiles, retractable and security bollards, and anti-intrusion obstacles. In the last two years, the group has launched two new product ranges: hydroalcoholic gel dispenser terminals and design bollards. In 2019, LBA Group acquired AMCO Les Escamotables, specializing in retractable bollards and anti-intrusion obstacles. LBA Group operates in a market with significant growth dynamics: increasing demand for security measures deployment, and the revolution of urban land use planning, including massive pedestrianization programs. The group has generated strong organic growth (12% of CAGR 2011–2021).

Based in Toulouse, Marseille and Lyon, iXO Private Equity meets the equity needs for the best companies in southwest and southeast of France and the Rhône-Alpes region. It focuses on venture capital for high potential startup firms and small businesses, growth capital for restructuring or expanding further for ambitious small and medium-sized enterprises, and LBO/OBO/MBOs.

Oaklins’ team in France assisted LBA Group and its shareholders throughout this four-month sale process to structure the most attractive transaction.

Talk to the deal team

Related deals

Dolmans Landscaping Group has welcomed Foreman Capital as a new shareholder to support further growth

Dolmans Landscaping Group, a leading full-service provider of landscaping services, has welcomed Foreman Capital as a new shareholder. By partnering with Foreman Capital, which has extensive experience in building stronger companies in the maintenance of public spaces, Dolmans can accelerate its growth trajectory across core verticals and further professionalize the business.

Learn moreGuard has strengthened its Danish platform with the acquisition of Holtec

Guard Automation AS, a leading Nordic provider of automation services, insight and process optimization, has acquired Holtec AS, a Danish engineering and automation company. The acquisition strengthens Guard’s presence in Denmark and supports its strategy of combining strong local expertise with digital platforms. Together with X Automation, Holtec will form a strong Danish automation platform, enabling knowledge sharing, best-practice transfer and enhanced capabilities across the Nordics.

Learn moreBackspin has completed a mandatory public tender offer for the shares of Spindox

Backspin S.p.A. has completed a mandatory public tender offer for Spindox S.p.A.

Learn more