Solstyce has completed an LBO alongside NextStage

The private shareholders of Solstyce have completed a primary LBO alongside NextStage AM.

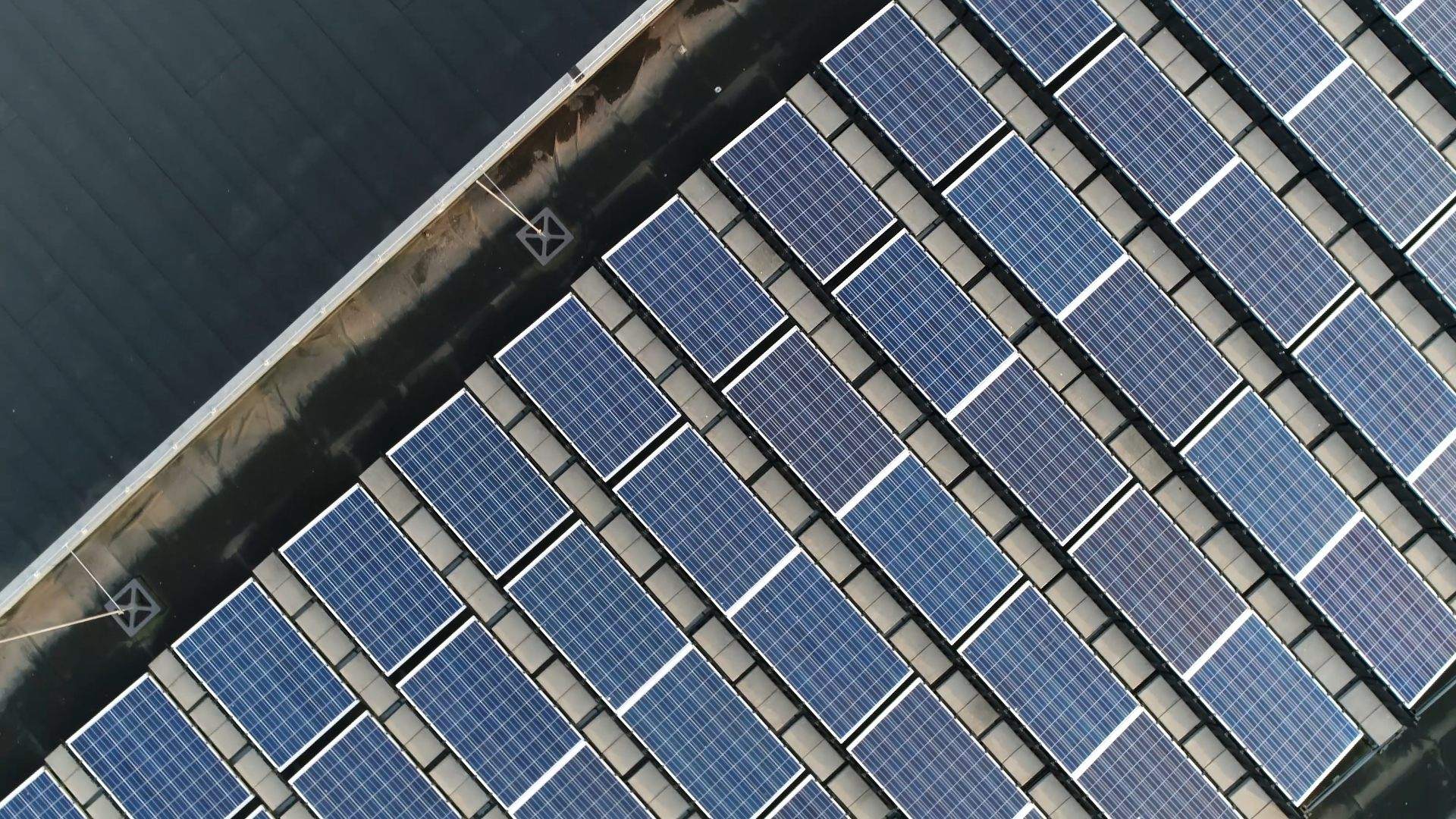

Solstyce is a renewable energy group that provides global services, such as development, building, operating and maintenance in the photovoltaic, e-mobility, carbon footprint and water tightness industries. The firm has an integrated model implementing comprehensive solutions where energy production, mobility and the creation of smart grids deliver an essential three-pronged approach in the transition towards clean energy to building the cities of the future. Solstyce also builds and maintains solar power stations. It has a cutting-edge engineering department and an integrated multi-disciplinary installation team, as well as a maintenance and operations department to ensure the optimal performance of facilities throughout their lifetime. For the last 10 years, Solstyce has been involved in electric mobility. It has a unique partnership with Group Renault, providing electric vehicle charging solutions for its customers’ fleets. The company is also establishing and implementing a low-carbon strategy.

NextStage AM has been supporting growth entrepreneurs in their development since 2002 with its multi-strategy private equity platform, which at the end of December 2020 represented more than US$7.2 billion of assets under management, directly and indirectly collected from institutional investors and individuals.

BPIfrance Investment is also co-investor in the operation with its fund FIEE dedicated to energy and ecological transition. BPIfrance Investment is the French Sovereign Fund investing in startups, SMEs and mid-caps through direct investment and a fund of funds activity.

Oaklins’ team in France acted as the exclusive advisor to the shareholders of Solstyce in this transaction.

Talk to the deal team

Related deals

Dolmans Landscaping Group has welcomed Foreman Capital as a new shareholder to support further growth

Dolmans Landscaping Group, a leading full-service provider of landscaping services, has welcomed Foreman Capital as a new shareholder. By partnering with Foreman Capital, which has extensive experience in building stronger companies in the maintenance of public spaces, Dolmans can accelerate its growth trajectory across core verticals and further professionalize the business.

Learn moreGuard has strengthened its Danish platform with the acquisition of Holtec

Guard Automation AS, a leading Nordic provider of automation services, insight and process optimization, has acquired Holtec AS, a Danish engineering and automation company. The acquisition strengthens Guard’s presence in Denmark and supports its strategy of combining strong local expertise with digital platforms. Together with X Automation, Holtec will form a strong Danish automation platform, enabling knowledge sharing, best-practice transfer and enhanced capabilities across the Nordics.

Learn morePresight Solutions has been acquired by Banyan Software

Banyan Software, a leading acquiror and operator of mission-critical software businesses, has entered Norway with the acquisition of Presight Solutions AS, a SaaS company delivering advanced software for safety, operational integrity and regulatory compliance in high-risk industries. The transaction marks a new chapter for Presight, strengthening its ability to scale while preserving the product focus, sector expertise and customer trust built since its founding in 2003.

Learn more