Oxy Signalétique has acquired Sud Laser

Oxy Signalétique has acquired Sud Laser and strengthens its know-how and market share in the technical marking and visual communication sector.

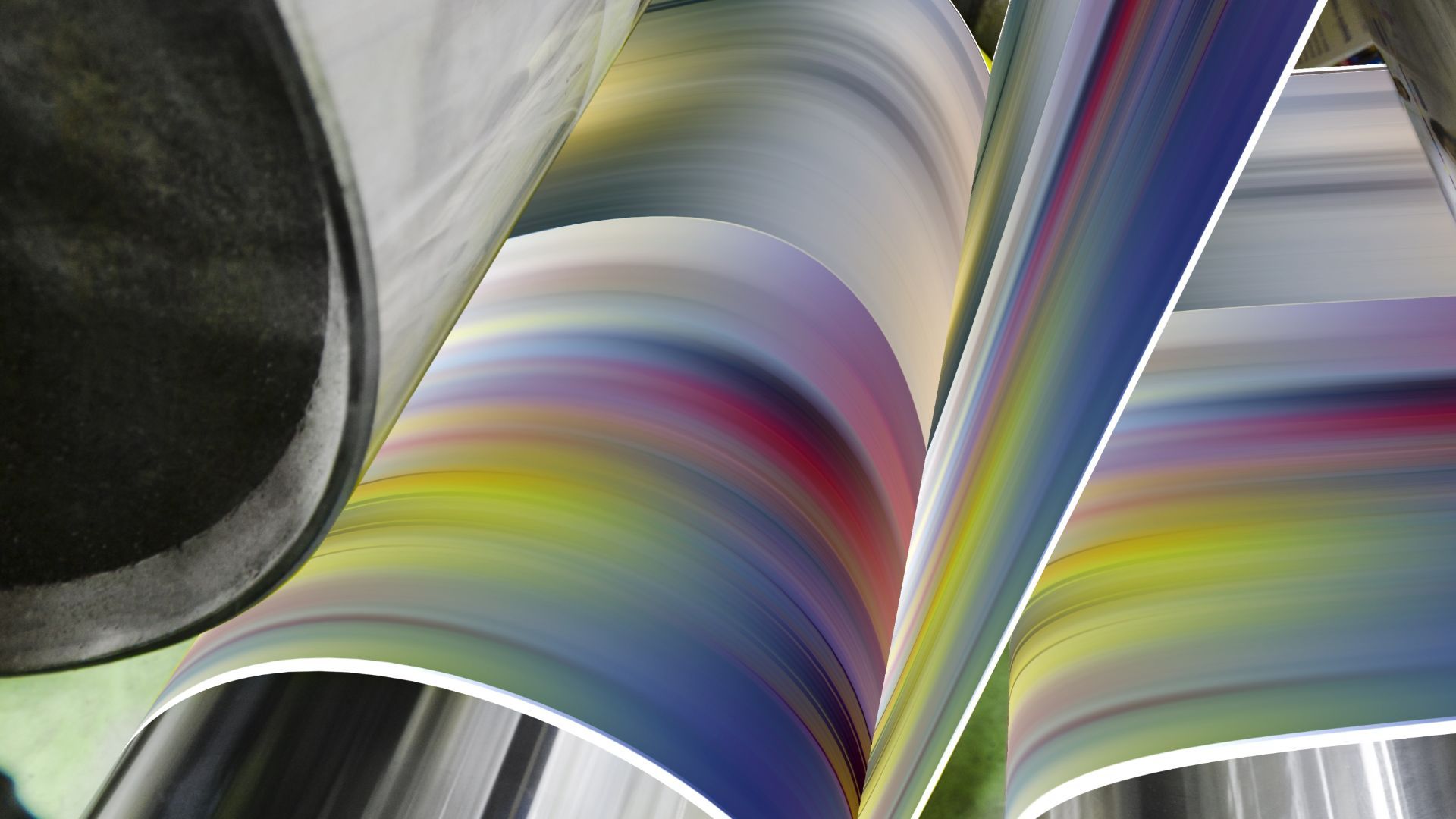

Founded in 1978 by François Robin and headquartered in Marseille, France, Oxy Signalétique quickly became a leading expert in the fields of technical marking and visual communication, and a preferred supplier for blue-ship customers such as Airbus, Airbus Helicopters, SNCF and major banks. Oxy Signalétique has developed a wide range of techniques and tailored products (digital, screen, textured and dye-sub printing, thermal transfers, photoengraving, cutting, engraving and finishing) to meet customers’ needs. The company has two production sites and 100 employees.

Founded in 1993, Sud Laser is a regional leader in the field of technical marking and visual communication for vehicles (buses, coaches, utility vehicles, trucks and light vehicles). Its products include the impression of panels, small and large size adhesives, stickers, the cutting of tinted vinyl, the realization of tarpaulins, roll-up and interior and exterior signage.

In addition to assisting Oxy Signalétique in structuring its LBO, Oaklins’ team in France also negotiated the acquisition of Sud Laser. The team was able to execute the deal in a 6-month timeframe, while securing the financing and playing the main role in the organization, negotiation and completion of this transaction.

Talk to the deal team

Related deals

Dolmans Landscaping Group has welcomed Foreman Capital as a new shareholder to support further growth

Dolmans Landscaping Group, a leading full-service provider of landscaping services, has welcomed Foreman Capital as a new shareholder. By partnering with Foreman Capital, which has extensive experience in building stronger companies in the maintenance of public spaces, Dolmans can accelerate its growth trajectory across core verticals and further professionalize the business.

Learn moreBackspin has completed a mandatory public tender offer for the shares of Spindox

Backspin S.p.A. has completed a mandatory public tender offer for Spindox S.p.A.

Learn moreGSP Group has secured an upsized growth refinancing package from HSBC

The GSP Group has refinanced its growth facilities through an upsized financing package provided by HSBC.

Learn more