Cerea Partners has acquired AB Process Ingénierie

Cerea Partners has acquired AB Process Ingénierie from Trajan Capital.

Cerea Partners is a sector-focused investor driven by one particular ambition: better nutrition, better production, better living. Cerea Partners supports companies and entrepreneurs in their growth, transformation and succession projects. With its unique thematic focus and diversified offer of financing solutions, Cerea Partners provides managers with its know-how and expertise of companies operating across the food and beverage universe. With more than US$1.2 billion in assets under management and thanks to its recognized know-how, Cerea Partners is the main investor for food and beverage companies, having completed more than 160 investments since 2004.

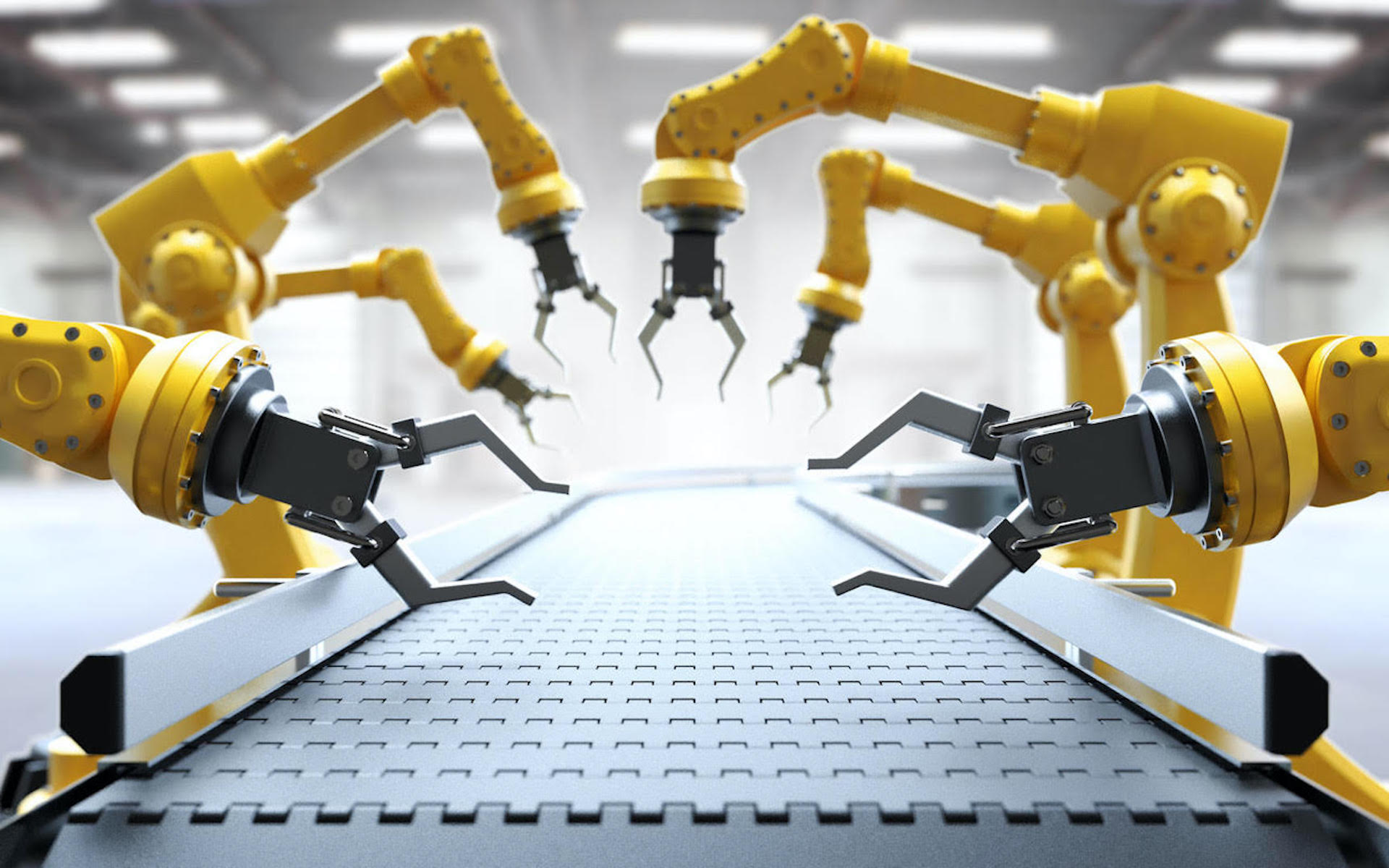

As an integrator of automation and industrial robotics, AB Process designs, manufactures and installs high-performance, tailor-made, turnkey automation solutions for production lines. As a long-term partner, the company supports its clients at every stage of their project, from defining customers’ needs to commissioning and maintaining their installation.

Trajan Capital is a generalist investment team with no sector exclusivity, founded by two former Andera investment directors. Its first investment was completed in March 2020. Trajan invests in French companies (or those in neighboring countries) with sales of at least US$10 million and EBITDA of at least US$2 million, and a proven business model. Its aim is to develop these companies over the long term, drawing on the entrepreneurial energy of the buyer. Trajan is specialized and referenced as the leader of the MBI operations in France.

Oaklins’ team in France acted as the exclusive buy-side advisor of Cerea Partners in this transaction.

Talk to the deal team

Related deals

Top Systems teams up with Holland Capital to create the premier Dutch battery-based solutions provider

Holland Capital, a Netherlands-based private equity firm, has acquired a stake in Top Systems, a leading provider of complete battery-based power solutions, with a unique value-added services proposition.

Learn moreXeros Technology Group has completed a placing, subscription and retail offer

Xeros Technology Group plc has raised funds to drive forward its commercialization strategy.

Learn moreSoler & Palau Ventilation has acquired subsidiaries of United Enertech Holdings

Soler & Palau Ventilation, Inc. (S&P) has acquired subsidiaries of United Enertech Holdings, LLC. (UEH). The subsidiaries included Air Conditioning Products, LLC; Air Performance, LLC; Metal Form Manufacturing, LLC; and United Enertech Corp.

Learn more