Market Review | H1 2025

Strong momentum in Norwegian M&A – Private equity and sector diversity fuel growth

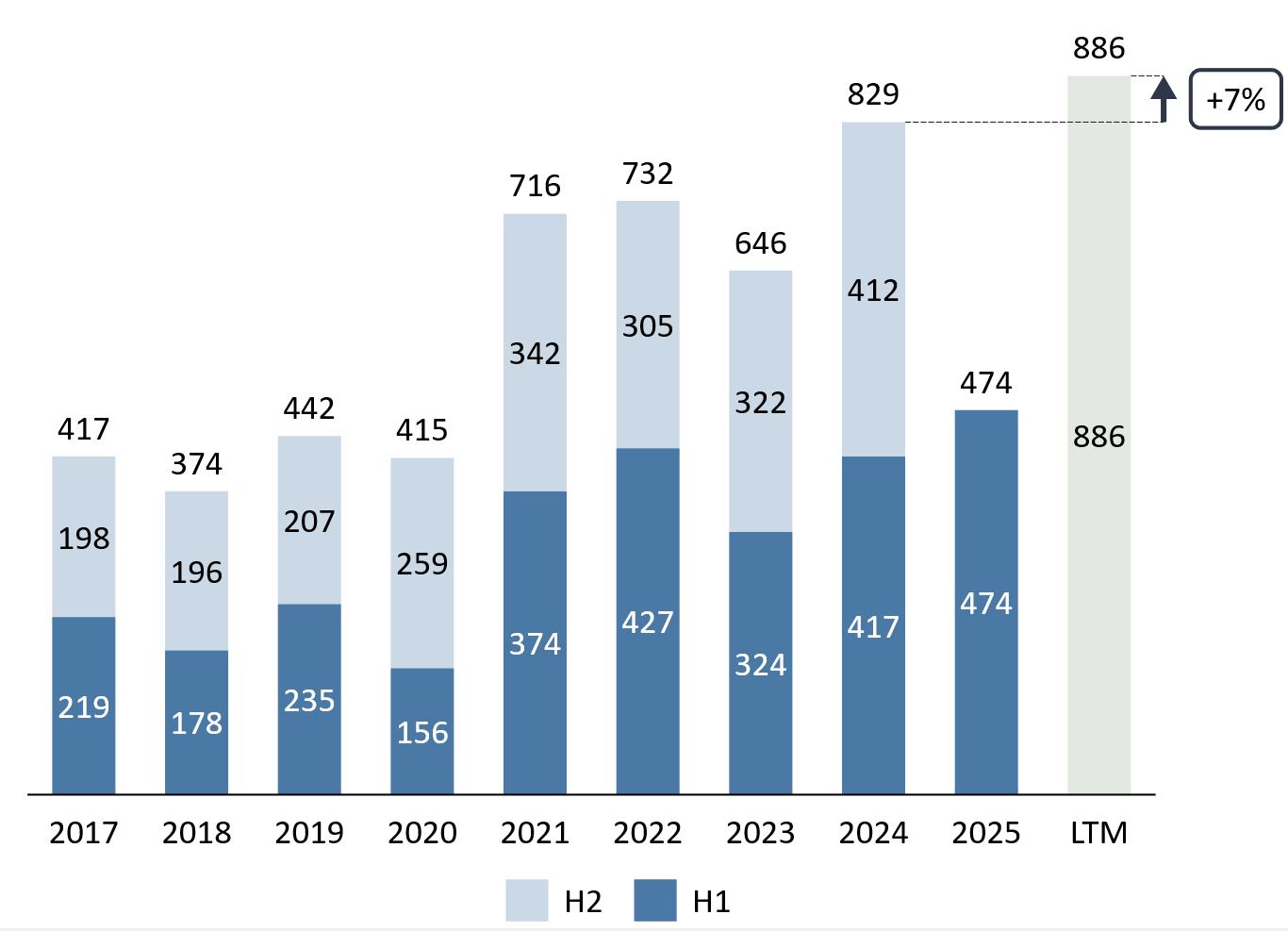

Norway’s M&A market maintained its solid performance in the first half of 2025, recording 474 announced transactions – a 14% increase compared to the same period in 2024.

The mid-market segment remained the driving force, supported by stronger valuation alignment, reactivated processes, and expectations of interest rate cuts. Financial sponsors continue to play a key role, with private equity now participating in 45% of all transactions.

We also see a strong level of international interest, particularly from European buyers who are increasingly active in the Norwegian market. Activity remains broad-based, with industry and service-related businesses leading in volume. Meanwhile, the technology segment has seen a modest slowdown after several years of rapid growth.

Looking ahead, the momentum is expected to continue, driven by strategic growth ambitions, access to capital, and a growing willingness to pursue cross-sector and cross-border transactions.

Norwegian transaction volume

The strong start to 2025 reflects a market that is highly adaptable, yet we are beginning to see how the delayed effects of macroeconomic uncertainty are shifting investor priorities and influencing deal dynamics.Nikolai Lunde, Managing Partner at Oaklins Norway

Read the whole report

Reach out to us

Managing Partner

View profile

Analyst

View profile