Market Review | 2025

Record activity in Norwegian M&A - confidence, private equity and strategic alignment drive momentum

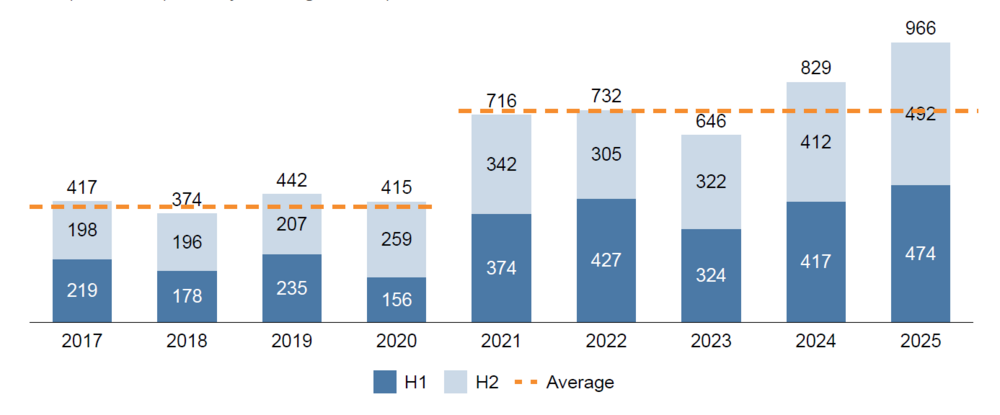

Norwegian M&A activity reached a new all-time high in 2025, confirming M&A as a core strategic growth lever for both corporates and financial sponsors. Transaction volumes were broad-based and resilient, supported by strong mid-market momentum, the return of larger and more complex deals, and increased strategic focus across sectors.

The mid-market remained the backbone of activity, underpinned by improved valuation alignment, more stable financing conditions and renewed confidence in execution. Private equity played a central role throughout the year, accounting for nearly half of all acquisitions, driven by available dry powder, add-on strategies and an increasing pipeline of exit-ready assets.

International interest in Norwegian assets remained strong, with European buyers continuing to dominate foreign acquisitions, supported by geographic proximity, established industrial ties and a weaker Norwegian currency. Sector-wise, services emerged as the most active segment, while industrial activity remained stable and technology showed more selective growth following several years of rapid expansion.

Looking ahead, Norwegian M&A is well positioned entering 2026. Continued strategic growth ambitions, ample access to capital and a growing willingness to pursue cross-border and cross-sector transactions are expected to support sustained activity in the coming period.

Norwegian transaction volume

With renewed confidence, strong international interest and an active mid-market, Norwegian M&A is well positioned going into 2026. We expect strategic transactions and cross-border activity to remain key drivers in the period ahead.Nikolai Lunde, Managing Partner at Oaklins Norway

Read the whole report

Reach out to us

Managing Partner

View profile

Analyst

View profile