Geevers Auto Parts has been acquired by Autodis Group

The founder and shareholder of Geevers Auto Parts (Geevers) has sold the company to Autodis Group.

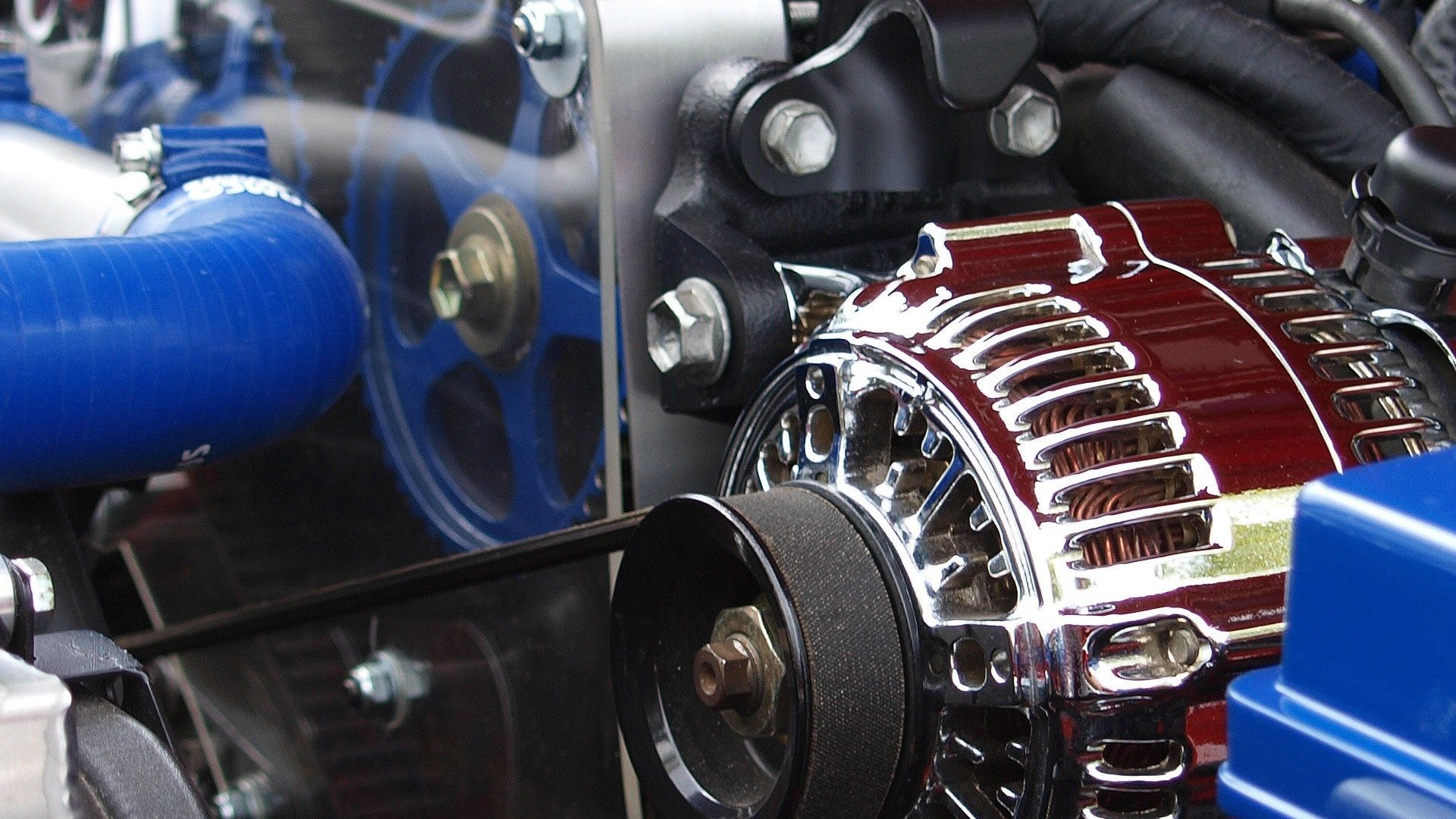

Geevers is the largest distributor of car spare parts to the Benelux collision repair market. The company offers a one-stop-shop for collision repair shops with OEM products from automotive players such as Audi, BMW and Toyota. Geevers’ philosophy has been built upon an unmatched value-added offering and best-in-class technical support services as well as in-house logistical capabilities. This strong positioning as resulted in continuous strong growth and market share increase.

Headquartered in France, Autodis Group is a European supplier of automotive spare parts for both the mechanical and collision repair markets. The company is actively following a buy-and-build strategy to grow its geographical footprint in Western Europe.

Oaklins' team in the Netherlands advised the shareholder on the sale of Geevers Auto Parts. Oaklins' team in France assisted in identifying and initiating contact with the buyer.

Talk to the deal team

Related deals

Dolmans Landscaping Group has welcomed Foreman Capital as a new shareholder to support further growth

Dolmans Landscaping Group, a leading full-service provider of landscaping services, has welcomed Foreman Capital as a new shareholder. By partnering with Foreman Capital, which has extensive experience in building stronger companies in the maintenance of public spaces, Dolmans can accelerate its growth trajectory across core verticals and further professionalize the business.

Learn moreBackspin has completed a mandatory public tender offer for the shares of Spindox

Backspin S.p.A. has completed a mandatory public tender offer for Spindox S.p.A.

Learn moreValmiermuižas Alus has been acquired by Cēsu Alus

Valmiermuižas Alus has been acquired by Cēsu Alus AS through the purchase of 100% of its shares. The transaction enabled the founder’s exit and strengthened the company’s platform for continued growth within a consolidating Baltic beverage market.

Learn more