VAF Instruments has been acquired by Aalberts Industries

VAF Instruments' shareholders have sold the company to Aalberts Industries N.V. Financial details have not been disclosed.

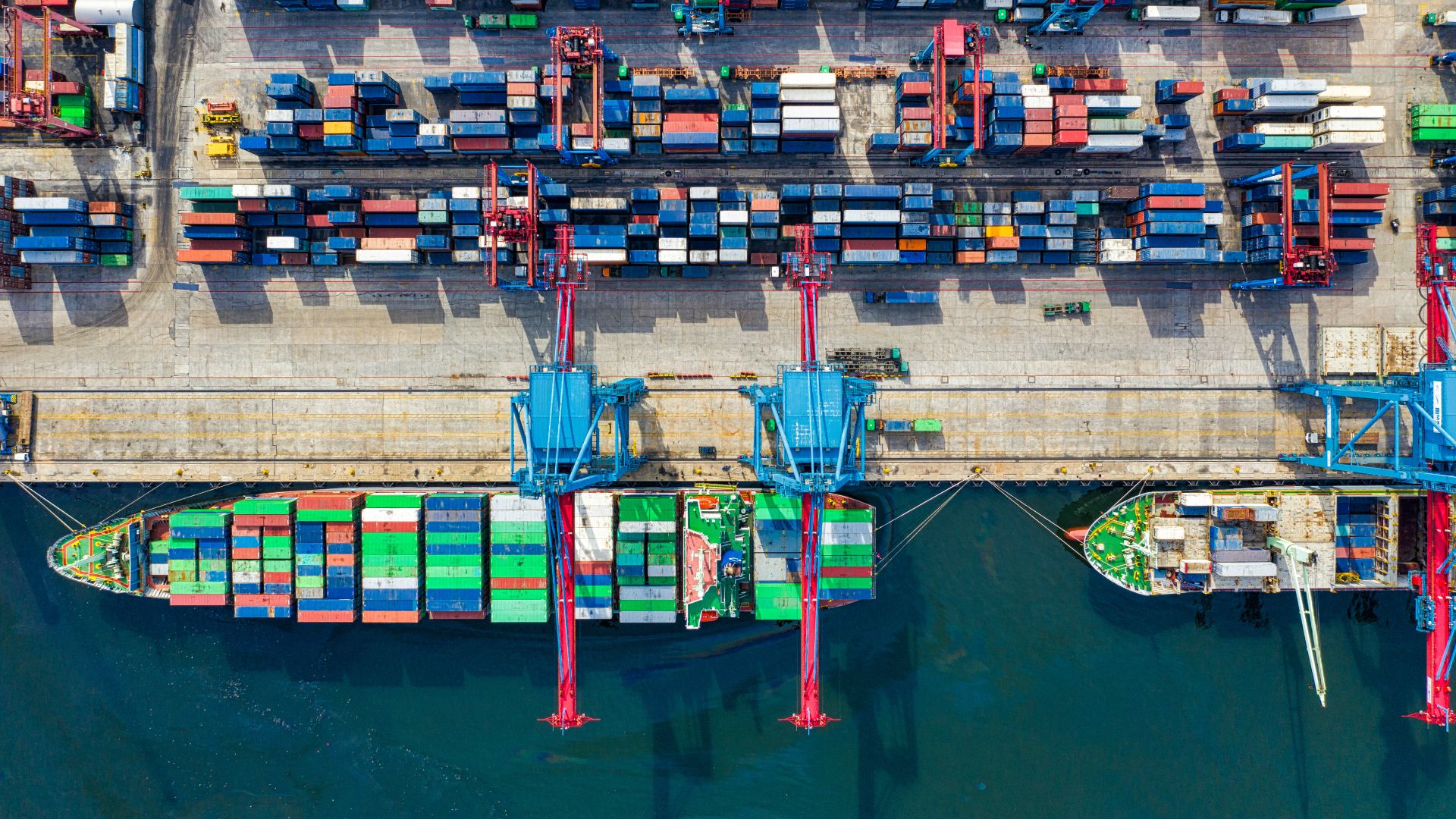

VAF Instruments B.V. is a leading global developer and manufacturer of high-tech sensors and measurement systems for the marine, power plant and industrial sectors. The company is dedicated to continuously developing and enhancing innovative, highly accurate measurement sensors and systems that maximize efficiency, improve operational excellence and reduce the environmental impact of its clients’ operations.

Aalberts Industries N.V. is a global technology company of mission-critical technologies. Headquartered in the Netherlands, the firm focuses on products in the installation, material, climate and industrial sectors.

This acquisition will further strengthen VAF Instruments’ worldwide reputation by bringing its world-class platform and tier-1 products for fuel and performance measurement into new B2B niche markets.

Oaklins' Dutch team acted as the exclusive M&A advisor to the shareholders of VAF Instruments. This transaction is a testament to the expertise of Oaklins' Marine Equipment team, which has advised on numerous mergers and acquisitions in the sector, including Vetus (sold to Yanmar), IMS (sold to Norac) and TMC Compressors (sold to Lifco), among others. It was the team's thorough understanding of the opportunities and challenges facing global marine equipment suppliers that led VAF Instruments to choose to work with Oaklins.

Leo Blankenstein

CEO, VAF Instruments

Talk to the deal team

Related deals

The assets of IMG have been acquired by SLV Mecklenburg-Vorpommern

The assets of Ingenieurtechnik und Maschinenbau GmbH (IMG) have been acquired by SLV Mecklenburg-Vorpommern GmbH (SLV-MV) through an asset deal as part of IMG’s insolvency proceedings.

Learn moreLauak Group has sold a majority stake to Wipro Infrastructure Engineering

After careful strategic reflection to secure the group’s future, Lauak Group’s shareholders have chosen an industrial partnership, in line with the ongoing consolidation trend in the market. Attracted by opportunities for innovation and international expansion, the Charritton family, founders and long-term shareholders, regard Wipro Infrastructure Engineering as a trusted industrial partner. The historical shareholders remain minority stakeholders, and the current CEO continues to lead Lauak.

Learn moreQuantum Base has completed a fundraise

Quantum Base Holdings plc (AIM: QUBE) has successfully completed a US$5.7 million fundraise.

Learn more