FrenchFood Capital has acquired JV La Française

FrenchFood Capital, a private equity firm focused on food businesses, has acquired JV La Française.

FrenchFood Capital is a private equity firm headquartered in Paris providing equity capital to innovative, fast-growing and value-added SMEs in the food sector with tickets between US$5 million and US$15 million. It supports entrepreneurs in their growth projects in France and abroad, while adopting an environmental, societal and balanced governance approach.

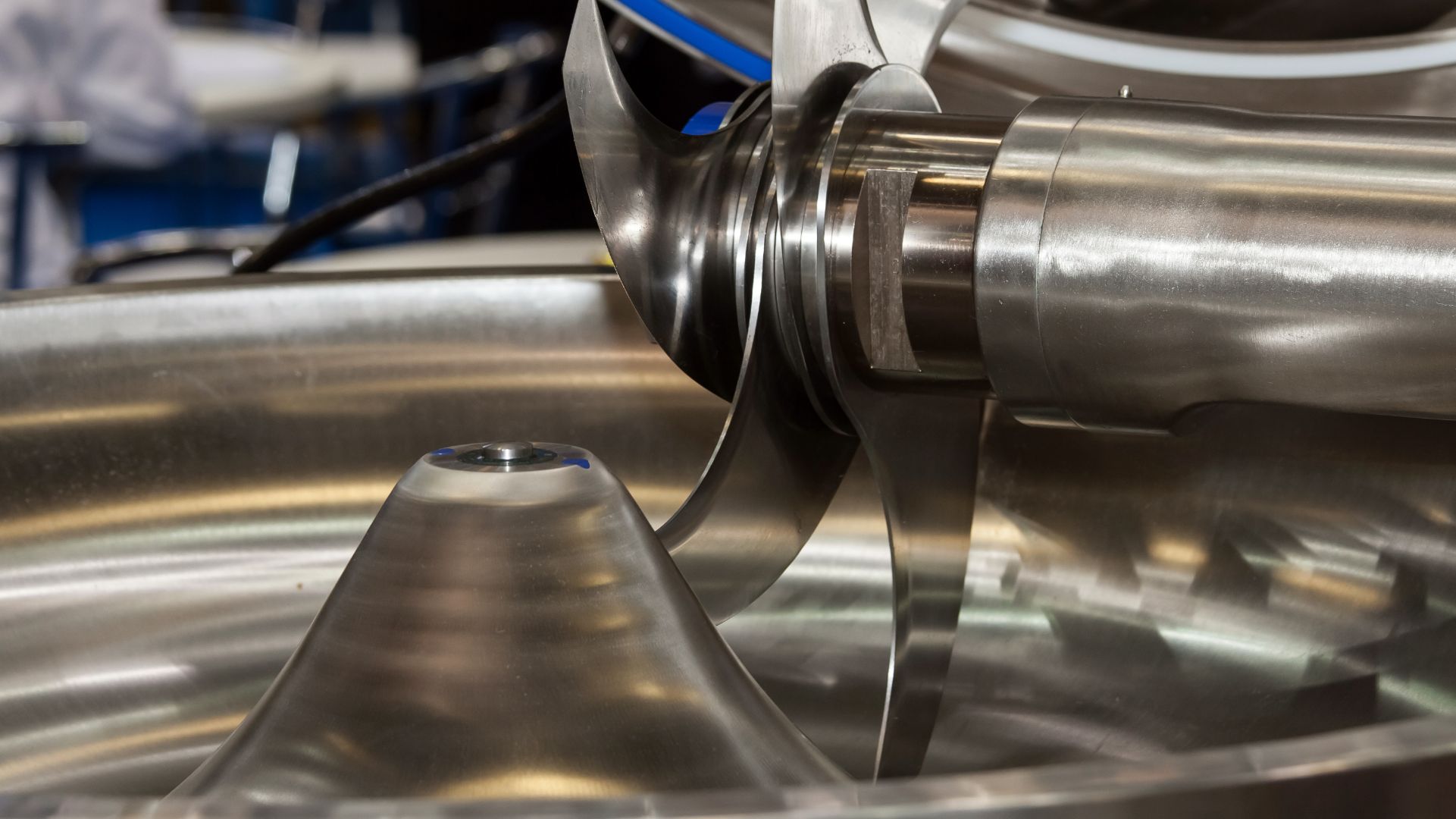

Founded in 1992, JV Groupe specializes in the supply of industrial equipment for the food industry as well as associated value-added services. It assists its customers with all their production equipment needs, from equipment design and selection to the supply of industrial equipment and spare parts management. While addressing the equipment needs of food processors active in the meat/delicatessen and bakery/pastry end-markets, the company targets two categories of clients: industrial and semi-industrial customers—often blue-chip players in France via the JV network—and artisanal retailers, SMEs and on-farm processors through the ADP network, with strong geographical proximity.

Oaklins’ team in France advised FrenchFood Capital in this transaction.

Contáctese con el equipo de la transacción

Transacciones relacionadas

Hemink Groep has been acquired by Gimv

Gimv has acquired a majority stake in Hemink, a Dutch specialist in real estate renovation and maintenance. This transaction marks a new chapter for Hemink, as it seeks to expand its position as a national leader in sustainable property services through its new partnership with Gimv.

Conozca másOGD has been sold to Building Beyond Technology Group

Building Beyond Technology Group (BBTG) strengthens its position in the IT sector by welcoming OGD IT-Dienstverlening (OGD) to its platform. With over 1,400 employees, OGD is an established name in the Dutch market as a mission-critical IT service provider for large-scale clients. This addition not only increases BBTG’s scale but also enhances its domain expertise and execution capabilities through close cooperation with the other platform companies.

Conozca másThe Providence Projects has been acquired by UKAT Group

Celebrity-success rehabilitation center, The Providence Projects, has joined The UK Addiction Treatment (UKAT) Group, backed by Sullivan Street Equity Partners.

Conozca más