Máquinas & Componentes Industriais

A maquinaria tradicional está rapidamente a tornar-se redundante. Em vez disso, empresas procuram soluções mais adequadas, como equipamento conectado e fabrico complementar. Os nossos profissionais de M&A, growth equity e ECM, debt advisory e serviços de corporate finance por todo o mundo têm o conhecimento e a rede de contactos para o colocar na vanguarda desta mudança – ou vender o seu negócio a um valor premium.

Contactar acessor

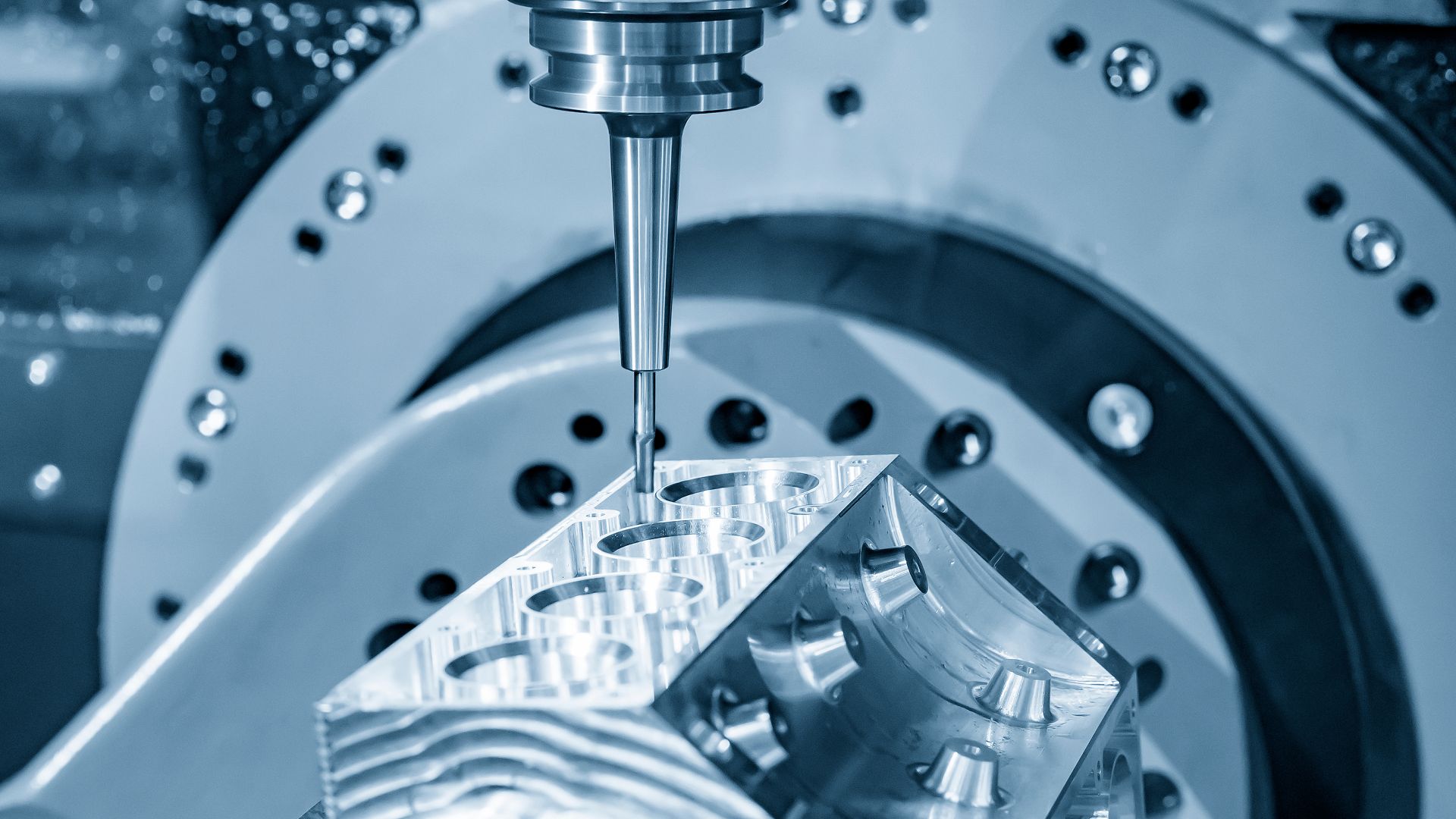

Sandvik has acquired Portugal-based Frezite

Walter, a division of Sandvik Manufacturing and Machining Solutions, has acquired Portugal-based Frezite, a family-owned polycrystalline diamond (PCD) tool manufacturer.

Saber maisSIT S.p.a. has acquired Janz CGF S.A.

SIT S.p.A. has completed the acquisition of 100% of Janz-Contagem e Gestão de Fluídos S.A. (Janz), a consolidated Portuguese player specialized in manufacturing residential water meters. The price, excluding cash and debt, amounts to US$34.3 million. An earnout of up to US$1 million is also stipulated on the basis of achieving certain targets in 2021.

Saber maisHCapital has divested Quantal to Horizon Equity Partners

The former shareholders of Quantal, S.A. have successfully divested their stake in the company, with an investment from Horizon Equity Partners to support Quantal in its next phase of strategic growth. This support will focus particularly on expanding Quantal’s production capabilities, including the development and construction of a new, state-of-the-art manufacturing facility.

Saber mais

Nadine Crauwels

President, Sandvik Machining Solutions

Ler mais

New chapters, global ambitions: mid-market M&A in Q4

QUARTERLY M&A ACTIVITY: In Q4 2025, Oaklins' clients completed 93 transactions across sectors and regions, highlighting how business leaders are using M&A to drive growth, succession and strategic change.

Saber mais